Pound Sterling Outlook: A Positive EU Response to Whitepaper will Trigger Gains Against Euro and Dollar

- UK White Paper detailing aims for future EU-UK trade released

- Sterling continues to recover but detailed response from EU to shape the outlook

- Positive response could push gains

- City of London Corporation warns plan throws UK banks under the bus

Image © Adobe Stock

The UK Government have released their much-anticipated White Paper that sets out its preferred stance on the future EU-UK trading relationship.

The details contained in the paper were largely expected with the UK pushing for the trade in goods to largely be unaffected through the implementation of a regulatory regime that largely mirrors that of the EU.

The British Pound's initial response to the release of the White Paper was a positive one with the Pound-to-Euro exchange rate grinding out a 0.20% gain to 1.1328. The Pound-to-Dollar exchange rate moved higher by 0.17% to be quoted at 1.3229 at the time of writing.

"Sterling rose on expectations that the policy document would assist negotiations between the EU and Britain when it leaves the bloc in March 2019," says Shireen Darmalingam, a strategist with Standard Bank.

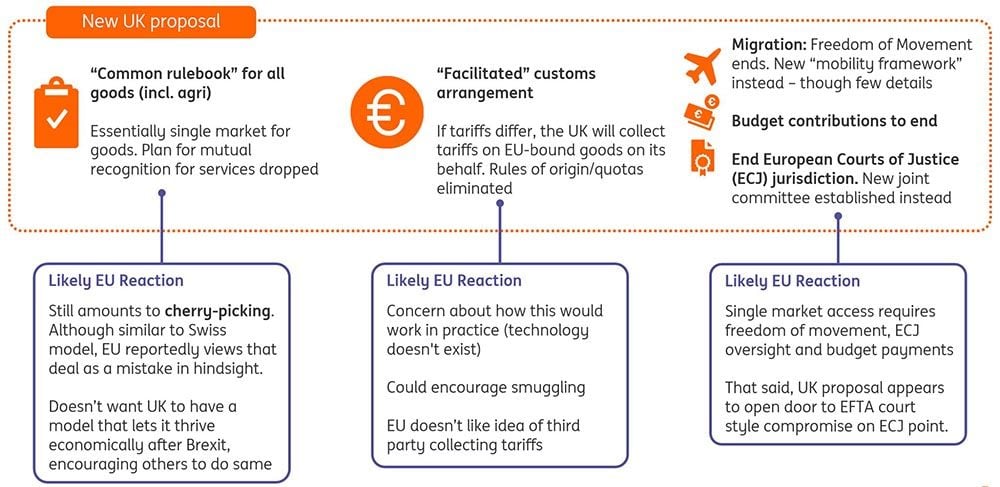

The central proposals which is that of a free-trade area for goods, with a common rulebook for manufactured and agricultural goods, and a “facilitated customs arrangement” which relies on technology to ensure tariffs are paid on imports at the right rate.

This keeps trade flowing while unlocking the sticking point that is the Irish border.

However, services which account for more than 80% of UK economic activity, will be subject to looser ties.

Graphic courtesy of ING Bank N.V.

Initial reaction to the release of the White Paper has been positive with the EU's chief Brexit negotiator Michel Barnier maintaining the constructive tone adopted earlier in the week.

"We will now analyse the Brexit White Paper with Member States & European Parliament, in light of EU Council guidelines. The EU offers an ambitious Free Trade Agreement and an effective cooperation on wide range of issues, including a strong security partnership. Looking forward to negotiations with the UK next week," says Michel Barnier, in response to the release of the White Paper.

The detailed response from the EU which will likely be revealed in part next week will be a key signal to markets whether this plan has traction and will likely inform much of the British Pound's movements over coming days and weeks.

Potential Moves in the Pound

"The Pound is treading water after the government's release of the Brexit White Paper. Still a lot of unanswered questions but key to GBP's short-term direction of travel is the EU's assessment of May's plan," says currency strategist Viraj Patel at ING Bank N.V.

Patel sees two broad outcomes for Sterling going forward based on the response by the EU:

If the plans are judged to be "workable" by the EU the Pound-Dollar exchange rate could rise into the 1.33-1.34 bracket.

If the plans are judged to be "unworkable" Sterling could go sub-1.30. "In our view, the EU is unlikely to succumb to the plan as it stands and tough EU-UK negotiations are set to remain ahead of the October deadline," say Danske Bank in a brief to clients.

"Sterling could rise if the European Union reaction to the British government's Brexit white paper policy document is relatively positive," says Robert Howard on the currency desk at Thomson Reuters.

"The net GBP short position held by IMM speculators rose to a 10-month high in the week to July 3, and some of those GBP shorts might be squeezed out if the Brexit blueprint reaction stars align in favour of GBP bulls," adds Howard. "A relatively positive EU reaction to the UK government's Brexit white paper might also increase the probability of a GBP-positive BoE rate rise next month."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

UK Political Risks to Remain Elevated

Growing concerns over Government unity that followed the formulation of the White Paper saw Sterling drop to a seven-month low against the Dollar and a four-month low against the Euro at the start of the week.

