The Pound-to-Dollar Rate Breaches 1.30 and with it the 50-Day Moving Average

Pound Sterling looks intent on registering its largest one-day rise against the US Dollar since late July.

The GBP/USD exchange rate is looking to rise into the 50-day moving average where Sterling would be expected to encountered renewed selling pressure. Such a break would typically indicate that follow-through momentum is likely.

Lower-than-expected Services sector data out this morning was not soft enough to damage Sterling's advance on the Dollar which appears to be technically inspired.

"As is the case for EUR/USD, we see current GBP price action mainly as technical in nature. Last week’s Brexit negotiations didn’t yield any concrete progress and this issue will return to the forefront but sterling shorts apparently are taking some chips of the table," says Piet Lammens, an analyst with KBC Markets in Brussels.

Typically the 50-day moving average - the red line in the above - would be expected to resist further advances by Sterling but a break above her would open the door to further gains.

As noted in the graph, the last time the 50-day moving average was breached GBP/USD quickly accelerated from ~1.2850 to highs above 1.32. Often traders will enter a trade once levels of such resistance are breached in what amounts to a self-perpetuating movement.

The near-term direction undertaken by GBP/USD will largely depend on how this key level is navigated.

At the time of writing the 50-day moving average is at 1.2985 and the spot rate is at 1.3019 but a daily close would be required to convince us a break has occured.

Analyst Shaun Osborne with Scotiabank in Toronto says that the short-term outlook for Sterling will improve when back above the combination of 1.2985 (40-day MA) and 1.2995 (early September high).

"But that might only mean gains extending towards 1.3100/50 again," says Osborne.

"We had expected a little more weakness in the pound through Sep as a result of the slippage seen last month but more range trading seems the most likely prospect for Cable now," adds the analyst.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Fundamentals for GBP/USD Hinge on Politics

While the political environment is looking benign at present, we would urge those watching Sterling and the Dollar to be wary of headline surprises.

For the Pound, Brexit negotiations are still the most important driver but continue to be fraught as the UK and EU seem no closer to agreeing any compromises on the key opening issues of the status of EU nationals in the UK, the cost of Brexit and the border between Northern Ireland and Republic of Ireland.

Most recently, Senior EU commissioner, Pierre Moscovici, reported the EU's chief negotiator had said to him he was "worried" about the way Brexit negotiations were going.

Speaking to Bloomberg, Mr. Moscovici said: "My friend Michel Barnier is a bit worried about the progress of the negotiations but," he added, " we still have some time to go, quite a bit of time to go."

Thursday will see Parliamentarians debate the "Great Repeal Bill" which seeks to adopt 19,000 EU laws into British law so they can also be kept, replaced or rejected over time.

However, the bill has come under fierce criticism, especially from opposition Labour MPs, who say it hands too much power to ministers to replace or overrule key rights enshrined in the EU laws thus adopted.

The opposition is particularly concerned about, "the power to replace certain laws via ‘statutory instrument’, which parliament does not get to vote on or debate," according to a report in the Independent online.

Labour's Brexit minister Kier Starmer has requested the government to amend the Bill to allow the UK to remain in the economic, customs and judicial union for an 'interim' period of about 4 years after the official triggering of Brexit in March 2019, in a reflection of Labours new, 'softer' stance.

The government may also face a rebellion from pro-EU conservatives in its own ranks, but it is not clear whether they number enough to beat Theresa May's small majority.

A government failure in passing the bill, would probably cause a knee jerk weakening of the Pound initially as it increases uncertainty over Brexit, however, if it would also de facto imply that the majority of parliament were in favour of Labour's softer Brexit version leading to a probable whipsaw higher for Sterling on expectations of a much smoother exit, with many trade functions remaining intact during the interim.

The Dollar - Debt Ceiling Unlikely to Cave In

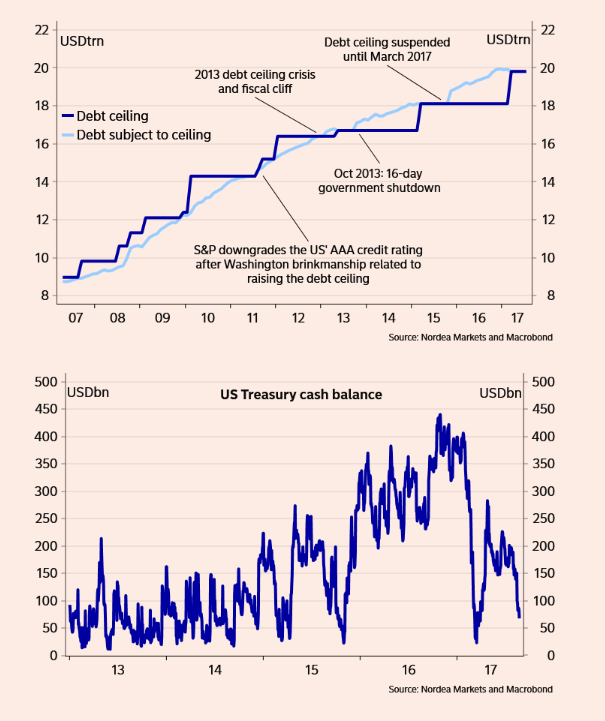

Of the multiple risks facing the Dollar, one of the biggest is the country hitting its debt limit.

This would lead to both a technical default but also a government shutdown because the cost of running government outstrips what the treasury makes in tax receipts so without being able to borrow the difference it would be at risk of having to shut down key services and operations.

The country will hit the limit at the end of September so both houses need to pass legislation on raising the debt limit before that deadline to avoid the state running out of money.

Clearly, if they fail it would be negative for the Dollar, as it would reduce the US's credibility, reduce its credit rating, reduce demand for the Dollar and would negatively impact growth.

There are concerns that politics may get in the way of pragmatism, leading to no rise in the debt limit, but how bad are the risks?

Nordea Bank's Bo Jacobsen provides us with an interesting analysis of how the whole debt ceiling thing might play out.

Jacobsen starts by setting the scene and explaining that not only does the government have to vote through a rise in the amount it can borrow but also legislation to fund the government.

"Yet again, a fresh battle over the federal debt ceiling is looming. Congress must enact a debt ceiling increase by the end of September or risk defaulting on obligations in early October," he says, adding that:

"To complicate matters even more, Congress must also pass legislation funding the government after 30 September or face a government shutdown."

The fact the two votes coincide, he says, risks another round of "political brinkmanship."

There doesn;t appear to be much time to sit around debating the issues, either, as from now until the end of September the house has only 12 days to pass this legislation.

If they fail to agree a rise in the ceiling or government funding there is a chance the US government could be shutdown as a consequence - and if you think that sounds unlikely then think again, as it wouldn't be the first time:

"Political fights over the size of the federal budget and debt led to government shutdowns in 1995 and 2013, and nearly in 2011, when S&P downgraded the US credit rating for the first time in the country’s history, stripping long-term federal debt of its AAA status," said Jacobsen.

On balance, the Nordea analyst thinks that the bill to extend the debt ceiling is likely to be passed but close to deadline.

"The debt ceiling and the spending bill will need 60 votes to pass in the Senate, and as a result, at least 8 Democratic votes would be needed in that chamber even if all 52 Republicans supported them. In exchange for Democrats support they will likely seek to avoid that an upcoming tax proposal is going to put on a massive tax cut for the very wealthy," he said.

Even if there is too much disagreement to agree an extension of the debt limit there is the possibility of a short-term fix, such that Congress can pass a short-term increase in the debt ceiling to buy time to work out the details of a longer-term increase.

Even if a short-term increase is not agreed, the chances of a technical default are still small as on past occasions the treasury has always kept back funds to cover the interest payments on its debts for a period of time in case of emergencies.

Other payments, such as social security payments, might be delayed as a consequence, however.

The debt ceiling could also impact on the Fed's plans to raise interest rates as market turbulence around the debt ceiling debate could "stay the Fed’s hand" and potentially postpone the next step towards policy normalization.

Nevertheless, we now see a higher chance of a concord occurring and facilitating the safe passage of legislation to increase the debt ceiling and allow government funding.

We think there may be more desire to put differences aside for the national interest after the devastation wreaked by Hurricane Harvey on Texas, and this may encourage a more bi-partisan approach to the government finances, given the poor timing any shut down would have in relation to the natural disaster.

Overall we see less risk of a political turbulence in the US than in the UK as a result of the Brexit debate which still has the potential to be extremely volatile.

Thus, purely from a fundamental perspective, we see a higher chance of GBP/USD's falling than rising, although the continued upside pressure on the 50-day is a bullish sign.