GBP/USD Rate Holds Post-CPI Gains, Unshaken by Election Announcement

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate holds onto the gains made following the release of UK inflation and further advances are possible into the July 04 General Election.

Pound Sterling rallied after it was reported UK services inflation rose 5.9% y/y in April versus the 5.4% forecast. The significant upside miss means inflation will unlikely fall to the Bank of England's 2.0% target on a sustained basis.

Economists at Deutsche Bank have this morning revised higher their inflation forecasts as a result, saying headline CPI is now expected to track around 2.6% y/y (previously: 2.3%) to end the year.

Such developments are not consistent with a June interest rate cut at the Bank of England. In fact, the market is now only 80% priced for a full 25 basis point cut to have been delivered by September.

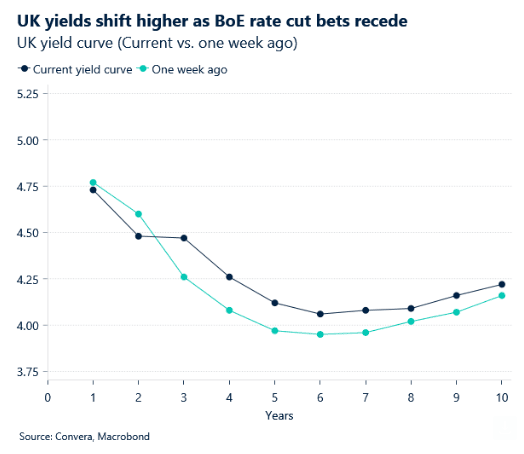

The result is a rise in UK interest rate expectations:

Above: UK interest rate expectations have lifted following the UK inflation data release, offering support for the Pound. Image courtesy of Convera.

Rising interest rate expectations are reflected in higher UK bond yields relative to elsewhere, which can support the Pound.

We note the gap between U.S. and UK bond yields has shrunk lately, and this is supporting Pound-Dollar which has risen 3.50% since its April lows.

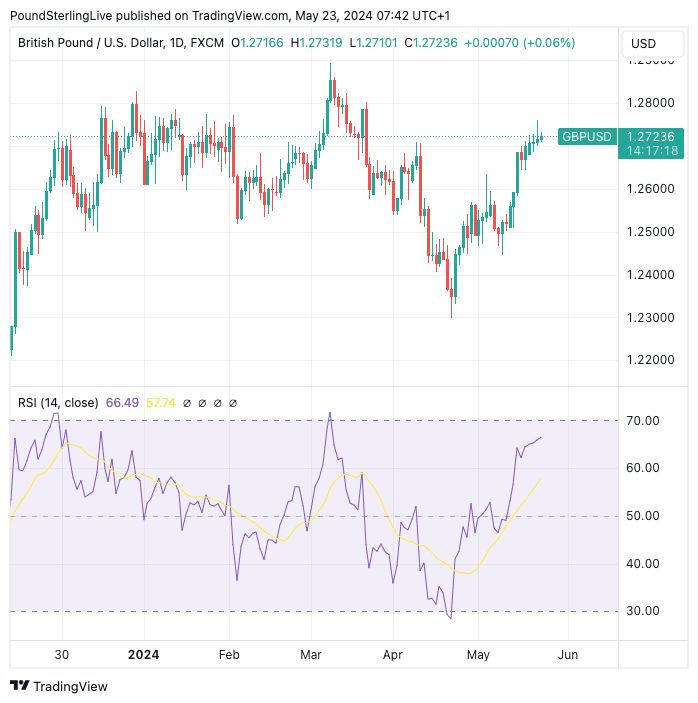

Above: GBP/USD at daily intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

The fundamental setup underscores technical studies that confirm momentum in GBP/USD remains firm and advocate for further upside with the 1.28 March highs looking like the next objective.

News that the UK will hold a General Election on July 04 has proven to be of little interest to the Pound, which is a positive development in itself if we consider it to have been heavily influenced by politics since 2016.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The market's shrug to Prime Minister Rishi Sunak's announcement suggests the UK has entered a more stable political era, which can allow the Pound to continue to focus on mildly supportive economic developments.

Analysts at Barclays and Rabobank say the prospect of political change could, in fact, provide mild tailwinds for the UK currency.

"Most political commentators believe a Labour victory is all but a foregone conclusion. Of course, the event is not devoid of uncertainty though, GBP implied volatility for 2-month and 3-month tenures jumped to multi-week highs, while risk reversals are also becoming less pound bearish," says George Vessey, Senior FX Strategist at Convera.

Vessey adds that a Labour government is expected to usher in a period of political stability and the prospect of a tighter relationship with the EU will help to unwind at least some of the pound’s Brexit premium.

"Plus, the party’s shift to a more pro-business, centre-ground position could further support sterling," he explains.