Dollar at New 2023 Highs as Bond Rout Gathers Pace

- Written by: Sam Coventry

Image © Adobe Images

The Dollar rose to a new 2023 high and kept the Pound and Euro under pressure as rising bond yields signal "trouble" for global markets, according to analysts.

Global equity markets were also lower, led by Europe, ahead of month- and quarter-end with the rise in long-term bond yields blamed by analysts for the rout.

"What a way to start the week. Core bonds fell off a cliff with the long end again underperforming. The move was natural, not driven by any particular event and that makes it so telling," says a note from KBC Markets (recall, falling bond demand and valuation = a rise in the yield of said bonds).

Jim Reid, an analyst at Deutsche Bank, points out in his regular daily briefing that the 10yr Treasury yields rose +10.0bps and closed comfortably above 4.5% for the first time since 2007 on Monday; 10yr real yields were near 15yr highs; the 10yr bund yield traded above 2.8% for the first time since 2011; the VIX index of volatility flirted with its highest level since May intra-day; the US dollar index hit a YTD high.

"Higher real rates are firmly in the driving seat after the Fed last week opened final deniers’ eyes with an end of 2024 policy rate projection above 5%. The increase in real rates continues to hurt risk sentiment," says KBC Markets.

Above: UK 30-year bond yields are up, but are being outpaced by German equivalent (lower panel) which are at new highs.

"The recent rise in yields is partly because investors are pricing in that policy rates will remain higher for longer, particularly after the Fed’s dot plot last week. But it’s also been driven by the growing realisation that supply is set to remain elevated given mounting budget deficits, along with a small uptick in longer-term inflation expectation," says Reid.

Longer-term bond yields are rising as investors bet central banks, most notably the Federal Reserve, will keep interest rates elevated for a longer period of time.

This is resulting in deteriorating investor sentiment as higher yields push up the cost of borrowing, creating headwinds to economic and consumer activity.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The new week has picked up where the last one left off. Stocks have dropped further in trading today, as the Fed’s 'higher for longer' rhetoric continues to prompt a flight from risk," says Chris Beauchamp, Chief Market Analyst at IG.

The moves have meanwhile been associated with a rally in the Dollar, which can continue, say analysts.

"Even if the US economy is headed for a slowdown, the USD could find support on the back of haven demand given broad-based concerns over weak global growth," says Jane Foley, Senior FX Strategist at Rabobank.

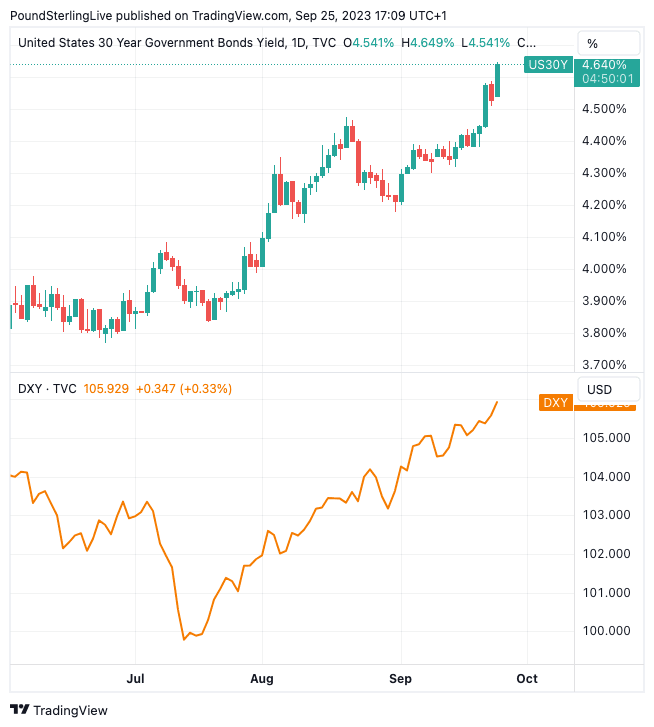

Above: The 30-year U.S. bond yield is surging, taking the Dollar index (lower panel) higher.

Beauchamp explains a fresh climb in yields only adds to the stock market’s woes, as investors come to realise that when Powell says 'higher for longer', he really means it."

Looking at the Euro-Dollar shows it has now shifted below 1.0635/11 support to currently change hands around the 1.06 big figure.

"Next support stands at 1.0516/1.0484 (March & Jan lows). The trade-weighted dollar is already testing the March (YTD) high at 105.8," says KBC Markets.

The Pound-Dollar exchange rate is meanwhile trading at 1.2216, its lowest level since March.

"We remain of the view that the USD is unlikely to weaken significantly until Fed rate cuts are firmly on the horizon. These will be instrumental in boosting risk appetite. This suggests that USD strength could remain in play into 2024," says Rabobank's Foley.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks