Pound Sterling: Manufacturing PMI Surges to Four-year High but Brexit Dominates Narrative

- Written by: James Skinner

The UK economy is regaining lost momentum but Sterling is vulnerable to Brexit developments Friday as Donald Tusk meets Irish PM Leo Varadkar.

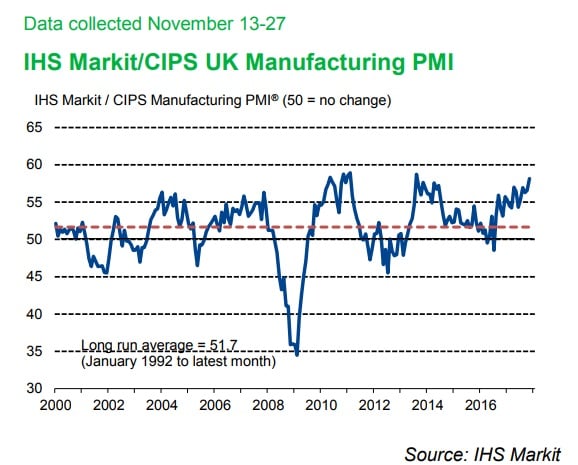

The Pound succumbed to profit-taking Friday despite a faster than expected rise in the November IHS Markit manufacturing PMI, which took the index to a four-year high.

The IHS Markit manufacturing index rose to 58.2 in November, up from the 56.3 initial estimate for October, and far ahead of the consensus estimate for a smaller increase to 56.6. October’s number was also revised higher to 56.6.

New order rose at their fastest pace for four years, supporting elevated levels of production activity and further gains in employment across the sector.

“UK manufacturing shifted up a gear in November,” says Rob Dobson, a director at IHS Markit. "“The breadth of the rebound is also positive, with growth strengthening across the consumer, intermediate and investment goods industries."

Manufacturing has been one of the few consistent bright spots for the UK economy since the Brexit referendum of 2016, although its relatively small share of the economy means it has had little impact on broader economic momentum to date.

“On its current course, manufacturing production is rising at a quarterly rate approaching 2%, providing a real boost to the pace of broader economic expansion,” notes Dobson.

Domestic activity has been key in fuelling demand across the sector in recent quarters but the post-Brexit devaluation of the Pound has also lead to hopes of a further boost, from a pickup in exports.

"Sterling’s slide seems to be providing ample support for manufacturers, with the new export order balance rising from 54.3 in October to 56.4," says Ruth Gregory, an economist at Capital Economics.

"What’s more, the three-month average of the survey’s output balance is consistent, on the basis of past form, with a hefty quarterly gain in manufacturing output of close to 2%, following Q3’s strong 1.1% rate."

The UK economy regained some lost momentum during the third quarter, when it expanded at a rate of 0.4%, up from the 0.3% seen in the second and first quarters.

"Overall, today’s survey provides us with further optimism that the manufacturing sector will continue to play a role in offsetting the slowdown in the consumer services sector," says Gregory.

Friday’s data also comes against a backdrop of a continued improvement in other survey data, which has prompted some economists to suggest the economy may have maintained its rediscovered momentum in the fourth-quarter.

“Meanwhile, there have been further optimistic signs that the UK & EU will make sufficient progress on the withdrawal agreement ahead of December’s European Council meeting, although it could still be a close call,” says Finn McLaughlin, another economist at Capital Economics.

Above: GBP/USD shown at hourly intervals.

The Pound was boosted this week by signs of “sufficient progress” being reached in Brexit negotiations, which strategists say could drive the Pound-to-Dollar rate as high as 1.3700 before year-end.

But Sterling is vulnerable to Brexit-related developments Friday as European Council President Donald Tusk is set to meet Irish Prime Minister Leo Varadkar Friday to discuss the Republic of Ireland's concerns over the border with Northern Ireland.

The Pound-to-Euro rate was quoted 0.38% lower at 1.1327 during early trading Friday while the Pound-to-Dollar rate was marked 0.31% lower at 1.3488.

Irish Border in Focus

Sky News reported Thursday that DUP leader Arlene Foster, who holds a majority in Stormont, has warned the UK government against sacrificing Northern Ireland for the sake of an agreement on trade and transition with the EU.

Foster spoke out due to concerns over a possible deal that would oblige Northern Ireland to abide by single market and customs union rules after Brexit, saying it could "destabilise" the confidence and supply deal with the DUP that has kept Prime Minister Theresa May in power since the June election.

Warning to the Government on Brexit from the party that’s keeping them in power, the DUP. pic.twitter.com/g9AMI52mCm

— Mark Simpson (@BBCMarkSimpson) 30 November 2017

The Northern Irish border is among the greatest stumbling blocks in the Brexit negotiations so far. For the sake of the peace agreement that has quelled earlier sectarian violence in Northern Ireland, it is necessary to avoid a border with physical infrastructure such as checkpoints.

However, this throws up issues such as the integrity of the EU single market and customs union, as well as those of the UK. The government has said it will not accept a sea border between the Britain and Northern Ireland.

Both Donald Tusk and Irish PM Leo Varadkar will discuss the issue Thursday, although it remains unclear the path they will take.

The Republic of Ireland can use its veto at the European Council summit in mid-December to prevent Brexit negotiations moving onto the subjects of trade and transition in the new year.

This would severely undermine Sterling's recent gains, which saw it feature among the best performing G10 currencies in November.

The DUP's Foster has previously accused the Republic of Ireland of attempting to use Brexit to force Northern Ireland's reunification with the republic.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.