New Zealand Dollar Finds no Love Despite Dairy Prices Finally Rising Again

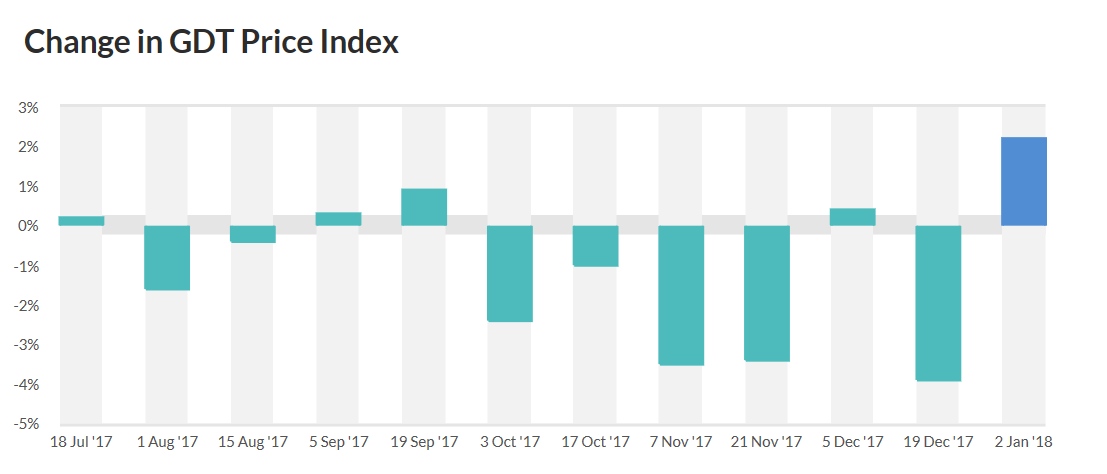

The New Zealand Dollar failed to rise following the latest release of the bi-weekly international dairy price 'fix' which showed prices of New Zealand's most important export rising 2.2%.

The gains will come as a relief to the agricultural sector which has suffered a protracted run of negative results.

Yet currency markets appear to have largely anticipated the recovery with New Zealand Dollar inertia being put down to analysts expecting a better result anyway because of 'dry season' scarcity.

"A dry season causing a drop in New Zealand milk production is expected to boost prices," said analysts at global investment bank TD Securities ahead of the release.

It appears that markets were well prepared for the good news and only a blow-out to the upside would have prompted sizeable buyers.

The GBP/NZD exchange rate traded to 1.9064, marginally higher than the pre-release level whilst NZD/USD had fallen about 10 points from 0.7115 to 0.7105 following the release.

Furthermore, analysts appear to be bearish the New Zealand Dollar overall with Societe Generale analyst Alvin T. Tan going as far as recommending clients to buy the Euro versus the Kiwi after EUR/NZD bounced off its 100-day moving average.

"EUR/NZD should climb were China growth concerns and higher volatility to come back into play. The Chinese economy is entering 2018 on a strong tide, but deleveraging efforts are expected to intensify too. Buy EUR/NZD at 1.69, targeting 1.74 initially with a stop at 1.67," says Tan.

Major bank analyst's forecasts for 2018 are also pretty bearish the Kiwi, with risks stemming from the new government's plans to regulate against foreign ownership expected to stifle inbound investment, and interest rate convergence with the rest of the world.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.