Rupee's Bounce Back Temporary, RBI Intervention Unsustainable – Analyst

- Written by: Sam Coventry

Image © Adobe Images

The Indian rupee's recent rebound is unlikely to last, as global volatility, a widening trade deficit, and looser monetary policy will continue to pressure the currency, according to a report by Shumita Deveshwar, an economist at TS Lombard.

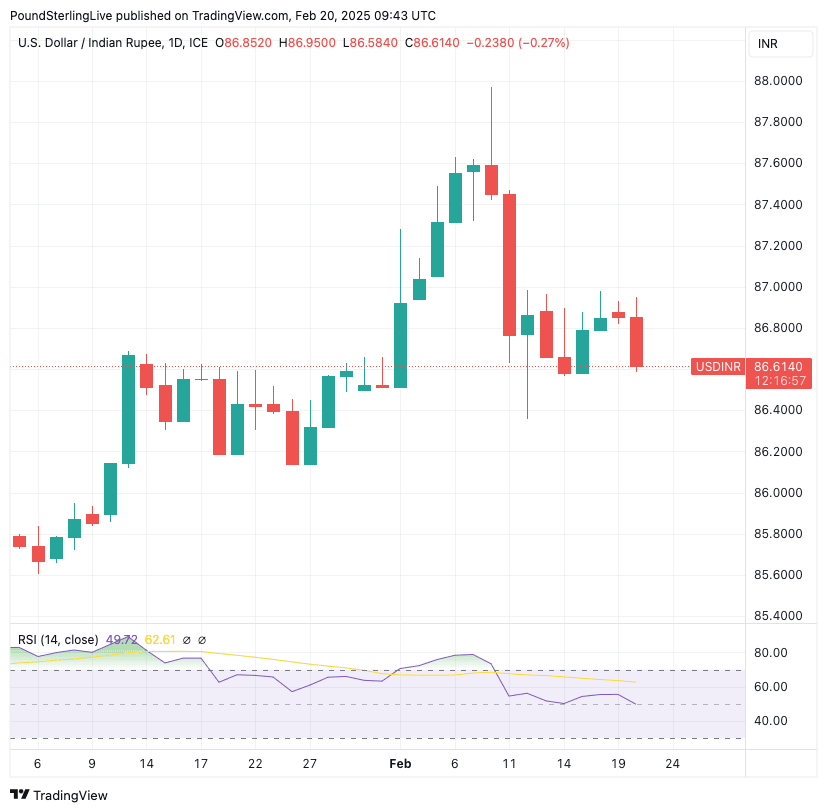

“The Reserve Bank of India’s (RBI) aggressive foreign exchange intervention last week helped the rupee pull back from record lows, but this is not sustainable,” Deveshwar wrote in the Feb. 19 analysis.

The rupee hit an intraday low of 88 per U.S. dollar on Feb. 7, before bouncing back to trade below 87 per dollar following what analysts believe was direct RBI action. However, Deveshwar warns that the currency will likely retest record lows.

“Foreign investors are net sellers of Indian equities and debt so far this year, cutting their emerging market exposure amid rising U.S. yields and concerns over stretched stock valuations,” she said.

A deteriorating trade balance adds to the rupee’s vulnerability. India’s trade deficit widened sharply to $2.7 billion in January 2025, up from just $0.4 billion a year earlier, as merchandise exports remained sluggish while imports rose.

"The trade gap is a key risk to further rupee depreciation," Deveshwar noted, adding that while services exports remain strong, they are not enough to offset weaknesses in goods exports.

Meanwhile, the RBI's first rate cut in five years, implemented earlier in February, is expected to be followed by further easing as policymakers seek to revive slowing economic growth.

"With high borrowing costs and weak demand leading to a slowdown in bank credit growth, the RBI is under increasing pressure to cut rates further," Deveshwar wrote.

The central bank’s frequent foreign exchange interventions have also strained banking system liquidity, forcing the RBI to inject funds through bond purchases, repo rate auctions, and dollar-rupee swaps.

Although the RBI remains active in curbing currency speculation, Deveshwar believes it has grown more tolerant of depreciation.

"Until late January, the rupee was among the most stable emerging market currencies, but that trend has reversed," she said.

At the same time, India faces international scrutiny over its trade policies, particularly from the United States. To maintain favorable trade relations, New Delhi recently reduced tariffs on select U.S. imports, including high-end motorcycles and bourbon whiskey.

"The World Bank says India’s trade-distorting measures have risen in recent years. A weaker currency will help make exports more competitive," Deveshwar noted.

Despite efforts to stabilise the rupee, analysts warn that the currency remains under pressure as India grapples with external headwinds, policy shifts, and a fragile trade balance.