British Pound Experiences Technical Surge vs Euro and US Dollar

- Written by: Gary Howes

- Spot Quotes:

- Pound to Dollar exchange rate: 1 GBP buys 1.3041 USD

- Pound to Euro exchange rate: 1 GBP buy 1.0916 EUR

The British Pound is one of the best performing currencies in the global G-10 complex of the past 24 hours with an especially strong performance being seen against both the Dollar and Euro.

The gains behind the Pound are said to be driven by technical considerations at present, and as such there are immediate concerns as to how sustainable the advance might be.

“The technical rebound of sterling took a breather yesterday but resumed today,” says analyst Piet Lammens at KBC Markets in Brussels.

UK data didn’t gift Sterling any strength; in fact the services PMI for August came in below consensus from 53.8 to 53.2 (53.5 was expected).

“As is the case for EUR/USD, we see current GBP price action mainly as technical in nature. Last week’s Brexit negotiations didn’t yield any concrete progress and this issue will return to the forefront but Sterling shorts apparently are taking some chips of the table, in particular against a strong Euro,” says Lammens.

Despite the technical recovery, "we have a long term Sterling negative bias, but wait for a deeper correction higher of sterling before stepping in and sell Sterling," says KBC's Lammens.

Nevertheless, with technical considerations dominant at present, chart studies are all the more important as they tell us how the market is positioned and where moves might accelerate or halt.

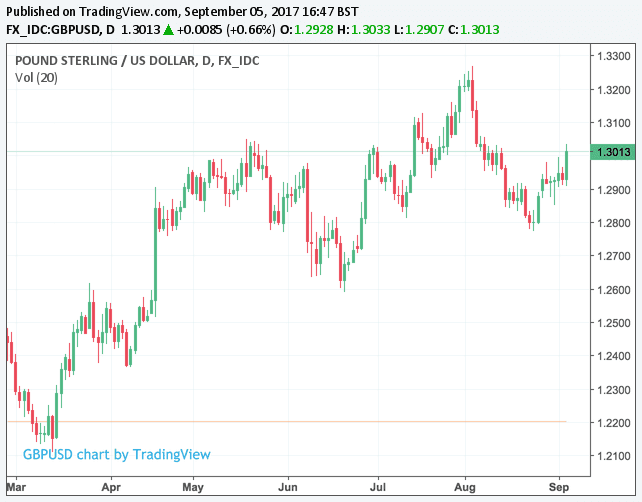

Against the US Dollar, we have noted Sterling to have breached a key resistance level which might encourage further follow-through buying interest.

For GBP/USD, the 2017 highs at around 1.32 are the obvious next target.

Fawad Razaqzada has also studied the charts and has other objectives in mind:

"With key short-term resistance area between 1.2965-1.2995 broken, a potential re-test of this region could provide support leading to another push higher. The next bullish objective is at 1.3075, which corresponds with the 61.8% Fibonacci level against the most recent drop.

"Another target is at 1.3190/5, which was the last support pre breakdown. Meanwhile all bets would be off if today’s low at 1.2910 breaks in the coming days. In this potential scenario, we could see a sharp move lower as the longs rush for the exits."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Pound-to-Euro Rate Targets

With regards to the Pound's efforts against the Euro we note the exchange rate to be in a sharp downtrend.

Momentum continues to favour the Euro. However, many analysts have warned that the move is in danger of over-extending in the near-term, and some short-term recovery might be due.

This could be the case at present.

We watch for further potential recovery from the mult-year lows set at around 1.0750 in late August.

Our technical analyst Joaquin Monfort wrote ahead of the week that a tough obstacle to further gains may come in the form of the monthly pivot (PP) just above the current market level at 1.0937.

Monthly pivots are used by traders to gauge the trend and as places to fade the dominant trend since the exchange rate often bounces or pull-back from them.

For a continuation higher he wanted to see the pair completely clear the 1.0937 level, which would be confirmed by a move above the 1.0975 level.

The next major resistance level is at the trendline (A) in the mid 1.10s and our next upside target is at 1.1025 since it is not known whether the exchange rate will be able to break above the trendline successfully.

KBC Markets' Piet Lemmens is of the opinion that any strength in Pound Sterling should be sold into, but the recovery must be allowed to extend somewhat.

"We maintain a buy EUR/GBP on dips approach as we expect the combination of relative Euro strength and Sterling softness to persist," says Lammens.

The 1.0621 'flash-crash' dip is the next target on the charts for Lammens. However, the analyst is inclined to wait for a correction, e.g. to the technical support in the 1.1364/1.1236 area, "to sell Sterling again versus the Euro."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.