Pound-New Zealand Dollar Fails at Key Hurdle

- Written by: Gary Howes

Image © Adobe Stock

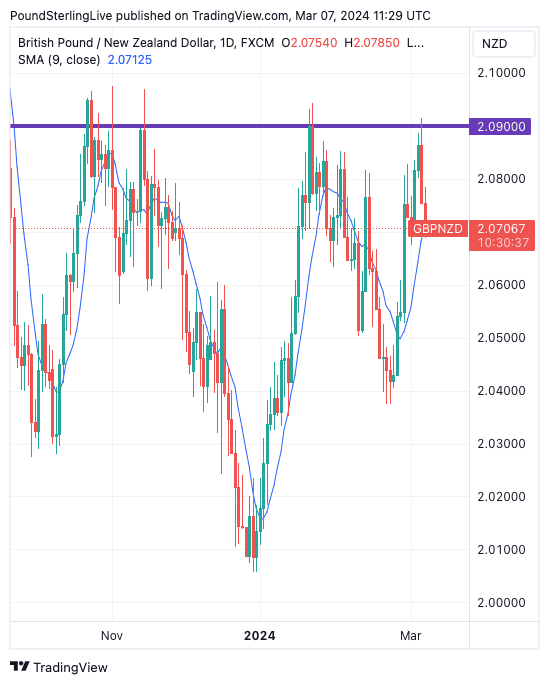

The Pound to New Zealand Dollar exchange rate (GBP/NZD) has retreated after hitting a key resistance point, which opens the door to a potential pullback in the coming days.

The New Zealand Dollar has been under pressure in 2024 and this resulted in a fresh 1-month low in GBP/NZD on Wednesday. But a rejection of the high at 2.09 and subsequent half-per cent drop, with follow-through selling pressure seen on Thursday, suggests the near-term picture has shifted.

Fresh New Zealand Dollar strength is linked with the broader pullback in the USD, in turn, linked to renewed confidence that the Federal Reserve will cut rates in June.

"The US dollar extended its decline against its major peers yesterday, with the commodity-linked currencies aussie, kiwi, and loonie gaining the most," says Charalampos Pissouros, Senior Investment Analyst at XM.com.

Above: GBP/NZD has failed at a key resistance zone. Track NZD with your own custom rate alerts. Set Up Here

According to Pissouros, USD has come under selling interest after the ISM manufacturing and non-manufacturing PMIs raised questions about the performance of the U.S. economy, with Wednesday's JOLTs data adding to the picture.

Fed Chair Powell meanwhile told U.S. lawmakers that if the economy evolves as projected, "it will likely be appropriate to start dialling back policy restraint at some point this year."

The New Zealand Dollar's gains confirm this is a currency that remains highly responsive to the global picture, benefiting when expectations for U.S. rate cuts grow. Falling U.S. rates are supportive of the global economic outlook, to which the ‘commodity currencies’ like NZD respond.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Investors are now watching Friday’s U.S. jobs report; any weakness here can send GBP/NZD lower still, with 2.06 being the obvious target near-term.

We also note Wednesday’s measures by Chinese authorities to stimulate the economy - a key destination of NZ exports - have aided NZD.

China's financial planners are set for "a countrywide bonanza" for citizens to trade in old cars, fridges and washing machines for new ones as they try to stave off a trade war with the West and stimulate the economy.

The plan, outlined in a rare joint press conference on Wednesday by the country’s five top economic administrators, is a response to faltering demand, oversupply in manufacturing and incipient deflation.

So, a couple of pieces of the NZD puzzle have fallen in a supportive manner, and this can arrest the near-term weakness GBP/NZD.

Should events conspire against NZD and favour further GBP outperformance (GBP is 2024’s best performer), we are watching for a retest of 2.09 with an eye on an eventual break.