Pound Rallies Against Dollar But Upside Limited

- Written by: Gary Howes

Image © Adobe Images

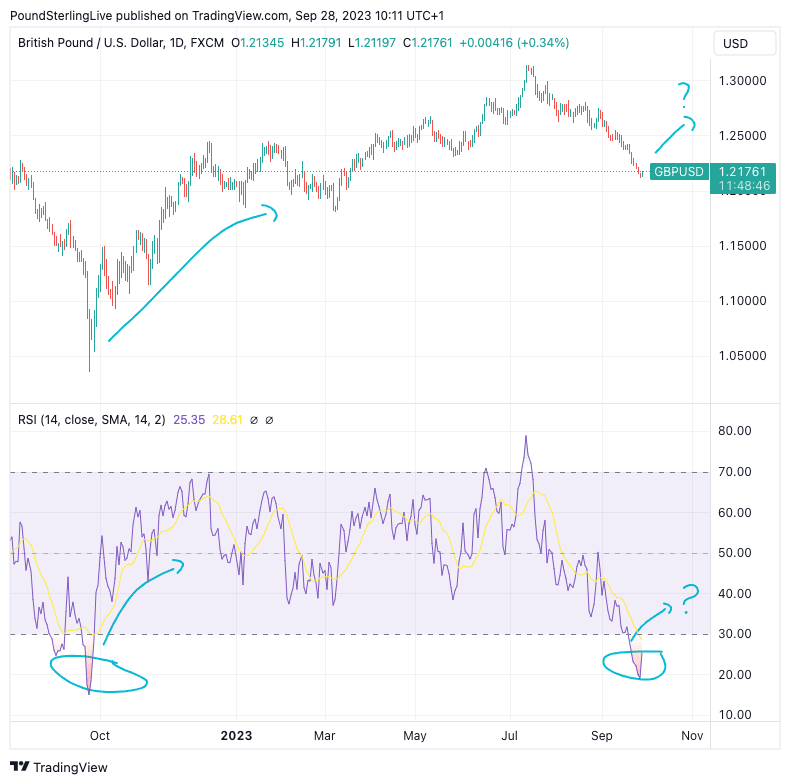

The Pound to Dollar exchange rate (GBPUSD) is in recovery mode as it unwinds previously oversold conditions, but those watching Pound Sterling's value should be aware that for now upside is likely to be limited as the Dollar retains commanding fundamentals.

GBPUSD rose a third of a per cent to 1.2169 by the time of writing on September 28 as investors looked forward to another month and quarter, prompting rebalancing that called time on the Dollar's impressive September rally.

The rise in GBPUSD was mirrored elsewhere; even EURUSD was higher despite some notably softer-than-forecast inflation data released by Germany and Spain.

"We see a strong possibility of further sterling downside over the next few weeks and months. However, it might be time for a short-term rebound or at least some consolidation at current levels given the extreme oversold conditions of GBP/USD, which is reflected in the daily relative strength index (RSI)," says George Vessey, an analyst at Convera.

Above: GBPUSD at daily intervals with the RSI shown in the lower panel. The scope of the RSI correction and associated GBPUSD rally is however questionable owing to the USD's current period of dominance.

Vessey notes the RSI for GBPUSD fell below 20 for the first in 12 months.

"The last time it was around this level, the currency pair had fallen to a record low but rebounded 10% in seven days. We’re not saying this kind of rebound will happen again, but we do feel the pound is overdue some relief," he adds.

Convera sees $1.23 as a potential short-term upside target, but the 50-week moving average may now be a tough resistance level to overcome.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"We also took profit on short GBP/USD ahead of our 1.2000 target as the price action was a bit extreme and the USD was very stretched on just about every measure I look at," says W. Brad Bechtel, Global Head of FX, Jefferies LLC. "Too many parallels to what we have seen in prior USD rally cycles, especially in the Fall time frame, where end up seeing a significant correction before the USD bid resumes. We will now wait for that USD correction."

The majority of foreign exchange analysts we follow are of the view any Pound-Dollar strength will prove shortlived as it would take a fundamental shift in the global and U.S. economies to throw it off course.

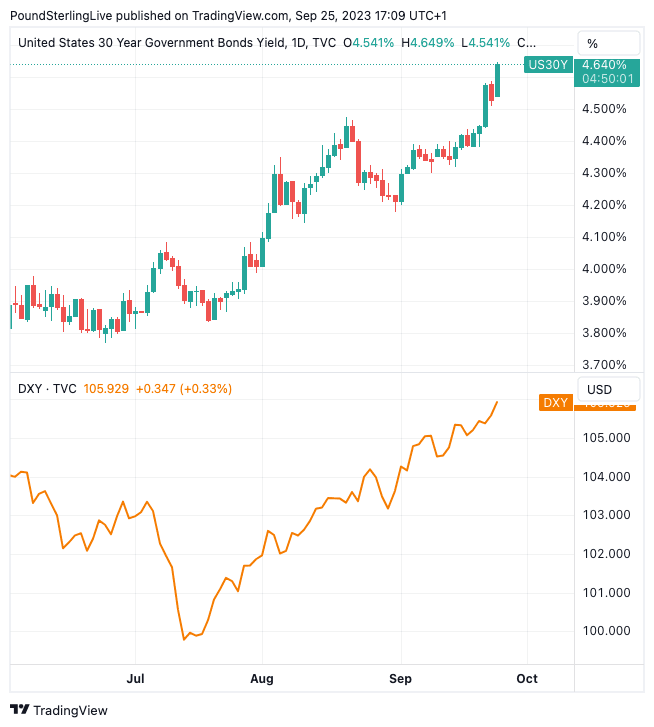

"The USD’s entrenched bull trend is developing breathtaking momentum as long-term yields repeatedly strike fresh 13yr highs," says Richard Franulovich, an analyst at Westpac.

Global long-term yields have surged - led by the U.S. - as markets factor in the Federal Reserve's September guidance that rates are going to remain higher for longer, prompting a reversal in the amount of cuts predicted by the market in 2024.

Rising bond yields have a positive correlation to the Dollar and can explain much of the strong rally witnessed over recent days.

Westpac's Franulovich says both rates and the USD have covered substantial territory toward realignment with the Fed’s more resilient outlook and scaled-back rate cut projections, "but there’s yet more work to do."

He explains consensus 2024 growth forecasts for 0.9% are below the Fed’s 1.5%, and 100bp in 2024 rate cuts are still priced into OIS swaps, materially more than the Fed’s revised dot plot for 50bp in cuts.

That means there is ample space for a further retracement in rate-cut bets, which can only fuel Dollar support.

Above: Rising long-dated bond yields (top) are pulling the Dollar higher.

Analysts at ING Bank say the situation will potentially only turn around when the U.S. economy starts to slow, allowing investors to raise confidence in the prospect of Fed rate cuts.

"A softening in U.S. activity data is required to turn the dollar around. But because of the poor investment outlook overseas, that bar for poor U.S. activity data is now higher," says Chris Turner, head of FX analysis at ING Bank.

ING cites the following factors that can keep the Dollar bid:

- Strong U.S. growth and a Federal Reserve that is showing no signs of letting up its hawkish rhetoric.

- The market is building the view that the next Fed easing cycle will not be the kind of 300-400bp affair seen in prior decades.

- This has lifted the market pricing of the low point for the next Fed easing cycle - priced in around three years - to 4.29%.

- It was just at 3.99% last Friday and around 3% in the spring.

"This has been a key factor driving long-end US rates higher. 5.00% on the US 10-year Treasury yield is the bias from our rates strategy team," explains Turner.

In addition, "higher crude oil prices, as Saudi supply cuts keep the market in deficit, are driving a renewed wedge between the 'haves' - the U.S. - and the 'have nots' - Europe and Asia. Our commodities team sees the risk that Brent crude briefly spikes above $100/bbl," he explains.

GBPUSD strength can therefore be expected to be limited in duration.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks