UK Election Opens Door to a Higher GBP/EUR Exchange Rate Say Analysts

- Written by: Gary Howes

Westminster, London. The Prime Minister Rishi Sunak delivers an address outside of Number 10 announcing a General Election on July 4th. Picture by Edward Massey / CCHQ.

Strategists say the UK General Election of July 04 is no headwind to Pound Sterling; in fact, it is why some are holding a bullish stance on the UK currency.

Pound Sterling rose following the release of above-consensus data Wednesday and held onto them after Prime Minister Rishi Sunak announced the UK will go to the polls on July 04 and, according to pollsters, vote in a new government.

The Pound to Euro exchange rate traded at its highest level in two and a half months at 1.1746 as newswires first broke the news Sunak was set to call the July 04 vote.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sterling's resilience is the initial confirmatory signal from the market that political angst no longer has the hold on Sterling as has been the case in recent years.

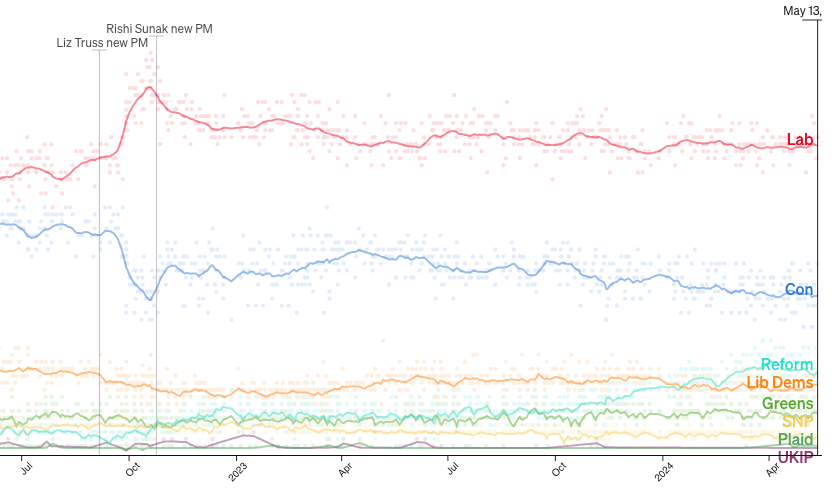

Polls heavily favour the opposition Labour Party, who would likely foment closer ties between the EU and UK, according to strategists at Barclays.

Barclays has been constructive on the Pound for some months now, with an expected closer relationship with Europe as a central pillar of this stance.

"Demand is resilient and the prospect for closer ties with the EU should trigger a partial, yet sizeable, unwind of the pound's Brexit premium following the next UK general election. We maintain a constructive view of the pound (particularly vs EUR and CHF)," says Barclays.

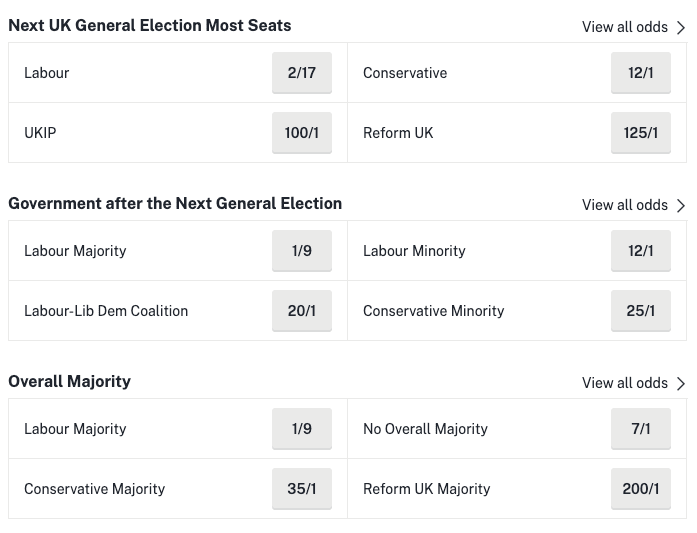

Above: Poll of polls by Politico.

Barclays forecasts that EUR/GBP will grind toward 0.82 by Q1 2025, which gives a GBP/EUR target of 1.22.

With the hard-left Jeremy Corbyn no longer at the helm of Labour, the prospect for economic disruption is greatly minimised. In fact, the Labour and Conservative parties have near-identical centrist economic policy stances.

"Despite the fact that the UK is facing an election... the 20 pt lead in the polls that has been held by the Labour party for some time suggests limited room for surprises," says Jane Foley, Senior FX Strategist at Rabobank.

"While traditionally, the market is more cautious about a left-of-centre government, the Labour Party has been openly wooing UK business," she adds.

It is speculated that Sunak went for a July vote as it became clear there was no fiscal space to allow Jeremy Hunt to deliver an Autumn Statement that would allow further tax giveaways to bolster the Conservative's position.

"Constraints implied by the UK’s poor fiscal position combined with the policy mistakes made by Truss in 2022, suggests limited room for any move away from prudent budget policy after the election," says Foley.

Above: Odds heavily favour a Labour majority outcome on July 04. Image: Oddschecker.

The ongoing improvement in UK business investment might also continue under Chancellor Rachel Reeves, who appears to recognise the importance of business investment in improving productivity and growth.

"Assuming that the UK political backdrop remains calm, we expect that GBP can continue its slow grind higher medium-term," says Foley.

Rabobank maintains a 6-12 month forecast of EUR/GBP 0.84 based on the view that a more stable UK political landscape will allow GBP to continue the slow, grinding recovery that has been in evidence since the start of 2023.

EUR/GBP at 0.84 gives a GBP/EUR exchange rate of 1.19.