GBP/USD Week Ahead Forecast: Red Hot, Must Cool Off

- Written by: Gary Howes

Above: File image of Jerome Powell, image courtesy of the Federal Reserve.

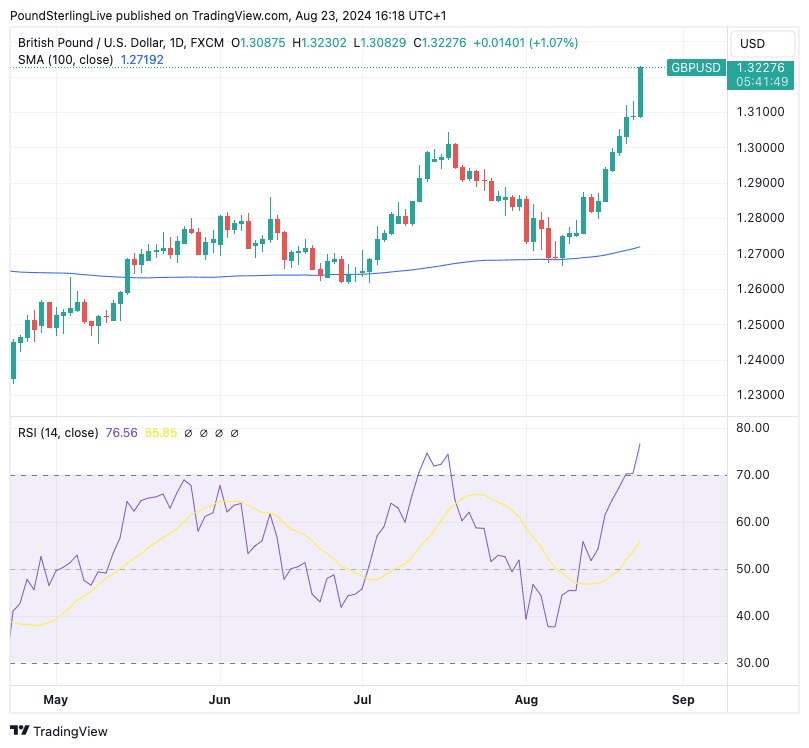

Pound Sterling powered to fresh two-year highs at the end of last week, buoyed by the Federal Reserve's commitment to a September rate cut. But, the rally is looking stretched.

The Fed's Jerome Powell couldn't have been more 'dovish' in his comments that the time to cut rates had arrived and that the Fed would do what was necessary to protect jobs.

This signalled a decisive shift from targetting inflation to limiting economic weakness, which spells rate cuts. The question for markets is whether or not the Fed will proceed with a decisive 50 basis point hike in September or start off with a 25bp move.

Rising odds of a strong 50bp sent the Dollar hurtling lower and the Pound to Dollar exchange rate rose to a two-year high at 1.3223.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

To be sure, this exchange rate is in a technical uptrend and the clearest route forward in the coming weeks is higher.

But, fatigue is growing and we note signs of overbought conditions in the charts. In particular, the RSI is at 76 which is significantly stretched, raising the odds of a retreat in the coming week. There will be no major data releases out of the UK in the next five days, and we think the thrust of action will depend heavily on how global markets behave.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

On this count, it is hard to be anything other than bullish now that the Fed has greenlighted rate cuts with Powell's speech sounding so 'dovish' that it invited the prospect of a decisive 50 basis point cut in September.

We can look for some exhaustive pullbacks in markets - and, by extension, the Pound in the coming days - but ultimately, standing in the way of this train will be difficult and risky to justify.

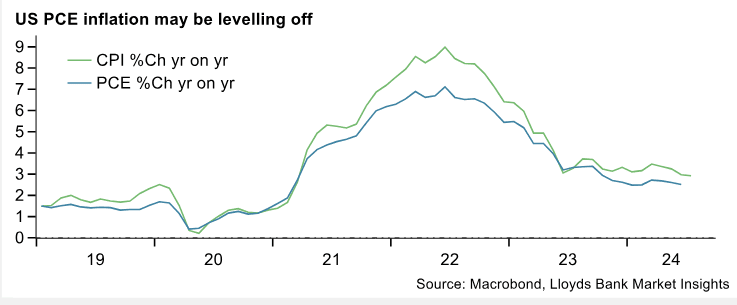

Look for pullbacks in the Dollar if this week's data beats expectations and raises doubts about the odds of a 50bp hike in September. The highlight will be Friday's release of the PCE deflator, which is a measure of inflation impacting consumers.

The Fed tends to watch it closely, but we think there is a limited chance of it throwing up the kind of surprise that would shift the broader narrative.

Powell said in his Jackson Hole speech he was confident inflation would not make a surprising return and that he was now much more focussed on the labour market. This suggests that the early-September release of the U.S. non-farm payroll report will be the next major event for the Dollar.