GBP/USD Rate Surges to 1.23 Following U.S. Payrolls Miss

- Written by: Gary Howes

Image: Doug Turetsky. Sourced: Flikr, licensing: CC 2.0.

The Pound to Dollar exchange rate rose by over a per cent to retake 1.23 and further improve its short-term setup following the release of U.S. labour market statistics that disappointed against expectations.

The Dollar was sold across the board after official figures revealed the U.S. created 150K jobs in October, which was below the consensus estimate for 180K and September's downwardly revised 297K

The unemployment rate unexpectedly rose to 3.9% from 3.8%, while average hourly earnings rose 0.2% month-on-month, which was below the 0.3% expected and 0.3% reported in September.

"With the rest of the US jobs report reading soft, markets got the green light to continue purchasing high-yielding US debt, reduce USD longs, and bring forward pricing of the Fed’s easing cycle," says Simon Harvey, Head of FX Analysis at Monex.

The Pound to Dollar exchange rate rose to 1.2336 and the Euro to Dollar exchange rate to 1.0718.

The Dollar was down against all G10 peers, with the largest losses coming against the Kroner and New Zealand Dollar (-1.55%).

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The jobs market looks to be softening after all," says economist Sarah House at Wells Fargo. "October's rise in the jobless rate was due to a noticeable decline in the household measure of employment and rising ranks of unemployed workers."

The slowing labour market reinforces market expectations that the Federal Reserve won't raise interest rates again and that the next move will be a rate cut.

This helps bring down U.S. bond yields which represents an easing in financial conditions, which is supportive of equity markets and risk-on currencies.

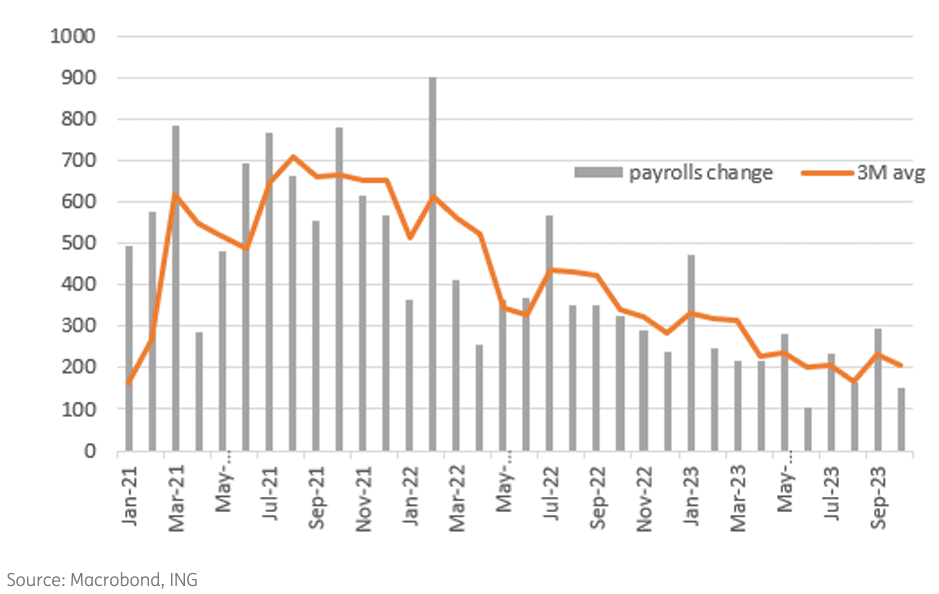

Above: U.S. non-farm payroll outcomes, image courtesy of ING.

"Labour market numbers are always the last thing to turn in an economic cycle so the softening in employment and wage growth and the rise in the unemployment rate makes it all the more likely that the Federal Reserve won’t hike interest rates again," says James Knightley, Chief International Economist at ING Bank.

The data showed the U.S. participation rate dropped back to 62.7% from 62.8%, a development that suggests a loosening labour market.

"This should give the Fed a bit more confidence that inflation can continue its softening trend, especially in the wake of the big falls seen in gasoline prices," says Knightley.

Economists are also picking up that the rise in unemployed workers in October was accounted for by job losers as opposed to new and re-entrants into the labour market.

"That’s different than earlier months when the increase in the unemployment rate was largely driven by longer job search times rather than higher layoffs," says Claire Fan, Economist at the Royal Bank of Canada.

"Clearer signs of moderating wage growth and low inflation readings mean the Fed should not need to hike again in the current cycle while waiting for softening economic conditions to emerge elsewhere," she adds.

The implications for the Dollar are pretty significant, as per the sizeable losses being recorded in the wake of the numbers.

Should the U.S. exceptionalism story roll over, the Dollar's latest cycle of appreciation could have already turned.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks