Yen Pumped by BoJ Intervention

- Written by: Gary Howes

Image © Adobe Stock

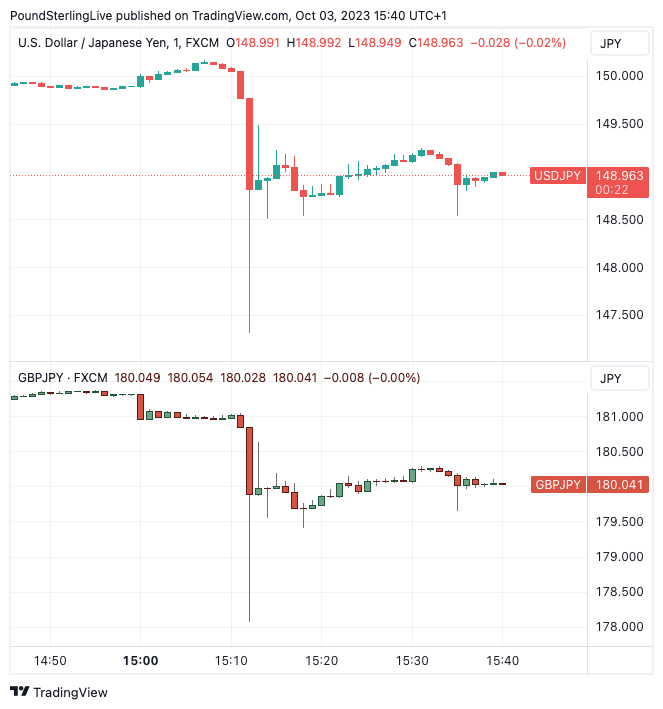

A sudden surge in the value of the Japanese Yen suggests the possibility that the Bank of Japan has intervened in the market to defend the currency which has been steadily falling in value against the Dollar.

The Dollar to Yen exchange rate suddenly slumped by nearly 2.0% in morning U.S. trade to 147.312 having earlier hit a fresh one-year high at 150.16, a level considered a "line in the sand" for authorities in Japan who have been growing increasingly uncomfortable with JPY's devaluation.

Other Japanese crosses reacted accordingly with the Pound to Yen rate sliding to 178.62 from the day's high at 181.37.

"A widely anticipated currency intervention by the Bank of Japan (BoJ) once USD/JPY rose above the ¥150 mark briefly pushed the cross down by over 200 pips. The intervention has not yet been a success though as buyers have taken USD/JPY straight back above the ¥149 level," says Axel Rudolph, Senior Market Analyst at IG.

Above: Dollar-Yen (top) and Pound-Yen clearly showing a sizeable purchase of JPY.

That the exchange rate suddenly fell having encountered the 150 level suggests strongly that the Bank of Japan has intervened with analysts at Japanese bank MUFG warning this level was one to watch.

"A shift in BoJ policy also becomes more likely and we would expect strong resistance to Yen weakness at levels over 150.00," said MUFG in a note out this week.

Mizuho also warned clients about the potential for intervention around this key marker.

"Admittedly, the continued JPY weakness is a concern. While 150 remains a closely watched figure, it is not a clear line in the sand," says the research. JPY weakness will be restrained as JPY bears will be wary of intervention risks."

Japan authorities defended the Yen in September in a first foray into the market to boost the currency since 1998.

Yen weakness is considered problematic, with Japanese firms having shifted production overseas and the economy heavily reliant on imports for goods ranging from fuel and raw materials to machinery parts.

Finance Minister Shunichi Suzuki has recently said authorities "won't rule out any options" to deal with excessive currency volatility, and that they were watching currency moves with a "strong sense of urgency."