Pound Sterling Firms Against the Euro as Barnier Strikes Constructive Tone ahead of White Paper Release

- EU's Barnier strikes positive tone in New York

- GBP/EUR exchange rate finds support at key 1.13 area again

- Further GBP strength expected if May consolidates her power

- EU response to UK's latest Brexit White Paper is next key hurdle

Above: Michel Barnier sees progress on Brexit negotiations according to a speech delivered in New York. Image © European Union , 2018 / Source: EC - Audiovisual Service / Photo: Mauro Bottaro

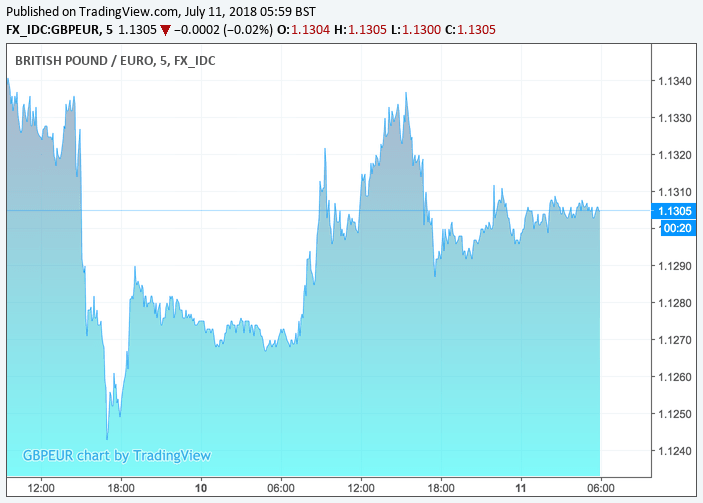

The Pound-to-Euro exchange rate trades back above 1.13 amidst signs that the EU might be open to move forward with the UK's latest Brexit proposals and that this key technical support level that has underpinned the exchange rate for months remains as firm as ever.

The exchange rate had tested fresh four-month lows towards 1.1230 earlier in the week amidst a significant bout of fresh uncertainty posed to the currency by domestic politics that saw a slew of high-level ministerial resignations in protest of the UK government's evolving approach to Brexit.

That Theresa May has however ultimately prevailed has allowed foreign exchange markets to believe continuity will be ensured. Recall, Sterling detests uncertainty more than anything, and any return to stability is almost inevitably a positive driver.

There remains a likelihood that PM May’s leadership could yet be challenged and renewed fear on this front is a source of uncertainty for Sterling.

"But we wish to add that any failed attempt to weaken her leadership will only further strengthen her stand. And this could well be positive for the GBP. In addition, riddance of opposition (hard Brexiters) within her party only suggests a more unified voice and solidarity when negotiating with the EU. This could in fact add to GBP strength," says Saktiandi Supaat, a foreign exchange strategist at Maybank in Singapore.

Above: The Pound claws back losses agianst the Euro.

However, volatility over the second half of the week must be expected as the political landscape both in the UK and regarding Brexit continues to evolve.

The response of the European Union to the UK government's White Paper on the future trading relationship - due for release on Thursday - will now be the next major test for the British Pound we believe.

Signs of a constructive reponse have grown over the past 24 hours with the chief Brexit negotiator for the European Union has declared that 80% of a deal with the UK has been agreed, in a change of narrative that suggests a full agreement can be sealed before October’s deadline.

Speaking at the Council on Foreign Relations in New York overnight, Michel Barnier said: "after 12 months of negotiations we have agreed on 80% of the negotiations." He added that he was determined to negotiate a deal on the remaining 20%.

The declaration that four-fifths of the deal is done is a significant change of tone from the EU after months of protests that it could not negotiate because the UK had not put its own proposals on the table.

Barnier adds he looks forward to a "constructive discussion" with the UK after the white paper on Brexit is published on Thursday. But he maintained a familiar warning: "We need clarity for these negotiations to move forward for the time is very short."

The UK government's White Paper will detail the 'Chequers agreement' that appears to be a turn by the government to a 'softer Brexit' that sees the UK and EU remain closely aligned, particularly when it comes to the trading of goods.

Traders and businesses gave the plan a cautious welcome and we believe Sterling would be notably higher had doubts grown over May's leadership in the wake of the cabinet resignations.

If the EU rejects the White Paper, or expresses doubts that it is unworkable, it will be taken as a sign that they are seeking yet more concessions from the UK.

With Theresa May aware that she has limited room to give further concessions, and with the government agreeing to step up plans for a no-deal Brexit, markets could become wary that the UK and EU are heading for a no-deal outcome.

This would be negative for Sterling but based on Barnier's comments we would suggest probabilities for such an outcome are quite limited.

In short, we would expect the EU to strike a cautiously optimistic note, and Sterling to remain supported into the weekend.

"Behind the scenes both sides concede they will need to soften their respective stances to conclude a comprehensive trade agreement over the next few months," says Richard Grace, a strategist with CBA.

But with UK politics moving so quickly, we keep an eye on the headlines.

Conservative Rebels to Quash May's Chequers Plan

News reports out midweek confirm that a tranche of Conservative parliamentarians are to quash Theresa May's Brexit plans, having failed to gather the numbers required to oust her.

According to the Sun, Jacob Rees-Mogg and fellow Conservative backbenchers have lodged a total of four amendments to alter Government’s flagship Trade Bill – claiming No 10 has “broken their trust”.

It’s the first big show of strength by the Eurosceptic grouping on the Tory backbenches and threatens to wipe out Theresa May’s Commons majority when the bill goes before MPs on Monday.

One amendment demands the UK scraps its pledge to collect taxes and duties on behalf of the EU unless EU member states vow to do likewise.

The government will have to negotiate with the rebels in order to pass legislation; being unable to pass legislation would effectively render the government ineffective.

And, by bending to the requests of the rebels, Brexit gets harder which is ultimately negative for Sterling and increases the prospect of the European Union rejecting the UK's proposals.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here