GBP/USD Week Ahead: Getting Stretched

- Written by: Gary Howes

Image © Adobe Images

The Dollar is in charge, but the pace of recent advances could be a case of 'too fast, too soon' and a pullback could be on the cards this week.

The Pound to Dollar exchange rate's fall below the 200-day moving average last week means the pair is now in a downtrend as per Pound Sterling Live's Week Ahead Forecast rules.

Therefore, we see the broader direction of travel being lower from here, with rallies to be considered counter-trend corrections that offer tactical opportunities.

Track GBP/USD with your own custom rate alerts. Set Up Here

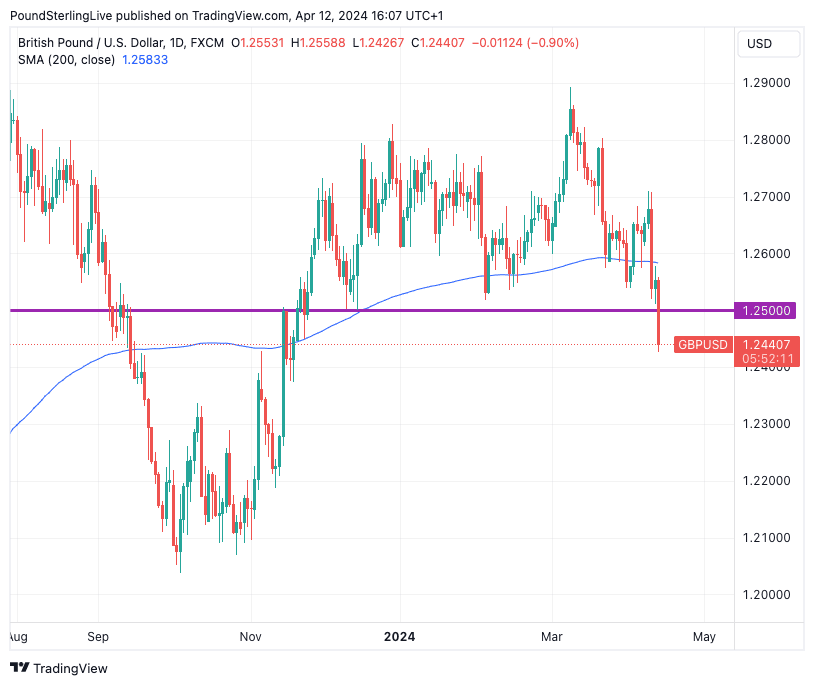

The above chart shows Pound-Dollar has finally broken below the 1.25 level which has been considered a horizontal line of support that delineated the 2024 range, a development that also advocates for further weakness.

"A technically bearish close for the GBP on the week and, perhaps more importantly, a clear break under the 1.25 support zone that has underpinned the GBP for months leaves Cable prone to more weakness," says Shaun Osborne, Chief FX Strategist at Scotiabank. "Support sits at 1.2465—50% retracement of the pound’s Q4 rally. Below there, a return to the 1.22/1.23 range is a risk."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Driving the Dollar's advance is the massive repricing in central bank expectations that followed last Wednesday's U.S. inflation report, which has lit a fire under volatility and sent the Dollar racing higher.

Markets have scrapped expectations for a Federal Reserve rate hike in June and now see just between one and two hikes from the Fed in 2024 while maintaining expectations for the Bank of England and other European central banks to cut interest rates more generously.

The Dollar's strength is only reinforced by the creeping fear washing over equity markets that the rally of 2024 must bow before the realities of a higher-for-longer U.S. interest rate regime.

We need to respect this repricing, and recent momentum could deliver further advances for the Dollar in the coming week.

But, with the marquee job and inflation reports behind us, we suspect the triggers required to deliver further significant gains will be lacking and this can provide some welcome support to Pound-Dollar in the coming week.

We will keep an eye on the U.S retail sales release on Monday: any strong reading here will only confirm solid consumer demand is driving the ongoing rise in inflation. The recent USD advance can extend should the data beat the 0.3% m/m expected by the consensus.

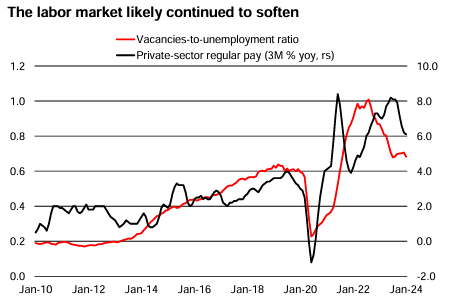

Look for volatility in Pound-Dollar on Tuesday morning when the all-important UK wage figures for February are released. The Bank of England has been reticent to cut interest rates for fear wages are running too high and propping up domestic inflation rates.

Image courtesy of UniCredit.

Should the figures undershoot expectations then the market will grow more comfortable with the idea of a June rate cut, which can result in Pound-Dollar weakness. Tuesday also sees a speech by Bank of England Governor Andrew Bailey, which will offer him the chance to address the issue of potential rate cuts at the Bank in the coming months.

There is no Bank of England decision due in April, making this a potentially important speech as it will serve as the link to the May meeting.

Any hint of increasing confidence that rates can be cut without stoking inflation will likely result in a softer Pound. Wednesday brings with it another Bailey appearance and that of fellow MPC member Haskel.

It will be Wednesday's all-important inflation releases from the UK that will form the week's FX focus: it goes without saying that any undershoot vs. expectations will weigh on the UK currency.

Any above-consensus reading (consensus = 2.9% y/y) would offer the Pound a boost as it would shift the balance of odds for the first rate cut from June to August, putting the Bank of England behind the ECB with regard to the start of the rate cutting cycle.

Image courtesy of UniCredit.

The week ends with the release of UK retail sales, which have, on a couple of occasions in the recent past, triggered greater GBP reactions than either inflation or wages.

According to an analysis from UniCredit Bank, retail sales volumes likely rose 0.6% m/m in March, boosted by the earlier timing of Easter, which likely lifted food sales.

"The British Retail Consortium reported that sales among its members (deflated by its shop price index) rose 2.2% yoy in March, up from -1.4% yoy in February. In contrast, the BDO High Street Sales Tracker (which is not adjusted for prices) posted a steeper fall in yoy terms. The UK consumer remains under pressure from high interest rates, exhausted savings buffers, and a deteriorating labour market," says UniCredit.