GBP/USD Rate Nears Fresh Lows

- Written by: Gary Howes

Image © Adobe Images

Rising U.S. bond yields, surprisingly strong U.S. economic data, falling equities, rising oil prices and a pivotal break higher in USD/JPY are conspiring to keep the Dollar on the offensive.

This long list of developments results in the Pound to Dollar exchange rate falling to 1.2080 and puts a retest of 2023 lows at 1.2038 on the near-term agenda, with a potential break below 1.20 possible before the weekend.

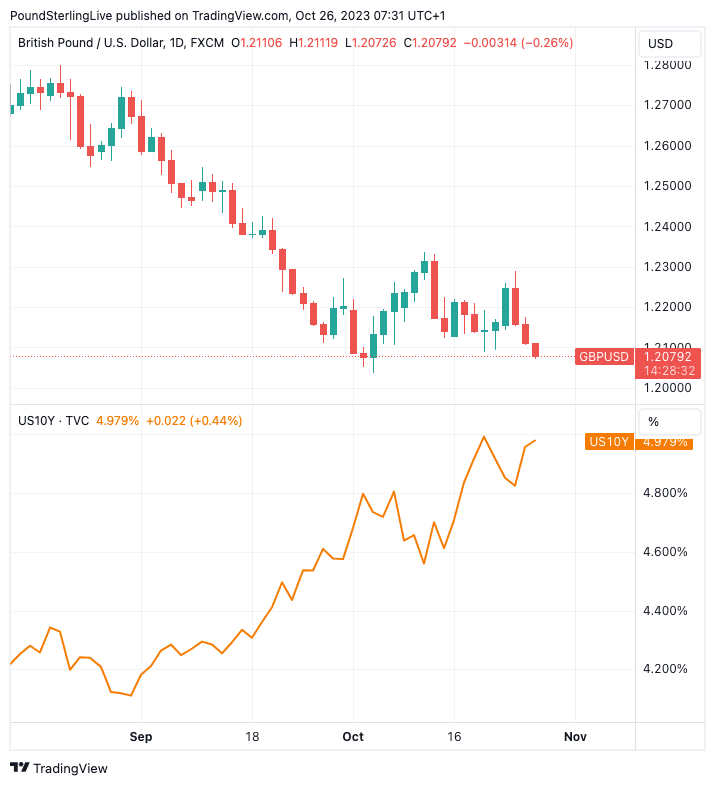

U.S. ten-year treasury yields (UST10s) are back in focus with another push to the 5.0% marker underway, reflecting diminished investor demand for these bonds amidst uncertainty over the economic outlook. Rising yields meanwhile raise the cost of money and, in turn, undermine equity markets, both developments proving supportive of the Dollar.

"UST10s are heading back for a test of 5% (4.965%) as twin bond/equity weakness remains the theme, despite the brief pullback at the start of the week. USD remains the top performer," says Elsa Lignos, Global Head FX Strategy at RBC Capital Markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Yields were helped by data that showed new home sales in the U.S. surged 12.3% in September to 759K, defying expectations for a rise of 680K. The data confirms the U.S. economy to be in rude health and puts paid to the likelihood of rate cuts at the Federal Reserve coming in early 2024.

This underpins the 'higher for longer' narrative that supports bond yields and the Dollar.

The Dollar pushed the Yen back above 150, which amounts to a significant technical development for the broader market, given the scale and importance of the Dollar-Yen exchange rate.

"This break higher could prove key though and may well be a signal for the markets to buy the U.S. dollar more broadly," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

The Bank of Japan appears to have intervened in the market in London morning trade, putting a halt on USD/JPY's advance for now, which is, in turn, giving other exchange rates room to recover.

The Euro had declined back to EURUSD 1.0540, although this pair remains surprisingly robust.

However, Pound Sterling is looking decidedly more fragile than the Euro and Pound-Dollar has now fallen for three days in succession and could threaten a break below 1.20 if current trends persist.

Above: As U.S. ten-year yields rise (bottom pane) the Pound to Dollar exchange rate (top pane) will remain under pressure. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

A rally in oil prices is also proving supportive of the Dollar, with prices rising by over a per cent on Wednesday night following news that Israel is set to invade the Gaza Strip.

No timeline for an invasion has been given, but the risk of Iran becoming more active in the region grows under such a scenario, potentially leading to oil supply disruptions.

"Dollar strength seems set to persist in the week ahead," says Sean Callow, FX Strategist at Westpac. "Since the Hamas attack on Israel, traditional haven currency the Swiss franc has led the G10, though the US dollar is not far behind."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks