Pound vs. Indian Rupee Forecast: Bullish 'High Probability' Pattern Noted, RBI Dominates the Calendar

Image © Adobe Stock

- GBP/INR to rise on condition of break of April highs

- Bullish ‘three-white-soldiers’ candlestick pattern forms

- RBI meeting dominates weekly agenda for Rupee

The Pound-Rupee exchange rate is quoted at 93.74 at the start of the new week having lost a quarter of a percent in the week before, mainly as a result of changing Brexit dynamics which weakened the Pound.

An improvement in global investor appetite, linked to a view that U.S. Federal Reserve is going to ease back on raising interest rates over coming back, has proven supportive to emerging market currencies, such as INR. A less agressive Fed implies global funding costs won't rise to levels that will constrain global credit flows, while a stable, or softer, Dollar following the more dovish Fed stance benefits the Indian economy by keeping key imports such as oil at affordable levels.

From a technical perspective, the new, young, uptrend in GBP/INR which has been unfolding since the start of the year is forecast to remain intact, and given the old adage the ‘trend is your friend’, is expected to probably continue pushing the exchange rate higher.

The bull trend has been rather strong since the start of the year and despite pulling back marginally in the previous week it remains intact.

The RSI momentum indicator has just entered and then exited the overbought zone, which is usually a signal to ‘sell’. The shallow correction in the actual exchange rate so far, however, does not particularly back up the sell signal elicited by the RSI. Nevertheless, there is a strong chance the pair could go sideways, or go a bit lower before resuming its dominant uptrend.

Eventually, we expect a break above the April highs at 94.34 to materialise and this would provide bullish confirmation for a move, potentially all the way up to a target at 98.00, although interim targets at 95, 96 and 97 apply for the more conservatively-minded.

Our bullish base case is supported by evidence from the weekly chart which is showing the formation of a bullish ‘three-white-soldier’ Japanese candlestick pattern at the beginning 2019, and this is a strong bullish reversal sign for the pair.

The ‘three-white-soldiers’ pattern is composed of three strong up-weeks in a row. It usually signals the start of a new trend higher. The pattern gains veracity if the three-white-soldiers rise more quickly than the decline which immediately preceded them, as is the case for GBP/INR. This fact further reinforces the bullish forecast.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Indian Rupee: What to Watch

The main event for the Rupee in the coming week is the meeting of the Reserve Bank of India (RBI) on Wednesday at 6.00 GMT.

The RBI sets base interest rates for the country’s banks and this has an impact on currency flows. When interest rates rise it tends to benefit the Rupee because net foreign capital inflows tend to increase, as investors are drawn by the higher potential returns on offer in India.

The RBI’s base interest rate is currently set at 6.5% after several decisions to raise rates last year when inflation was rising. Now the consensus appears to favour a shift in the RBI’s stance to a more dovish stance (in favour of lower interest rates), if not an outright cut.

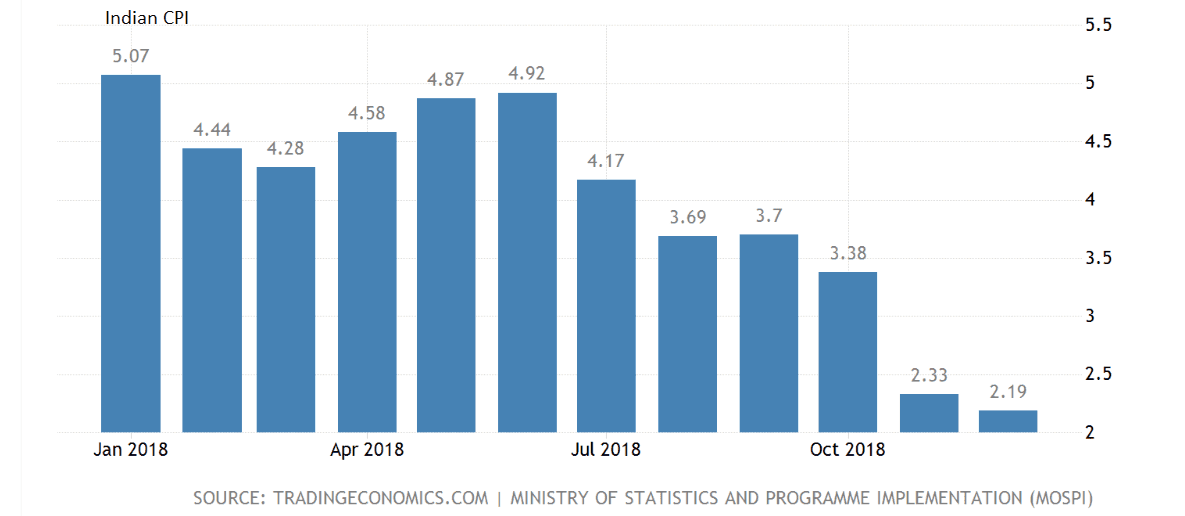

This comes partly after recent inflation data showed a fall to a one-and-a-half year low of 2.19% in December. Although this was mainly attributable to weaker fuel and food inflation it could still prompt a shift in stance.

Previously the RBI had been raising rates as a result of a rising core and headline inflation, now the dramatic fall in food and fuel prices is so marked it is overshadowing any rises in the core rate.

One argument for expecting a gentler shift in RBI outlook, to perhaps a completely neutral stance, is the recent interim budget, which was particularly generous in tax and spending giveaways and as a result suggests marginally less need for expansive monetary policy since some of the work has already been done on the fiscal side.

“The interim budget focused on increase social spending and tax cuts. For example, there was a support package of INR750bn for farmers comprising of assured income of INR6k per annual for 120mn farmers,” says Thu Lan Nguyen, an analyst at Commerzbank. “We see limited implications for RBI’s policy decision this Thursday from the budget. We expect RBI stay on hold at 6.5%. The focus instead is on RBI’s policy bias and whether it will shift back to neutral from the current “calibrated tightening” stance.”

Even a clear move by the central bank to a neutral stance, however, could have negative implications for the Rupee which could fall as a result - translating into a rise for GBP/INR in line with the bullish technical forecast.

Much, however, may be dependent on the exact wording of the RBI’s statement.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement