U.S. Dollar Holds Lead in G10 for 2021 after Second Half Comeback

- Written by: James Skinner

- USD tops class after Fed ignites zero to hero rally

- With June signal of QE taper & higher rates ahead

- USD/JPY strongest as USD/CAD struggles to lift-off

- GBP/USD enters new year carrying -1.2% decline

Image © Adobe Images

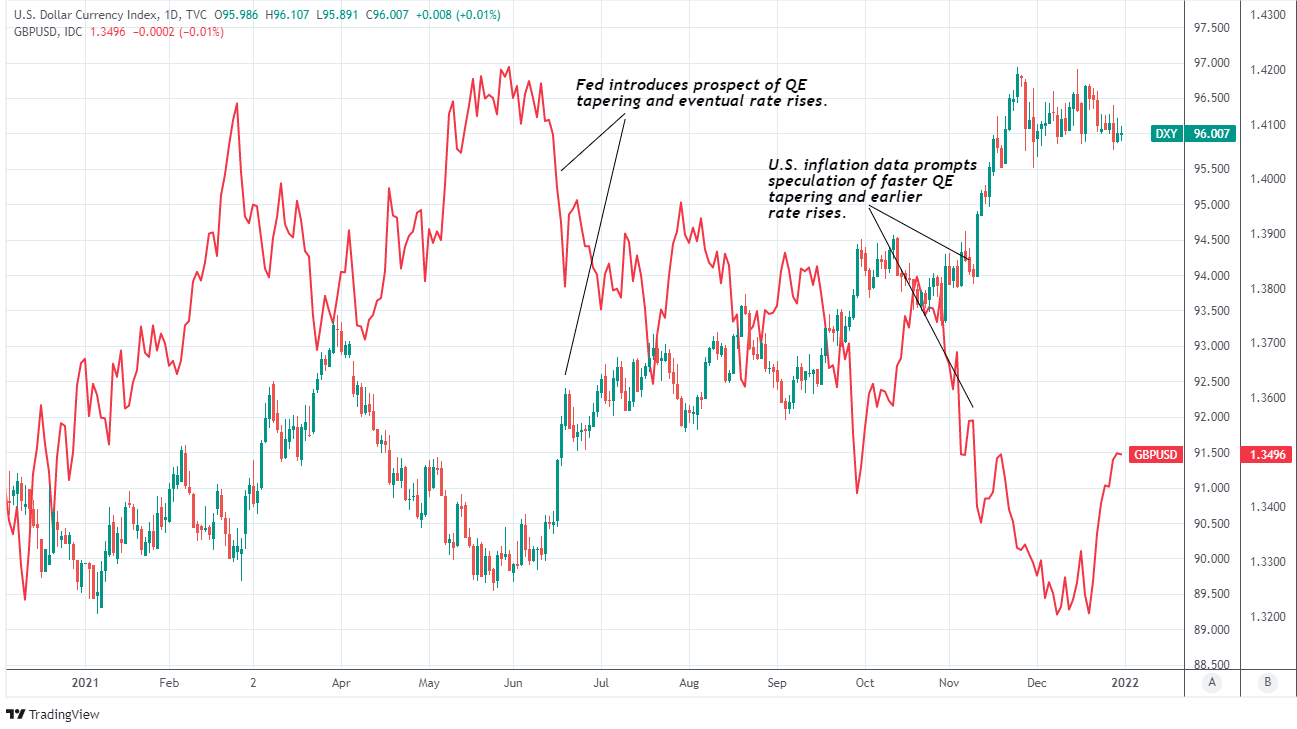

The U.S. Dollar retained an annual lead in the G10 contingent of major currencies during the final day of trading for 2021 following a comeback that was ignited by the June shift in Federal Reserve (Fed) monetary policy that remains front and centre for financial markets heading into the new year.

Dollar exchange rates were a mixed picture on Friday after the greenback eked out tepid gains over the Japanese Yen but otherwise gave way to the rest in the G10 contingent of major currencies including Sterling, enabling the Pound-Dollar rate to edge tentatively back above 1.35.

Elsewhere the greenback was higher against the Polish Zloty, Turkish Lira and Russian Rouble but had fallen more than half a percent against the Chinese Renminbi, which pushed the USD/CNH exchange rate back beneath 6.35 and toward its 2021 low at 6.3322.

