GBP/USD: Correction Due, But Broader Setup is Turning Bullish

- Written by: Gary Howes

Image © Adobe Images

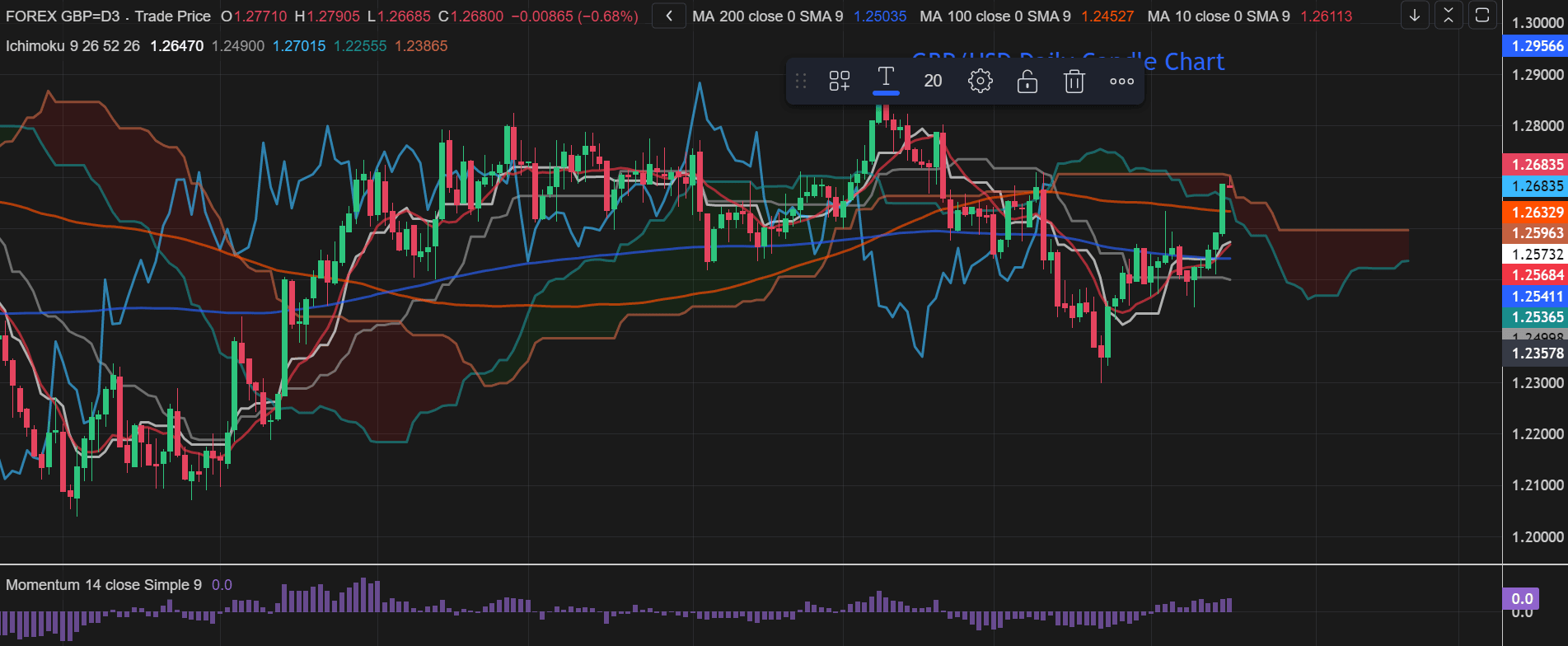

Pound Sterling looks at risk of a near-term pullback and consolidation against the Dollar, but further gains the bigger picture is one of an increasingly bullish technical setup as indicators advocate for further advances.

The Pound to Dollar exchange rate's 0.75% advance that followed the release of softer-than-expected U.S. inflation numbers breached a number of key technical barriers that opens the door to further advances.

The pair pushed through the 50- and 100-day moving averages, all supportive developments near-term. It touched a new one-month high 1.27 on Thursday morning, but has since retraced the move and some consolidation of the strong midweek move looks to be an immediate term prospect.

However, following the pace of recent moves, the risk of a pullback and some consolidation is high. According to Peter Stoneham, an analyst at Reuters, there is a chance of a corrective dip from here and he looks for a move to 1.2530.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But any pullback and consolidation could well lay the foundations for the next leg of the rally into the 1.27s over the coming days and weeks.

Five straight bull sessions for Pound-Dollar, and Wednesday's acceleration, "could be the precursor to a direction change," says Stoneham, who is looking beyond the immediate-term pullback he thinks is a possibility.

Above: Stoneham says the cloud is acting as a near-term barrier for GBP/USD. A break above it would open the door to more gains. Image courtesy of Reuters.

Pound-Dollar has been trending lower through 2024, in line with all other USD-exchange rates, reaching a low of 1.2299 in April. It has since been in a recovery move, that was viewed as a counter-trend pullback.

This essentially means that it was always prone to slipping back into the bigger downtrend of 2024.

But, the recent technical improvement suggests the possibility that 2024's downtrend is turning and bulls are taking the initiative.