Starmer's Gloom Hits the Economy, Pound Sterling Reteats

- Written by: Gary Howes

Above: London, United Kingdom. Prime Minister Keir Starmer gives a speech in the garden of 10 Downing Street. Picture by Simon Dawson / No 10 Downing Street.

The British Pound has retreated on the day the UK reported a sharp slowdown in growth.

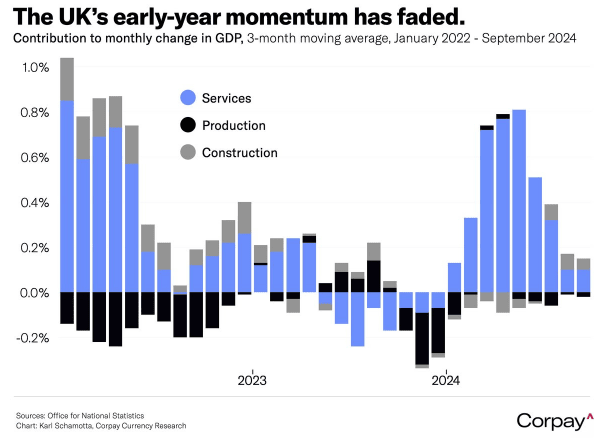

UK GDP grew a mere 0.1% in the three months to the end of September said the ONS, below the 0.2% the market consensus was expecting, marking a disappointing first quarter for the new government of Keir Starmer.

In the second quarter, the economy expanded 0.5% amidst expectations that the economic recovery was gaining momentum and a business friendly Labour government was about to take the reins.

Starmer must take a great deal of responsibility for the slowdown, thanks to his government's bleak messaging on the economy and finances, which culminated in an excruciating budget of tax hikes at the end of October.

Pound Sterling Live wrote on August 29: "Prime Minister Keir Starmer risks stalling UK growth and the British Pound's impressive run by killing sentiment and enacting taxes that specifically target the growth sectors of the economy."

Subsequent economic surveys pointed to deteriorating business and consumer confidence since Labour took over and warned of pain to come in the October budget, which prompted economists to warn that today's GDP reading would be a disappointing one.

"The news that the UK economy stalled again in the third quarter shows the importance of animal spirits as a driver of growth. The incoming government’s downbeat rhetoric about the 'economic inheritance' clearly had a negative effect on business and consumer confidence," says Julian Jessop, Economics Fellow at the Institute of Economic Affairs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The latest quarterly figures will not help to quell further negativity around the government’s latest Budget following the increase in taxes on businesses which will potentially slow growth even further. With the Government's growth agenda looking increasingly at risk, it may be down to the BoE to save the day by cutting rates at their December meeting," says Isaac Stell, Investment Manager at Wealth Club.

The Pound has softened against both the Euro and Dollar in the aftermath of the data, with GBP/EUR retreating to 1.20. GBP/USD is flat on the day, having given up earlier gains, and is quoting at 1.2660.

Growth of 0.1% represents an undershoot of the Bank of England's projection made in the November Monetary Policy Report.

Market expectations for another rate cut as early as next month have risen slightly since the GDP release, which explains why the Pound is broadly softer.

The expectation is that the Bank will cut at a quarterly pace, which would mean the UK's interest rate fall slower than elsewhere, which is fundamentally supportive of the Pound.

But, should the Bank accelerate the pace it cut rates, the Pound can come under pressure.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

To be sure, the UK's inflation outlook remains too poor for the Bank to materially speed up the pace it cuts.

Nevertheless, these growth data point to economic stagnation risks, which hardly ever support a currency.

"With overall GDP growing only 0.1% q/q despite the consumer performing much better than that, and news that GDP per capita fell 0.1% q/q in Q3 and is unchanged versus Q3 last year, this report reinforces the existing narrative that the UK economy is stuck in low growth mode," says Sam Hill, Head of Market Insights at Lloyds Bank.