GBP/USD Week Ahead Forecast: Uptrend Activated

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate has entered a short-term uptrend that can extend over the coming days, particularly if UK service inflation figures disappoint on Wednesday.

The technical setup behind Pound-Dollar turned positive last week following Wednesday's 0.75% daily advance that followed a softer-than-forecast U.S. inflation print. The advance took the exchange rate to the cusp of 1.27, but it could be a case of too much, too soon as it looks vulnerable to a corrective pullback.

This correction played out on Thursday and Friday, and we would not be surprised to see further such moves in the coming days.

"Momentum peters out after test of 1.2700," says Tanmay Purohit, a technical analyst at Société Générale. "Support 1.2510, resistance 1.2709".

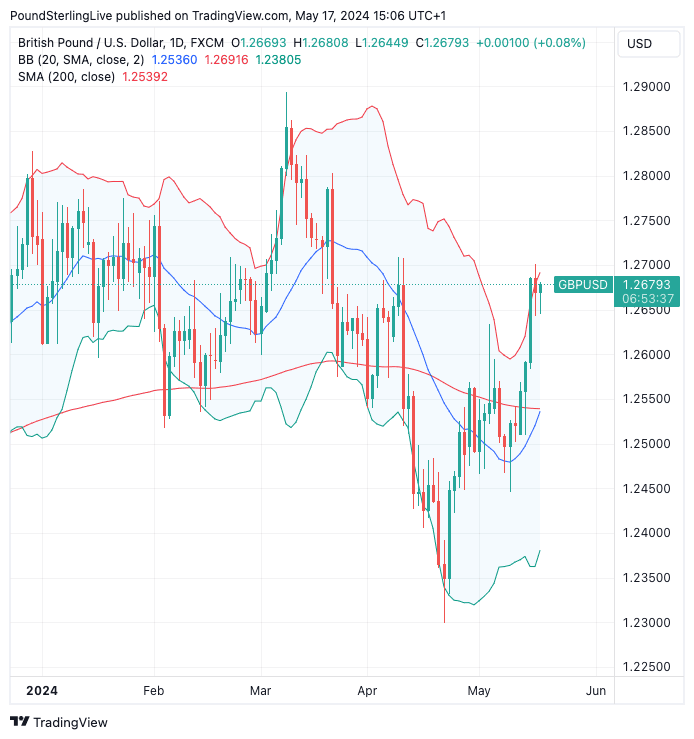

Above: GBP/USD at daily intervals with the 200 DMA and Bollinger bands annotated. Track GBP/USD with your own custom rate alerts. Set Up Here

Last week was important from a technical perspective as Pound-Dollar broke above the 200-day moving average. Followers of our Week Ahead Forecast series will note that we use a simple rule that says when an exchange rate is above the 200 DMA it is in a medium-term uptrend and that any weakness will ultimately fade and yield to further moves higher.

The above chart also shows the rally took Pound-Dollar into the upper Bollinger band, which signals the need for a near-term pullback/consolidation. So while the bigger picture is constructive, near-term weakness can be anticipated.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The corrective move lower can continue in the coming days says Shaun Osborne, Chief FX Strategist at Scotiabank. "Sterling’s drift after reaching my technical target of 1.27 looks corrective. While the daily chart suggests a potential stall in the GBP’s rebound, losses are minimal, taking the form of a small, bull wedge."

His studies show that underlying trend signals remain bullish on the intraday and daily studies.

"Losses may extend to the 1.2550/00 area in the near-term but sterling's overall technical tone remains positive," says Osborne.

The main data event to watch is the midweek UK CPI inflation release, where markets expect inflation to fall to 2.1% year-on-year in April from 3.1% in March, the core inflation rate is expected to fall to 3.7% from 4.2%.

Any deviation from these expectations can influence the currency, with the Pound gaining on upside surprises and falling on any undershoot.

Also, keep in mind that it could well be the services component of the inflation basket that generates the biggest market reaction, as the Bank of England has been at pains to point out that this is their main area of focus. This was highlighted by Ben Broadbent, the Bank's deputy governor, who said on May 09 that he will look more closely at services inflation than wages in the short term.

There is no estimate for the services number, but we would expect any downside progress from last month's 6.0% to bolster expectations for a June interest rate cut. "We see services CPI coming in at a strong 5.4%," says Sanjay Raja, an economist at Barclays.

Analysts at TD Securities look for services to edge down 5.6%, highlighting the divergent expectations in the analyst community. The market's verdict on the actual outcome will be made apparent by the Pound's reaction.

"As it stands, markets are fully priced in for a summer rate cut by the BoE, thus it is a question of when that first cut takes place with the June meeting priced at 54%," says Justin McQueen, market analyst at Reuters.

The Pound can weaken if markets move to fully price a June cut.

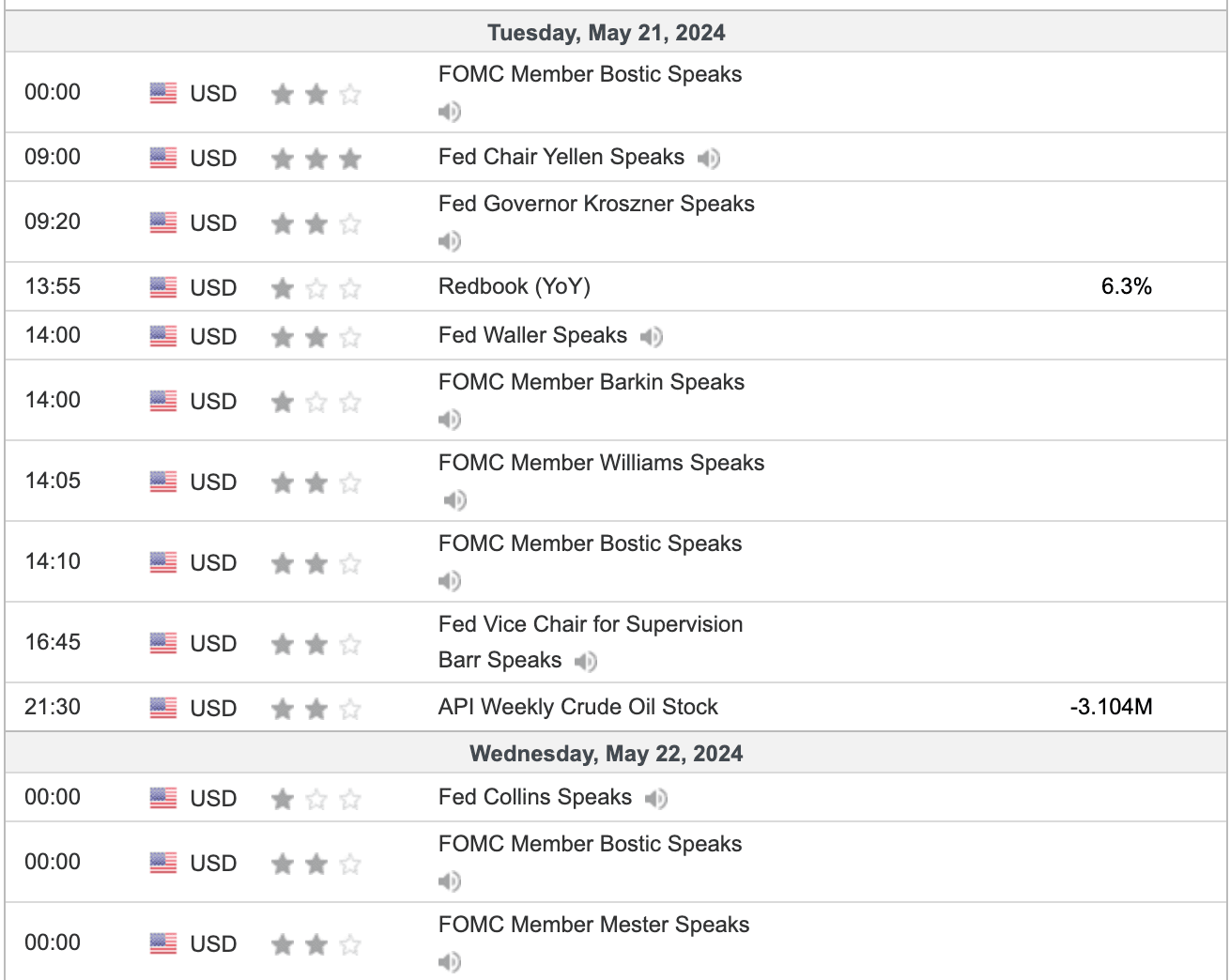

There are no major headline data releases due from the U.S. next week, however, there will be an unusually packed calendar of Federal Reserve speakers.

A look at the below shows the rump of the Fed speak will fall on Tuesday and Wednesday:

We expect the overall message to be one of caution when considering a recent slowdown in U.S. data, with most unwilling to say they support imminent rate cuts. Any impact on the Dollar won't last.