Pound-Rupee Exchange Rate Relying on Support at the 50-Week Moving Average

Image © Ash T Productions, Adobe Stock

- Sterling finds support at key technical level vs. Rupee

- GBP/INR could pivot higher from the support line

- We will be watching Indian wholesale prices this week

The GBP/INR pair has been in a downtrend ever since the April highs at 94.33 were rejected and the Pound weakened down to current levels at 89.43.

Since April INR has been supported by two interest rate hikes from the Reserve Bank of India whilst the Pound has lost ground on increasing no-deal Brexit fears.

The downtrend appears to have stalled over the last two trading days, however, as Pound gained ground from rumours of a game-changing concession from the EU which has revived hopes for a Brexit deal.

The Rupee has meanwhile weakened following the release of a lower-than-expected inflation data, which reduced the chances of a third rate rise from the RBI this year.

Higher rates tend to appreciate a currency by increasing inflows of foreign capital.

From a technical perspective the pair is in an established short-term downtrend which whilst intact and, therefore, biased to go lower, although, it is also showing conflicting evidence of a possible bullish reversal.

Momentum has dipped below the oversold level and then promptly risen back out - an indication that the exchange rate is likely to rise from here, and a signal to buy.

The pair is also in the process of forming a doji/hammer which could also signal a reversal if it is followed by another bullish candlestick for confirmation.

On the weekly chart the exchange rate is in the process of interacting with support from the 50-week MA at 88.63 which could see it pivot higher.

The pair would have to break below the 87.83 lows for confirmation of more downside to a target at 85.90.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Indian Rupee: The Fundamental Picture

The Indian Rupee weakened versus the Pound on Monday after inflation data surprised to the downside, reducing chances of a further rate hike from the Reserve Bank in 2018.

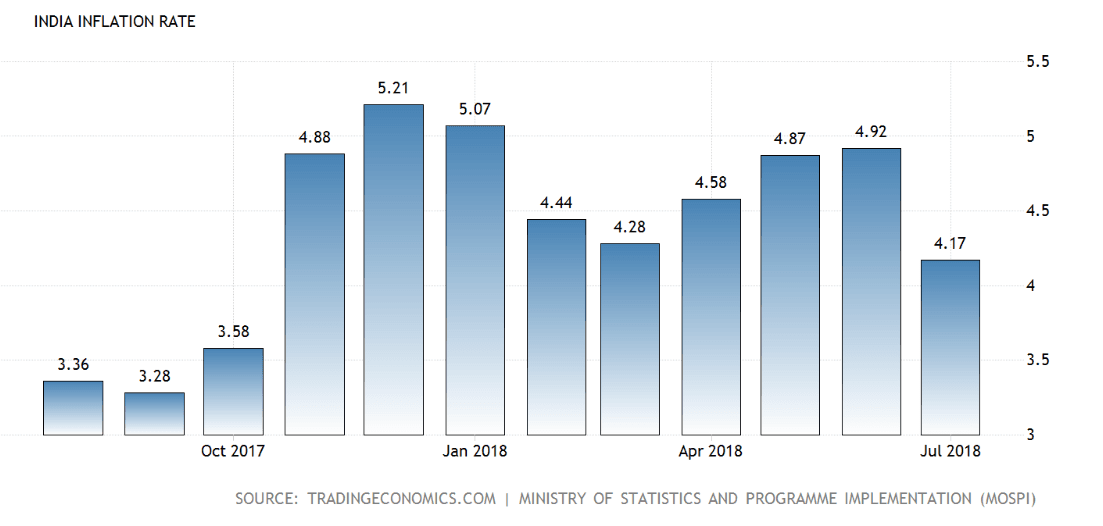

Inflation data in July showed a fall in broad headline inflation to 4.17%, the lowest it has been since November 2017. This was below the 4.92% of the previous month and the 4.51% forecast.

The main driver of inflation continued to be core, non-food items, such as housing which rose 8.3%, clothing and footwear which increased by 5.3% and tobacco (and other intoxicants) which rose 6.3%; miscellaneous items rose by 5.8%.

Although down, inflation remains above the RBI's 4% target so although down it remains elevated and it is still possible the RBI will raise rates before the end of year.

More inflation data is scheduled for release on Tuesday when wholesale prices are released at 7.30 B.S.T and forecast to come out at 5.24%.

The Rupee may also be affected by oil price data out in the week ahead as there is also a fair amount of oil related data, including an OPEC report on Monday, Crude Oil Inventories on Wednesday and API weekly stock on Tuesday.

India has to import most of its fuel and oil alone comprises a third of its entire imports. A rise in oil prices tends to weigh on INR as it has to sell more of its currency to buy oil.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here