Pound-to-New Zealand Dollar Rate: Week Ahead Forecast

Housing data is the most important release for the New Zealand Dollar whilst Trade and GDP estimates dominate UK data, meanwhile GBP/NZD chart studies show the potential for losses.

The Pound-to-New Zealand Dollar exchange rate has broken out of a rising channel and looks poised to move lower.

It will probably reach a downside target of 1.8560, calculated by extrapolating the height of the channel, 'a', down from the break-point in a move labeled 'b'.

The MACD momentum gauge is now below the zero-line which is a sign the downtrend is dominant, further supporting the bearish forecast.

Confirmation of further downside would be dependent on a break below the 1.8887 lows.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data and Events for the New Zealand Dollar

The 2.2% recovery posted by dairy prices in the previous week helped spur the New Zealand Dollar higher, but in the week ahead a lack of data may make further such gains for the currency more difficult to come by.

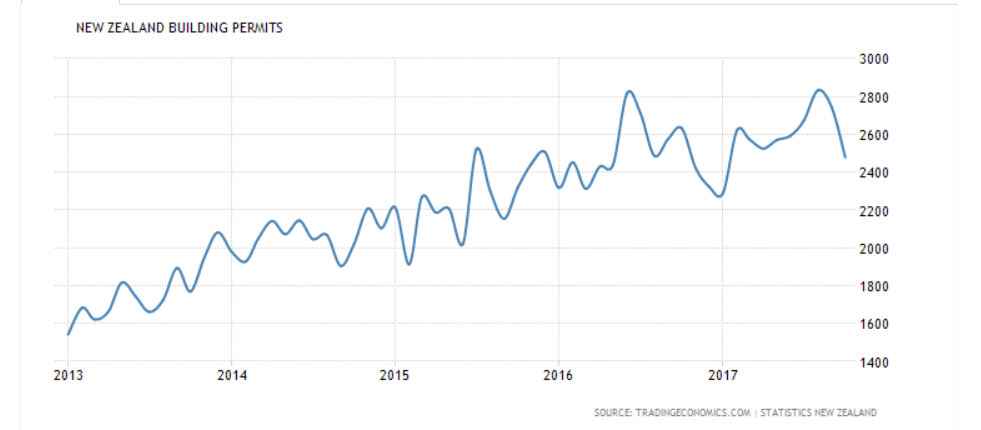

The only noteworthy release on the calendar is NZ Building Permits in November due for release on Thursday at 21:45 G.M.T.

Although the data series can be very volatile the chart below showing historical data indicates further weakness could see the previous long-term uptrend come to an end and a new downtrend begin instead.

A fall below 2400 - or certainly 2200 - would be a very negative sign for the outlook for the sector and probably be explained as resulting from the new prohibitions on foreign ownership of New Zealand property, reducing demand.

"We expect to see housing market activity gradually strengthen over the coming months as the recent disruption to the market from a change in government wains. In addition, the RBNZ’s loosening of loan-to-value ratio (LVR) restrictions from 1 January will also support interest in the housing market – particularly from the first-home-buyer segment," says a note from New Zealand lender Kiwibank ahead of the release.

Data and Events for the Pound

The week kicks off with the extremely timely, December British Retail Consortium (BRC) Retail Sales figures out at 00.01 GMT on Tuesday 9, with analysts keen to gauge whether the economic slowdown is worsening or not.

The big day for the Pound, however, is Wednesday, December 10, when Industrial and Manufacturing Production data for

November is out, as well as the Trade Balance and an estimate of GDP.

Industrial Production is forecast to rise 0.4% from 0.0% in October, and Manufacturing production by 0.3% from 0.1% previously; although the data is important, neither of these sectors is very big anymore so only large unexpected shifts are likely to move the Pound.

The trade deficit is forecast to widen in November to -11.0bn from -10.78bn previously, and if it is even wider than expected, then the Pound will weaken as it reflects net demand for the currency from buyers of UK exports.

Finally, The National Institute of Economic and Social Research (NIESR) GDP estimate for the last three months, released at 13.00 GMT on Wednesday, is expected to come out at 0.5%.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.