GBP enters descending structure versus US dollar

- Written by: Sam Coventry

The British pound sterling (Currency:GBP) has started Wednesday off in good fashion, however the strong start to today's trade could be tested at 11 AM London time when The CBI Industrial Trends data is released. Otherwise, Eurozone PMI data will come under scrutiny as will US housing data later on in the day.

16:06: Pound sterling traders await Q2 GDP data

Thursday kicks off with Nationwide Housing Prices being released at 7 AM.

Don't expect much impact on sterling though because the big event is due at 9AM.

Tomorrow we get the first reading on UK Gross Domestic Product (QoQ) (Q2).

Consensus estimates are for a reading of 0.6 pct, up from a previous 0.3 pct in the first quarter.

A figure either side should shift sterling; lower if it is a miss, higher if it is a pleasant surprise.

14:25: Scotiabank bullish on the GBP-USD

We reported earlier that the British pound could be about to extend gains against the US dollar. Eric Theoret at Scotiabank says his analysis suggests this call could be premature and he is bullish GBP/USD:

"Continued resistance at the 61.8% (1.5394) Fibo re-tracement level suggests caution against expectations for further gains following nearly 4.0% rally from early July. However, RSI at 56 leaves plenty of upside. Key near term levels include support at 1.5300 and resistance just below 1.5400."

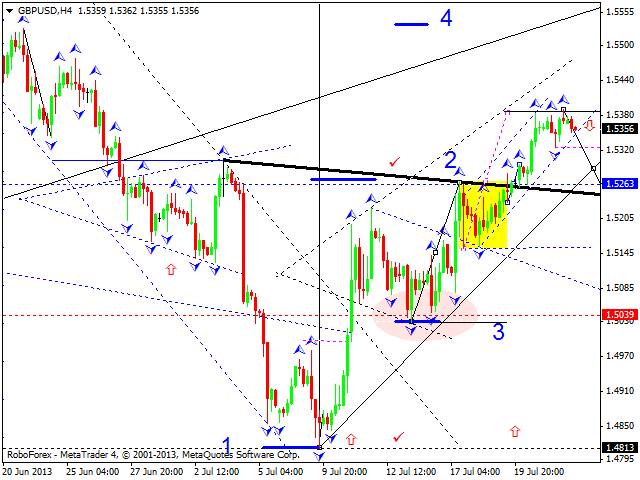

14:08: GBP enters descending structure versus US dollar

RoboForex note the British pound could be set for a fresh pound of weakness:

"The Pound is starting a new descending structure. We think, today the price may continue its correction towards the level of 1.5040 and then start forming another ascending wave.

"

More US dollar gains ahead? See how the most successful traders on the world's largest social trading network are currently playing the Pound / Dollar exchange rate.

12:40: Sterling advances vs NZD, AUD but down vs EUR and USD

In early afternoon the British pound is having more luck against the commodity currencies than is the case against the two majors:

- The GBP/EUR is 0.22 pct down on Tuesday night's closing rate at 1.1597. See why the EUR is having such fun.

- The GBP/USD is 0.09 pct in the red at 1.5356.

- The GBP/AUD is 0.64 pct higher at 1.6642. See why the Aussie is so glum.

- The GBP/NZD is 0.14 pct higher at 1.9247.

NB: The above are wholesale market quotes, your bank will affix its own discretionary spread to the figures. However, an independent FX provider will guarantee to undercut your bank's offer, thereby delivering more currency. More here.

11:15: CBI data is bang-on in line with expectations

Today's only major economic release out of the UK has proven to be sterling neutral.

The UK CBI Industrial Trends Survey reported that orders contraction slowed down to -12 in July, from -18 registered in June, according to data released today by the Confederation of British Industry.

This result is in line with consensus.

9:24: Euro strength maintained on the back of solid PMI data

The big data event this morning concerns PMI's out of the Eurozone. They have beat expectations and this has allowed the Euro to become the key driver on forex markets today. The pound / euro exchange rate has been sold off and is now 0.18 pct in the red at 1.1602.

Eurozone July Advanced PMI manufacturing at 50.1 v 49.1 expected; services at 49.6 v 48.7.

More euro gains ahead? See how the most successful traders on the world's largest social trading network are currently playing the euro.

8:20: Sell any GBP-USD rallies

We hear from UniCredit who are not convinced by the British pound's strength against the US dollar:

"A stronger CBI survey might offer cable some relief today, but we still recommend selling it on rally ahead of a re-assault on the 1.54 area."

8:17: GBP gets off to a good start on Wednesday

- The pound to euro exchange rate is 0.16 pct higher than seen on Tuesday night's close. GBP-EUR is at 1.1642.

- The pound to US dollar exchange rate is 0.07 pct higher at 1.5380.

- The pound to Australian dollar rate is half a percent higher at 1.6620.

- The pound to New Zealand dollar rate is 0.34 pct higher at 1.9287.

8:05: UK CBI data ahead

Today's only domestic economic data of consequence to the pound sterling is second-tier in nature; but with little else on the calendar it will get a good look-in.

"The UK CBI business optimism survey for July is due for release later in the morning. We expect the output series to recover, in part reflecting firmer orders and, in part, a lagged response to the manufacturing PMI, which has risen consecutively over the past four months," say Lloyds Bank Research.