A number of high-profile government resignations suggested the Prime Minister might soon face a leadership challenge, but the currency stabilised as it soon became clear that unseating May would be no easy task for those Conservative party MPs who want a hard, clean Brexit.

"May claims her team will be resuming the negotiations "at pace” with a view to having agreement by October. But Brussels will likely demand concessions, creating further anger amongst pro-Brexit MPs, and retaining the threat of even more spectacular political fireworks," says Mantas Vanagas at Daiwa Capital.

But, the pro-Brexit MPs simply don't have the numbers required to make the PM walk and will instead look to force changes on two key Brexit Bills, governing Taxation and Trade, that are due to go through parliament next week.

Where the passage of these bills were once seen as a crucial point for pro-Remain MPs to insist the government seek to remain in a customs union, they are likely in the main to have been appeased by May’s proposals.

"But this customs arrangement may well provoke opposition from Brexiteer MPs who see it as meaning the UK continues to have rules dictated by the EU, although they may not be sufficient in numbers to make an impact," says Vanagas.

We would argue differently, noting that the Conservative's waifer-thin majority in the UK parliament means the government can tolerate very little descent from within the party in order to pass legislation.

The unhappy segment of hard-Brexit Conservative MPs do in fact have the numbers to block legislation we believe, and this makes next week's domestic political agenda a notable risk for Pound Sterling.

Businesses Response to White Paper is distinctly Mixed

First off, that Sterling has actually displayed broadly positive responses to the White Paper (the initial move following the Chequers meeting last Friday was for Sterling to go higher). This tells us that markets judge the White Paper to represent something of a sensible approach and a lean towards a softer Brexit.

Part of the UK's plan for the future EU-UK trading relationship is a proposal for what amounts to a new "UK-EU free trade area" with closely linked customs regimes to ensure there are no tariffs.

However, the UK services sector - most notably its banks - would suffer significant disruptions thanks to the "regulatory freedom" envisioned by May argues the body that represents UK finance.

Notably, the White Paper revealed that May has accepted that the UK's banks will need to leave the European banking union.

“Today’s Brexit white paper is a real blow for the UK’s financial and related professional services sector," says Catherine McGuinness, Policy Chairman of the City of London Corporation.

The government will be aiming for a "regulatory equivalence" regime similar to that already adopted by the EU towards external countries.

While UK banks would lose their unfettered access to EU markets, May hopes that a new "treaty-based" process would allow them to achieve an enhanced version of equivalence where the EU would commit to maintaining long term access for UK banks.

“With looser trade ties to Europe, the financial and related professional services sector will be less able to create jobs, generate tax and support growth across the wider economy. It’s that simple," adds McGuinness. “The sector has been clear since the referendum: Equivalence in its current form is not fit for purpose so any “enhancements” to this regime would have to be substantial."

McGuinness adds that as the EU’s gateway to capital, the UK is a significant trading partner for the bloc. "It’s in the interests of households and businesses on both sides of the Channel that an ambitious future trading relationship, covering services as well as goods, is secured."

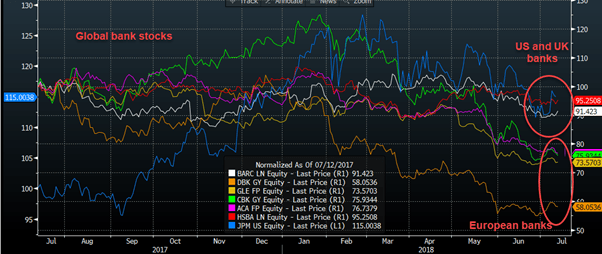

But, bank shares aren't reflecting the type of concerns raised by McGuinness:

"Interestingly, UK banks have not under-performed vs. their European counterparts during this pivotal period of Brexit negotiations. As you can see in the chart below, HSBC and Barclays have outperformed their European rivals since April," says Kathleen Brooks at Capital Index.

"Deutsche Bank is the weakest performer in this group, which is unsurprising due to the internal problems at the German behemoth. What is interesting, is that French banks have also had a lacklustre performance in recent months. This suggests that the prospect of Frankfurt or Paris taking financial business away from London as a result of Brexit, is not yet reflected in the share price of the European banks," notes Brooks.

The CBI - easily the largest business body in the UK - was broadly welcoming of the details.

“The Brexit White Paper reflects much of the evidence that business has been highlighting since the Referendum. This direction is welcome - protecting jobs and investment now and in future should be the guiding star for both sets of negotiators," says Carolyn Fairbairn, Director-General of the CBI. “Many of the intentions are reassuring. Seeking a free trade area for goods and a common rule book shows the Prime Minister has put pragmatism before politics and should be applauded.

Fairbairn notes businesses on both sides have been asking for frictionless trade between the UK and EU, and shared rules could go a long way towards delivering that.

"It is now the EU's turn to put economics before ideology on these proposals," says Fairbairn.

Fairbairn's take on the impact to the services industry actually differs quite significantly to that offered by McGuinness:

"The UK’s world-beating services industry, representing around 80% of our economy, will be pleased by moves to maintain free-flowing data, mutual recognition of qualifications and mobility for skilled workers across the EU. This is the right ambition that makes sense for both sides."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here