AUD/USD is a Sell with 0.9 as a target

The Australian dollar is a Sell

Jyske Bank analyst Leander Dreyer says today's Chinese data release turns the outlook for the Australian dollar / US dollar exchange negative once more. Dreyer says he sees 0.90 as being attainable"

"A lower-than-expected (Australian) CPI was announced, which made the market discount a high likelihood that the central bank will continue to reduce interest rates at the coming monetary meeting in August.

"AUD was otherwise shortly trading above 93, but due to the miserable PMI data from China and the low CPI figure from Australia focus will once again be on selling AUD, and a decline to below 90 will not come as a surprise to us.

"An idea for fresh investors is to sell AUD with stop loss above 94 and take profit below 90."

Would you sell the Australian dollar at these levels? See what the most successful traders on the world's largest social trading setup are doing with the AUD. Follow and copy the proven winners.

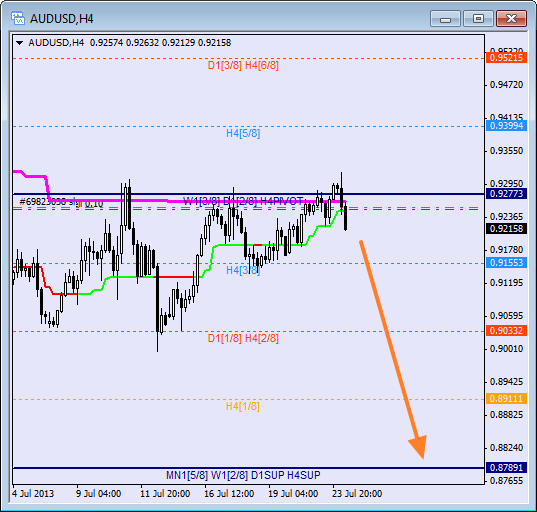

Murray Math lines: Outlook for AUD is lower

RoboForex have taken a look at the Murray Math line setup behind the Aus dollar versus the US dollar rate and confirms declines are likely:

"Australian Dollar is trying to rebounds from the 4/8 level and the daily Super Trend again. If the market is able to keep the price below the 3/8 level, the pair will continue falling down. In this case, the target will be at the 0/8 level."

Euro is a winner, Australian dollar is the loser

Boris Schlossberg at BK Asset Management has more on what has been an interesting day for foreign exchange markets:

"The euro hit fresh monthly highs while Aussie stumbled in a lively midweek trading session in the currency market that saw a fair amount of volatility amidst a heavy deluge of data. In Asia the Aussie initially spiked higher taking out the 9300 barrier after CPI figures showed that core inflation was in line at 0.5%.

"The news sent the Aussie higher on the assumption that modest price pressures would keep the RBA from cutting the benchmark by another 25bp at the upcoming meeting in August. The euphoria didn't last long however, as the release of the Chinese PMI Manufacturing data took the steam out of the rally.

"The HSBC Chinese PMI came in at 47.7 versus 48.6 - its worst reading in 11 months as operating conditions have deteriorated at the quickest pace since last August.

"The majority of activity sub-indices declined, including total orders, employment, production and work backlogs, although some analysts found a ray of sunshine in the fact that new export orders rebounded to 47.7 from 44.9 the period prior.

"Nevertheless this was a very weak release that suggested Chinese industrial output is clearly slowing and will therefore have negative impact on demand for Australian commodities.

"Little wonder then that Aussie slid in the aftermath of the news dropping through the 9200 level before finally finding some support."