British Pound Suffers Profit-Taking at Start of a New Month

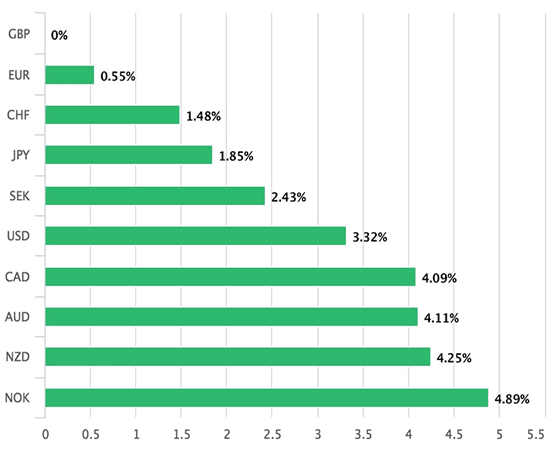

The Pound was the best performing major currency in November, however December 1 sees a little retracement in the currency with investors cautious of some instrumental events on the Brexit front falling in coming days.

Pound Sterling - the best performer in November amongst the family of the world's major currencies - was caught by a bout of profit taking at the start of the new month.

With the major story of Brexit taking a backseat Sterling found itself a passenger to moves in its bigger cousins, the Euro and Dollar.

The Euro pushed higher against major competitors in a broad-based move ensuring the Pound-to-Euro exchange rate edged lower to record a low of 1.1310 before recovering to 1.1344.

The Pound-to-Dollar exchange rate meanwhile went as low as 1.3458 at one stage before recovering to 1.3493 ahead of the weekend.

Paring gains on Sterling makes sense for traders - after recording a 0.60% gain on the Euro in November and a 3.33% gain against the Dollar, markets are opting to calm the uptrend ahead of a key meeting of European leaders that will decide whether or not Brexit negotiations should move on to the issue of trade.

We have seen Sterling rally over recent days amidst hopes that a breakthrough in Brexit talks is imminent, but nothing has been officially confirmed and until final confirmation comes through lingering doubt will nurture caution.

"Sterling continued to profit from hopes that EU and the UK were making progress to start a next stage in the Brexit negotiations. However, the issue of the Irish border remains a tough nut to crack. Negative headlines on this issues might block further sterling gains," says Piet Lammens, an analyst with KBC Markets in Brussels.

The yes or no answer delivered by the European Union heads of state a meeting of the European Council on December 15 presents a binary risk for Sterling: Yes and the Pound will move higher, no and it will move lower.

Responsible traders would be forgiven for cutting exposure to Sterling upside ahead of such an event.

"There are still potential obstacles: we still need clarity on citizens’ rights issues and the EU side will need to confirm that it is willing to leave the full resolution of the Irish border situation until Phase II of the talks," says Bilal Hafeez at Nomura Plc.

However, Nomura believe the market has been too pessimistic on the Brexit negotiations for the past month or two and is now seeing that real progress is being made.

"There are also reasons to be more optimistic on the UK banking sector outlook. We expect a grind higher in GBP pairs," says Hafeez in a note dated December 1.

The Pound failed to capitalise on data from IHS Markit and the CIPS released on the first of the month that confirmed UK factories are enjoying something of a boom.

The Manufacturing PMI read at a four year high at 58.2 in November, up from the 56.3 initial estimate for October, and far ahead of the consensus estimate for a smaller increase to 56.6. October’s number was also revised higher to 56.6.

New order rose at their fastest pace for four years, supporting elevated levels of production activity and further gains in employment across the sector.

“UK manufacturing shifted up a gear in November,” says Rob Dobson, a director at IHS Markit. "The breadth of the rebound is also positive, with growth strengthening across the consumer, intermediate and investment goods industries."

Sterling's lacklustre reaction is understandable - Brexit is all that matters right now, yet the stronger the economy performs, the greater the potential for rallies in Sterling as Brexit uncertainties die.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Dollar, Euro in Charge

The Dollar saw big moves amidst signs Washington was moving closer to clinching a deal on tax reform.

"Dollar bulls are pinning their hopes on a sweeping tax deal that boosts the economy and leads the Fed to adopt a more aggressive pace of interest rate hikes," says Joe Manimbo at Western Union.

At the time of writing we advise that further news headlines can come through on the matter, but it appears markets have priced in some progress ahead of the weekend.

U.S. Senate Republicans said on Friday they had enough support to pass a sweeping tax overhaul later in the day, after last-minute negotiations to ease some senators’ concerns about its impact on the federal deficit, healthcare and property taxes.

“We have the votes,” Senate Republican leader Mitch McConnell told reporters after emerging from a morning meeting with the party’s lawmakers. “Sometime today we will wrap up.”

The Euro's uptrend against the Dollar meanwhile faded amongst Dollar optimism, allowing Sterling to recover some lost gorund.

Yet, underlying sentiment towards the shared-currency remains bullish thanks to data that showed the strongest growth among Eurozone factories in 17 years.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.