GBP/USD Rate Above 1.27 After U.S. ISM Miss

- Written by: Gary Howes

Image © Adobe Images

The Dollar was broadly softer after a highly-anticipated business survey missed expectations and hinted at a potential slowdown in America's hot growth rate.

The Pound to Dollar exchange rate rose a quarter of a per cent to reach 1.2722 after the U.S. ISM services PMI read at 52.6 in February, down on January's 53.4 and below consensus expectations for 53.

The composite index indicated growth in February for the 14th consecutive month after a reading of 49% in December 2022, the first contraction since May 2020.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Employment Index meanwhile contracted for the second time in three months, reading 48%, a 2.5-percentage point decrease from the 50.5% recorded in January.

These contractions suggest a moderation in the pace of U.S. economic growth and are a rare disappointment for investors who have become used to the economy pumping out positive surprises after positive surprises.

The U.S. Dollar has benefited from these surprises, as they pushed back expectations for the timing of the first U.S. rate hike.

Any hint of a turnaround in the data would suggest this move has run its course and the prospect of rate cut bets building comes into focus.

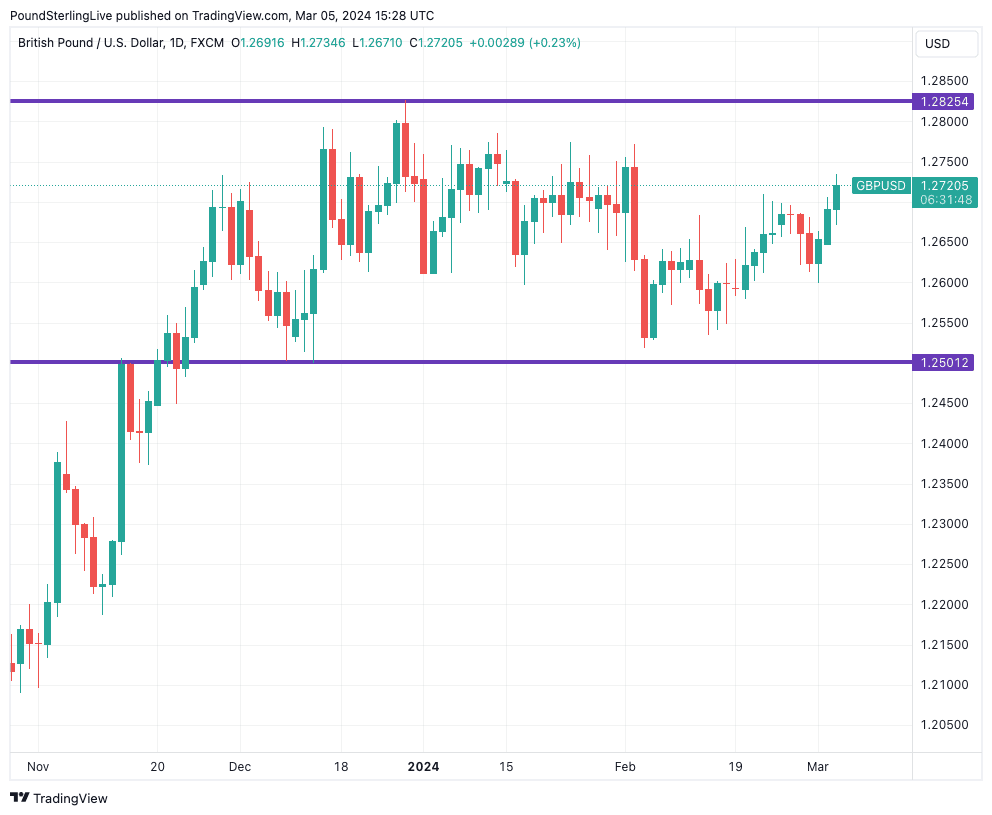

This opens the door to further Pound-Dollar gains, potentially towards the top of the recent range:

Above: Pound-Dollar is in tacking back towards the top of the November-March range. Track GBP/USD with your own custom rate alerts. Set Up Here

Although this report represents a cooling in activity in the dominant services sector, it still points to an economy that is in expansion mode. The New Orders component of the report read at 56.1 in February, its strongest showing since August of last year and a second consecutive month of acceleration to start 2024.

The Business Activity component read at 57.2, reflecting service industry businesses’ ability to meet demand, the strongest since August 2023.

Inflationary pressures continue to simmer as the rise in costs faced by services-oriented businesses cooled moderately to 58.6 after a spike to 64.0 in January.

"The greatest threat to the Fed’s goal of re-establishing a 2% average pace of consumer price inflation is the exceptionally tight U.S. labor market that leaves businesses no choice but to raise wages in order to attract and retain talent. With service industry businesses still seeing the lion’s share of consumer demand, they will continue to bear the greatest challenge of balancing pricing pressures with demand," says Gus Faucher, Chief Economist at PNC Financial Services Group.

So while the market won't have the fresh fuel required to push back against rate cut expectations even further, the economy is still some way from requiring the hep of a Fed cut.

This will limit USD weakness and cap Pound-Dollar ahead of the 1.2825 December high.