Pound / Dollar Rate Pointed Higher in February

- Written by: Gary Howes

- USD a sell short-term says strategist

- As USD starts Feb on a soft footing

- GBP/USD recovers back above 1.34

- Beware BoE disappointment Thursday

Image © Adobe Images

The U.S. Dollar could be set for a softer February according to analysts, a view that could afford a move back to 2022 highs for the Pound to Dollar exchange rate.

Heading into 2022 the Dollar was a firm favourite amongst analysts and market participants alike coming off the back of a strong 2021, but it initially fell in the first half of the month before refinding its feet.

Indeed, the final half of January was met with concerted Dollar buying as a net USD long held by the market had now been pared back and investors began buying back into a hawkish Federal Reserve that signalled it could be set to raise interest rates by as many as four times in 2022.

But, for one strategist the Dollar is vulnerable at the start of February.

"To me, this is setting up as a spectacular place to take a shot at short dollars. You have all sorts of things going on that suggest it’s a good tactical entry," says Brent Donnelly, CEO of Spectra Markets.

- GBP/USD reference rates at publication:

Spot: 1.3446 - High street bank rates (indicative band): 1.3075-1.3170

- Payment specialist rates (indicative band): 1.3325-1.3379

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Donnelly says the January month-end period has been dominated by significant Dollar buying, but now that this has passed the market could be ready to sell Dollars.

Donnelly finds that the foreign exchange market can tend to revert on the moves seen in January, therefore USD strength must unwind.

In January the Dollar appreciated by about 1.0% against the Pound and nearly 2% against the Euro.

Donnelly also finds U.S. data is slowing, "because of the fiscal cliff, not omicron."

Importantly the boost to U.S. yields afforded by last week's Federal Reserve meeting will start to unwind says Donnelly and U.S. rates will therefore start to converge with rates elsewhere.

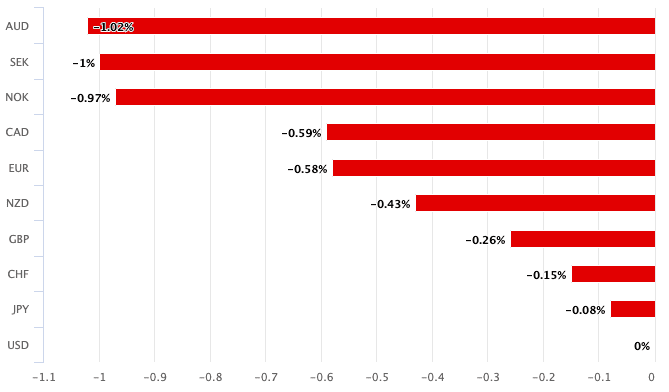

In a potential omen for the new month, the Dollar was out of favour on January 31 when it retreated against all its peers, allowing the Euro to Dollar exchange rate to recover back to 1.1215 and the Pound to Dollar exchange rate to climb back to 1.3440.

Above: USD lost value to all major peers at the start of the new week.

The week ahead should meanwhile prove an important one for the British Pound which will be subject to the Bank of England's policy rate decision, due Thursday.

The Bank is widely anticipated to raise interest rates by 25 basis points and announce it its intention to begin passively winding down its balance sheet by opting to no longer reinvest maturing bonds purchased under its quantitative easing programme.

For Pound-Dollar to remain steady the Bank must go ahead and meet market expectations by raising rates while also signalling further rate hikes will be necessary.

Downside risks to the Pound come in the form of the Bank cautioning that the market's expectation for up to 100 basis points of rises by the end of 2022 are unjustified.

"The BOE Thursday is expected to raise its key rate to 0.50% from 0.25% with area inflation around 5.5%, the highest in three decades. The BOE has a penchant for surprise, so if policymakers should decide against a rate increase this week, the pound would be at heightened risk of testing recent lows," says Joe Manimbo, Senior Market Analyst at Western Union.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We forecast a much less aggressive tightening cycle than what is currently priced in front-end rates, but the Fed’s hawkishness may provide the MPC some cover. We therefore look to add another 25 bps hike in May to our forecasts," says Stefan Koopman Senior Macro Strategist at Rabobank.

But Sanjay Raja, an economist at Deutsche Bank - who is ranked amongst the top forecasters for the UK economy by Reuters - sees the Bank of England meeting hawkish expectations.

"We're expecting the MPC to turn the page on its ultra easy policy stance. We expect to see the first back-to-back rate hike since 2004, with the Bank Rate raised to 0.5%," says Raja.

Deutsche Bank says more hikes are likely given the scale and persistence of inflation and they expect another 25 basis points of tightening in August, followed by two more hikes next year to take the terminal rate up to 1.25%.

This means the Bank would be on course to meet elevated market expectations for Bank of England rate hikes, albeit potentially later than some in the market are expecting.

But Raja warns bringing inflation down at all costs comes with a heavy price tag: a full stop to growth or even worse, another recession.

The longer term implications for the Pound of the Bank's hiking cycle therefore might be more complicated than the current playbook suggests.