The above-referenced gains brought the 2021 decline in USD/CNH to -2.5% and made China's Renminbi the top performer out of all currencies for the year with little except the Canadian Dollar even coming close to matching it.

“Today is the last day of 2021, and with no major market drivers yesterday, and no important events scheduled for today, we do expect a quiet trading activity,” says Charalambos Pissouros, head of research at JFD Group.

Above: U.S. Dollar performance against G10 currencies in 2021. Source: Pound Sterling Live.

- GBP/USD reference rates at publication:

Spot: 1.3475 - High street bank rates (indicative band): 1.3103-1.3198

- Payment specialist rates (indicative band): 1.3381-1.3410

- Find out about specialist rates, here

- Set up an exchange rate alert, here

“Monetary policy divergence may be one of the main drivers in the FX market. The currencies with central banks which are expected to continue to tighten aggressively are likely to perform better,” Pissouros said in a Friday note to clients.

With few exceptions the Dollar has swept the board of opposition since June when the Federal Reserve first indicated that it was beginning to think about an eventual winding down of its mammoth $120BN quantitative easing programme and future decision to begin lifting its interest rate.

A plan for that mooted tapering of the bond buying programme has since been announced and was subsequently accelerated between early November and late December, while this month the Fed also gave financial markets advanced notice that interest rates could rise as soon as March next year.

“The US has left the pandemic shock behind, while Europe lags considerably. This difference will become increasingly apparent in 2022,” says Athanasios Vamvakidis, head of FX strategy at BofA Global Research.

“The very loose fiscal policy stance, in relative terms, could force the Fed to tighten policies more than other G10 central banks,” Vamvakidis and colleagues wrote in a briefing setting out their views for the year ahead.

Above: U.S. Dollar Index shown at daily intervals alongside Pound-Dollar rate.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Fed has been set to to take until June 2022 in order to fully wind down its bond buying programme, with interest rates set to remain near zero for quite some time after and in any case for as long as it takes for the U.S. economy to return to pre-pandemic levels of employment.

However, December’s policy decision saw the Fed announce a plan to complete the tapering process in March 2022 and also came alongside new economic forecasts that suggested the Fed Funds interest rate could rise as many as three times next year, beginning in either March or April.

“The Fed’s shift has been partly priced in, but we think markets may still underappreciate the timing and pace of funds rate hikes (our economists now expect a first rate increase in March),” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

“Our forecasts still envision that the Dollar will be flat-to-down over the course of 2022 due to healthy global growth and rate hikes by other central banks (e.g. the Bank of Canada) that keep pace with the Fed. But over the near-term we would expect Dollar strength to continue,” Pandl and colleagues said in a late December research note.

The Fed’s policy pivot followed official statistics that showed U.S. inflation surging to more than 6% during October and November, as prices of many goods and services continued to be lifted by pandemic-related disruptions to supply chains and other factors.

Above: Dollar Index shown at weekly intervals with Fibonacci retracements of 2020 fall indicating likely areas of technical resistance to any recovery.

It marks a sharp and yet timely about-turn on the policy stance adopted by the Fed in December 2020 and held by the bank until June, a stance that sought to maintain an exceptionally stimulative monetary policy until certain preconditions around employment and inflation had been met.

“The more pertinent source of USD supremacy is likely to remain the Fed’s continued exit from emergency levels of policy accommodation,” says Dominic Bunning, European head of FX research at HSBC.

“On the flipside of this equation lies the EUR and the ECB where we believe the policy contrast with the Fed will remain acutely apparent through 2022,” Bunning and colleagues wrote in a preview of their 2022 forecasts.

The Fed had previously wanted to see “substantial further progress” made toward the “maximum employment and price stability goals” of the bank’s Federal Open Market Committee before even contemplating reducing the monetary support provided to the U.S. economy.

However, the number of officially unemployed persons fell from 10.7 million to 6.9 million between December 2020 and November 2021 while the number of individuals whose employment was temporarily disrupted by the pandemic fell from 15.8 million to 3.6 million.

Meanwhile, and since December 2020, U.S. inflation has sustained an increasing overshoot of the Fed’s 2% average target and played a key role in prompting the FOMC to entertain the idea of lifting U.S. interest rates.