GBP/NZD Week Ahead Forecast: Market Rebound Suits NZD Gains

- Written by: Gary Howes

- GBPNZD under pressure, eyes 2.0520 and then 2.0280

- NZD boosted by hopes for global interest rate peak

- Chinese CPI and trade data are key events to watch

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate has come back under pressure and is at risk of further weakness if Chinese data beats expectations this week and helps extend a recent equity market rebound.

The New Zealand Dollar is highly correlated with global sentiment, and last week's rally in global equity markets proved particularly supportive, with markets expressing relief that the interest rates have peaked.

The Pound to New Zealand Dollar slumped three days in succession to close the week at 2.0632, having been as high as 2.0974 on Friday.

NZ Dollar gains were sparked by the Federal Reserve's November policy update, where the odds of further rate hikes were downplayed.

Hopes that interest rates in the world's largest economy would not rise further were again boosted Friday by the softer-than-expected U.S. labour market report that showed fewer jobs were created in October than markets were expecting.

"Equities were up across the board in Asian markets as hope that interest rates were at a peak continued to support market sentiment. Japanese stocks were among the biggest gainers, partly reflecting some reaction to Friday’s soft US labour market report," says Nikesh Sawjani, an economist at Lloyds Bank.

In fact, financial markets brought forward expectations for U.S. interest rate cuts, which is supportive of the U.S. and global economic outlook. For currencies that are sensitive to global growth, such as the New Zealand Dollar, this is supportive.

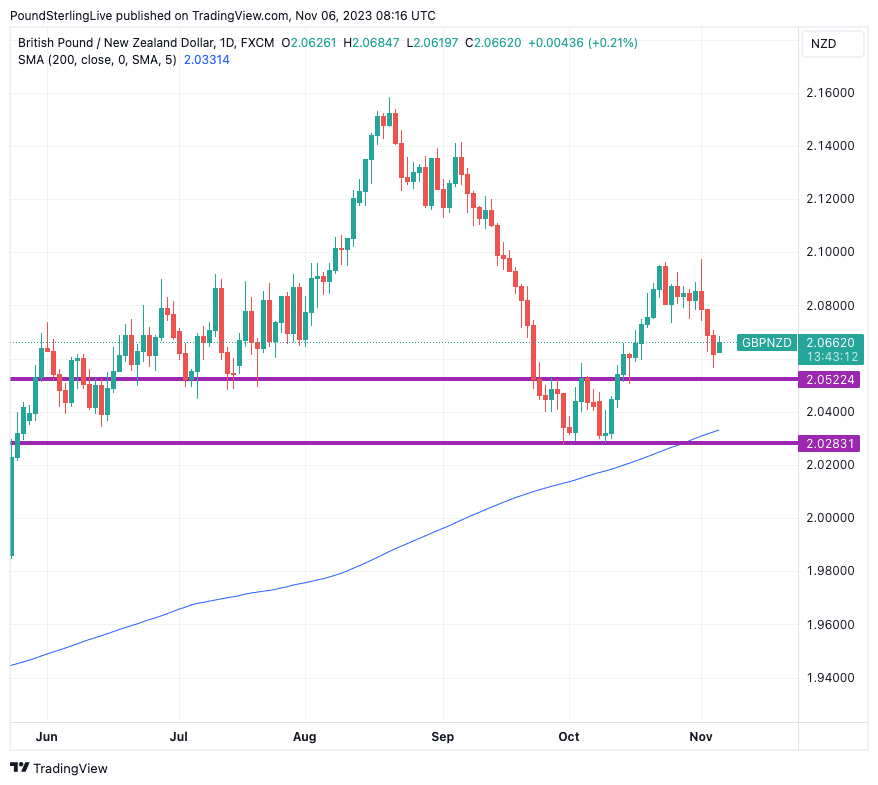

Above: GBPNZD at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Look at the charts, GBPNZD could be on course to test the 2.0520 level, which appears to be an approximate level of support and resistance in 2023, particularly in the event the positive momentum behind risk assets continues into this week.

Support can hold if the same 'risk on' environment underscores the Pound, which is oftentimes the case as Sterling is also sensitive to the global picture.

Should this prove to be an exceptionally positive week for the Kiwi, then GBPNZD would likely break through support and test the October lows towards 2.0280, where we would expect a more robust defence to ensue.

Note, too, that the 200-day moving average is also in the vicinity of 2.0280 (see above chart), which will only add weight to this level from a technical perspective.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

If GBPNZD were to break below the 200 DMA, then we would state the exchange rate has officially entered a downtrend, as per Pound Sterling Live's Week Ahead Forecast rulebook.

Should the market be in for a classic 'Santa Rally' this year, then such an outcome becomes a possibility, and Sterling-Kiwi could put the psychologically significant level at 2.0 in sight.

Regarding the calendar, we will be watching China's trade figures on Tuesday for signs of improvement in the economy. Chinese exports are anticipated to read at -3.1% year-on-year in October, an improvement from -6.2% previously.

Imports are expected at -5.4% y/y in October, up from -6.2%. Should the figures show a better improvement, it will confirm the 'peak China pessimism' moment has indeed passed, which can support sentiment and AUD.

On Thursday at 01:30 GMT is the release of Chinese inflation figures, and the same narrative as above will be in play whereby higher inflation implies improving economic activity.

CPI inflation is expected at 0.2% month-on-month in October and 0% y/y.

Signs of a strengthening Chinese economy can help boost NZD's prospects.

For the Pound's week ahead, which will be dominated by Friday's GDP data and a speech by Governor Andrew Bailey, please see here.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes