British Pound Tipped to Benefit if Rees-Mogg Fails in Attempt to Force Government to Change Brexit Policy

- Written by: Gary Howes

- Pound-to-Euro exchange rate @ 1.1326, Pound-to-Dollar @ 1.3247

- "Sterling may catch a bid" if May gets legislation through parliament unhindered

- "GBP markets waiting to see if Brussels can work with the UK government’s latest proposal"

Above: British Conservative Party politician Jacob Rees-Mogg poses for a photograph during an interview with Reuters at his offices in the Houses of Parliament in London, Britain March 21, 2018. Picture taken March 21, 2018. REUTERS/Toby Melville

One week ago the British Pound took fright as a series of high-level UK ministers stood down from Prime Minister Theresa May's government, citing opposition to her vision of Brexit.

Politics will again be the guiding light to Pound Sterling this week as Monday sees the the customs bill return to the House of Commons for final votes Monday while Tuesday sees the trade bill return for a final vote.

Jacob Rees-Mogg, the chairman of the European Research Group, indicated last week he is tabling amendments to the customs bill which will be debated and voted upon in the House of Commons next week. Rees-Mogg and fellow Conservative backbenchers have lodged a total of four amendments to alter Government’s flagship Trade Bill – claiming No 10 has “broken their trust”.

Rees-Mogg represents that arm of the Conservative party who believe Theresa May's proposals for a future UK-EU trading relationship are too soft and will leave the UK subject to many areas of EU oversight after Brexit. He hopes that his proposed amendments to the bill will rectify what he and others see as an affront to the wishes of Brexit voters.

MPs are now set to vote on Monday on the series of Commons amendments intended to wreck PM May's Chequers plan for a “common rule book” covering a new “UK-EU free trade area”.

“I’ve put down some amendments and we’ll see what support they get,” Rees-Mogg said on the weekend. “We’ll have an idea of the numbers, I suppose, at 10 o’clock on Monday evening.”

The threat to Theresa May's government is however two-fold with pro-EU Tories tabling their own amendments to the Customs Bill and the Trade Bill – which returns to the Commons on Tuesday – which would keep Britain in a customs union with the EU.

"Proposed amendments to the bills cover a wide range of outcomes, coming from both hard Brexiters (trying to undo the Chequers white paper) and Remainers (trying to bind the UK to an EU customs deal), many of whom are within the Conservatives own benches. Some of these votes could go right down to the wire in as dramatic a fashion as the EU (Withdrawal) Bill votes last month," says a note from TD Securities in a foreign exchange briefing.

For Sterling, there will be obvious negative implications if the government fails to pass legislation owing to opposition from within the Conservative party. Owing to Theresa May's waiter-thin working majority in parliament, any dissent could ultimately paralyse the government's ability to pass laws, which in turn could prompt the calling of a general election.

This is the kind of uncertainty that foreign exchange markets abhor, and Sterling will be the obvious conduit for any spike in UK political tensions.

But, where there are downside risks, there are of course upside opportunities.

"Sterling may catch a bid if Brexit supporters in PM May's Tory Party fail in their upcoming attempt to harden the UK government's plan on leaving the EU, as failure should increase the GBP-positive probability of a relatively soft Brexit," says a note from Robert Howard on the Thompson Reuters currency desk.

Foreign exchange strategist Adam Cole at RBC Capital Markets is so confident that all will turn out OK he has recommended buying Sterling at the start of the week.

"Although political risk premia have narrowed from their peak after last week’s cabinet resignations, proxies for the risk of an early election and the outcome of such an event have still not normalised. If this week’s amendments fail, as seems likely, we expect a further narrowing in risk premia as domestic political noise diminishes heading into next week’s parliamentary recess," says Cole in a briefing out Monday.

The votes will come through after UK markets are closed so the outcome of Monday's deliberations could well be Tuesday's FX story.

RBC Capital are going 'long' on GBP/USD at 1.3250.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

And Don't Forget the European Union Response

While May will be fighting her own side in Parliament, we cannot forget that in Brussels UK and EU negotiators get down to business once more in order to try and thrash out an agreement.

Talks will have Prime Ministers Chequers White Paper to provide a more detailed guide to the UK's stance. How the EU reacts to the proposals in the White Paper will be absolutely key.

"The ball is now in the EU’s court, with GBP markets waiting to see if Brussels can work with the UK government’s latest proposal," says Viraj Patel, a foreign exchange strategist with ING Bank N.V.

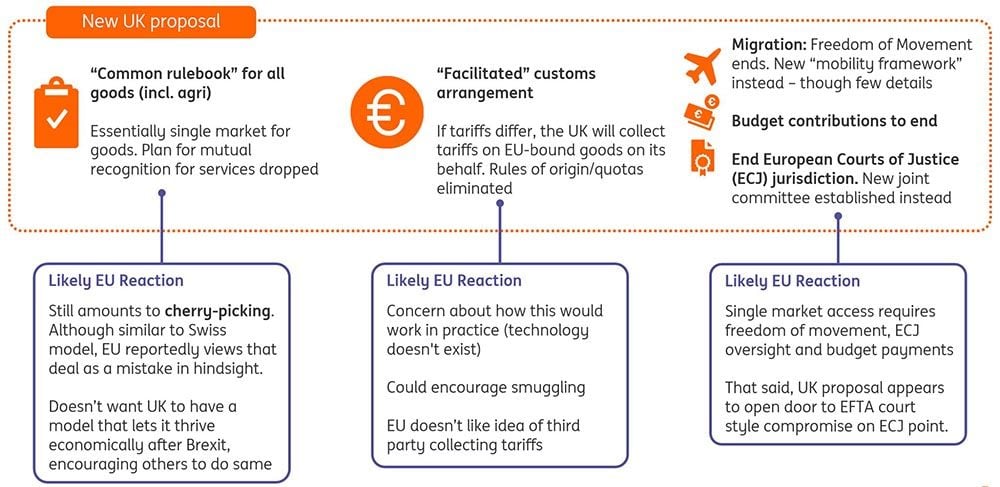

The central proposals which is that of a free-trade area for goods, with a common rulebook for manufactured and agricultural goods, and a “facilitated customs arrangement” which relies on technology to ensure tariffs are paid on imports at the right rate.

This keeps trade flowing while unlocking the sticking point that is the Irish border.

However, services which account for more than 80% of UK economic activity, will be subject to looser ties.

Graphic courtesy of ING Bank N.V.

"Sterling could rise if the European Union reaction to the British government's Brexit white paper policy document is relatively positive," says Robert Howard on the currency desk at Thomson Reuters.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here