Retail Sales Growth Strongest in Eight Months: BRC

- Written by: Gary Howes

Image © Adobe Images

The British Retail Consortium's monthly measure of retail sales hit an eight-month high in March, which points to an ongoing revival of the UK retail sector, according to economists.

UK total retail sales increased by 3.5% year on year in March, according to the BRC. This was well above the consensus expectation of 1.8% and above the 3-month average growth of 2.1% and the 12-month average growth of 2.9%.

The BRC survey is a leading indicator for the official ONS retail sales report, a significant component of UK GDP.

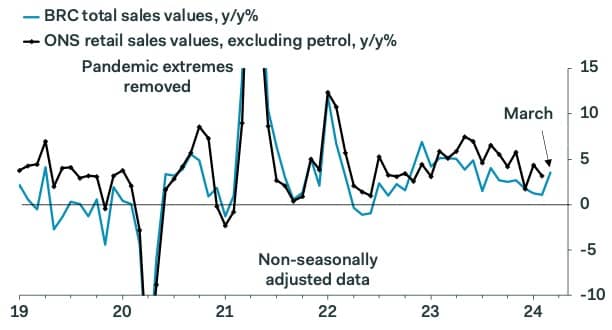

The below chart from Pantheon Macroeconomics shows that BRC measure of retail sales growth is consistent with year-on-year retail sales value growth accelerating in March.

Image courtesy of Pantheon Macroeconomics.

"After a difficult start to the year, retailers are hopeful that with warmer weather around the corner, consumer confidence will spring back up. A strong retail industry can boost investment across our towns and cities," says Helen Dickinson, Chief Executive of the British Retail Consortium.

However, much of the growth was driven by food sales, reflecting the early Easter, while non-food categories saw another decline.

Food sales increased 6.8% year on year over the three months to March, against a growth of 8.5% in March 2023. This is below the 12-month average growth of 7.7%. For the month of March, food was in growth year-on-year.

Non-food sales decreased 1.9% year on year over the three months to March, against a growth of 1.8% in March 2023. This is steeper than the 12-month average decline of 1.1%. For the month of March, non-food consumption declined year-on-year.

Economist Rob Wood says April should see the report record a softer outturn, as is often the case in the period following Easter.

That said, he sees a steady improvement in the prospects facing retailers as disposable incomes recover.

"We think the recovery in disposable income will be strong enough to enable households to ramp up spending while maintaining a higher-than-usual saving rate," says Wood.

Linda Ellett, UK Head of Consumer Markets for Leisure & Retail at KPMG, says economic indicators are heading in the right direction with inflationary pressures easing and interest rates having potentially peaked.

"However consumer confidence remains fragile, and households continue to keep a close eye on where their tight budgets are being spent. It remains a challenging environment, but as we head into the warmer months, retailers will be hoping that stronger consumer confidence will turn into stronger retail sales, especially in more discretionary categories such as clothing, following an incredibly difficult few years," says Ellett.