Dollar-Yen Soars Past 150, Bank of Japan Might Have Intervened Again

- Written by: Sam Coventry

Image © Adobe Stock

The Dollar to Yen exchange rate has breached the 150 'line in the sand' and invited another Bank of Japan currency market intervention, with further moves likely over the coming hours and days, although prominent strategists we follow say it might not be enough to halt the decline.

USDJPY was quoted as high as 150.74 following another push higher by the Dollar that is linked to another blow-out U.S. economic data release, rising oil prices, heightened geopolitical risks and a resumption of the U.S. treasury bond yield rally.

The factors behind the Dollar's latest rise are legion, and the Bank of Japan might be wondering whether any intervention is practical in this environment.

Nevertheless, there appears to have been some central bank-linked interference in the London morning with a sudden spike lower in USDJPY recorded around 7:45 BST:

Above: USDJPY at 5-minute intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Subsequent price action suggests that if this was an intervention, it has helped stem the upside impetus, although it has failed to bring the rate back below 150.

The most recent case of Bank of Japan currency market intervention appears to have been on October 03, when the Yen surged during mid-afternoon London / morning New York trade, suggesting it could be a long day of nerves ahead for Western markets.

"USDJPY is soaring above 150.20, raising the risk of intervention-related headlines," says a note from Citibank's strategy desk. "Further upside cannot be completely ruled out, even if intervention language risks rise proportionately to spot."

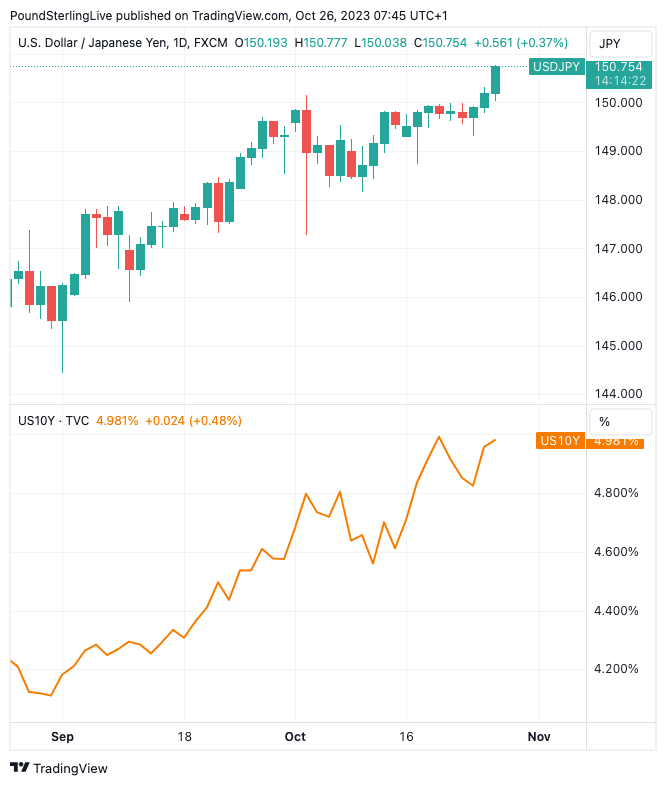

U.S. ten-year treasury yields (UST10s) are back in focus with another push to the 5.0% marker underway, reflecting diminished investor demand for these bonds amidst uncertainty over the economic outlook.

Above: The rise of U.S. ten-year yields (bottom panel) presents an irresistible upward influence on USDJPY (top panel), making 150 an ultimately arbitrary level.

Rising yields raise the cost of money and undermine equity market valuations, both developments proving supportive of the Dollar.

Yields were helped by data that showed new home sales in the U.S. surged 12.3% in September to 759K, defying expectations for a rise of 680K. The data confirms the U.S. economy to be in rude health and puts paid to the likelihood of rate cuts at the Federal Reserve coming in early 2024.

This underpins the 'higher for longer' narrative that supports bond yields and the Dollar.

"If earlier tests of 150 were a bit more tentative, overnight USD/JPY traded well clear of that level – hitting 150.47... with no sign of intervention yet," says Elsa Lignos, Global Head FX Strategy at RBC Capital Markets.

"Subdued volumes point to nervousness and an unwillingness of speculative investors to jump on the break. But in the absence of MOF intervention, and without a turnaround in U.S. yields, we think USD/JPY will keep grinding higher as domestic investors are still buyers," adds Lignos.

A rally in oil prices is also proving supportive of the Dollar, with prices rising by over a per cent on Wednesday night following news that Israel is set to invade the Gaza Strip.

No timeline for an invasion has been given, but the risk of Iran becoming more active in the region grows under such a scenario, potentially leading to oil supply disruptions.