Pound Sterling A Sell: HSBC

- Written by: Sam Coventry

Image © Pound Sterling Live

Foreign exchange strategists at HSBC are sellers of the British Pound because recent interest rate developments leave the currency looking over-priced while economic headwinds limit its attractiveness.

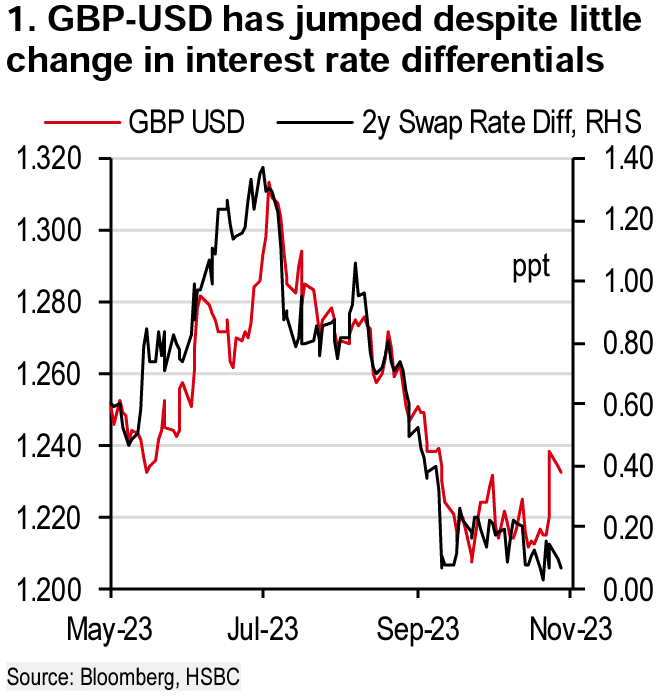

"The recent bounce in GBP-USD following softer US non-farm payrolls and a non-committal Federal Reserve meeting has run out of steam. The move looks extreme relative to changes in relative 2y swap rate differentials," says Dominic Bunning, Head of European FX Research at HSBC.

U.S. interest rate expectations fell last Friday following the release of U.S. labour market data that printed softer than the market was expecting. This weighed on U.S. bond yields relative to elsewhere, including the UK, prompting a rally in the Pound to Dollar exchange rate to a peak just above 1.24 on Monday

But, according to Bunning, the "FX move has diverged from rate differentials... it is unlikely that rate pricing shifts more in favour of GBP, in our view."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

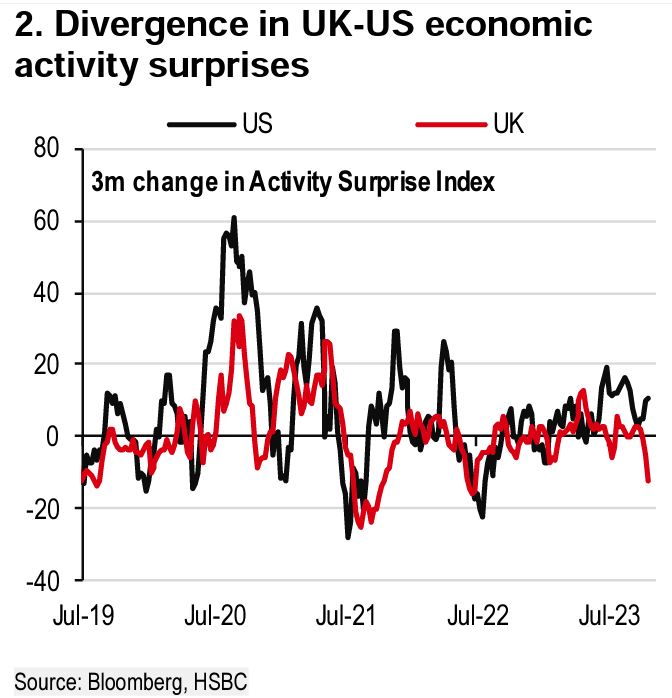

Further considerations include recent economic activity data, which remains weak in the UK.

"The UK activity surprise index has taken a turn lower, while US activity data continues to surprise somewhat to the upside. Global risk appetite is also unlikely to rise significantly, given a soft global data pulse and limited potential for policy support," says Bunning.

HSBC's foreign exchange strategists are short-term sellers of Pound-Dollar at 1.2315, targetting a retreat to 1.2040.