Mr. Fixit: Huw Pill Helps Pound Sterling Stabilise

- Written by: Gary Howes

Above: File image of Huw Pill, Chief Economist at the Bank of England. Image © Sérgio Garcia/Your Image for ECB

It's not quite comeback Friday for the British Pound, but it has stabilised following its sharp fall on Thursday, helped by Bank of England Chief Economist Huw Pill.

Pill said he remains "concerned about the possibility of structural changes sustaining more lasting inflationary pressures" in the UK economy.

Speaking to accountants at the ICAEW, Pill said his latest economic modelling tells him "there is ample reason for caution in assessing the dissipation of inflation persistence."

The comments come a day after the publication of an interview with the Bank's Governor, Andrew Bailey, which caused a slump in the Pound as he was seen to abandon the Bank's long-curated message for caution and urge for a faster pace to rate cuts.

"The BoE Governor tried to repeat Liz Truss success on collapsing the Pound," says John Meyer, an analyst at SP Angel. "The BoE Chief Economist is backtracking as best he can by urging caution over interest rate cuts. Maybe one day the BoE will get the hang of how to manage its signalling to the market."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pill said "further cuts in Bank Rate remain in prospect should the economic and inflation outlook evolve broadly as expected," however, "it will be important to guard against the risk of cutting rates either too far or too fast."

"For me, the need for such caution points to a gradual withdrawal of monetary policy restriction," he concluded.

This contrasts with Bailey's comments published on Thursday that the Bank of England could afford to be more "activist" in cutting rates, which flips his stance from just two weeks prior when he also urged caution.

"Relatively hawkish interest rate guidance from Bank of England Chief Economist Huw Pill has stirred the sterling pot, 24 hours after a dovish steer from Governor Andrew Bailey gave GBP longs indigestion," says Robert Howard, a Reuters market analyst.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Bear in mind no meaningful UK data has been released in the interim, which is why the Governor's comments raised eyebrows.

"Bailey's comments have lowered the bar for faster cuts, but the data is not there to deviate from the gradual quarterly pace," says Ruben Segura-Cayuela, Europe Economist at Bank of America.

Pill appears to be watching inflation, but Bailey appears to be watching his colleagues at other central banks, who are all quite keen to get on with the job of juicing their economies with lower rates.

"Pill striking a different tone to Governor Bailey's soundbite yesterday," says Simon French, economist at Panmure Gordon.

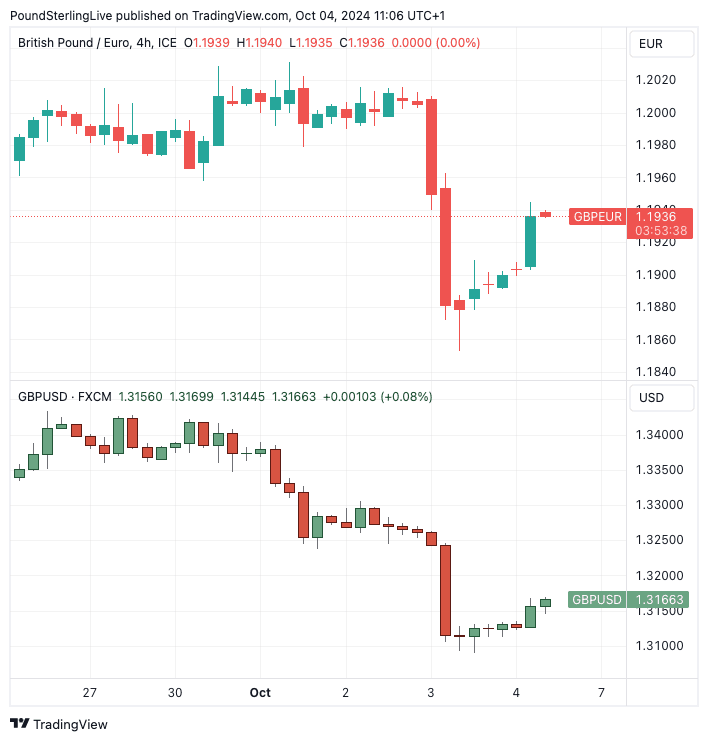

Above: GBP/EUR (top) and GBP/USD at four-hour intervals.

French says Pill is showing considerable caution and a preference for the Bank's "Scenario 2," whereby a prolonged restrictive monetary policy is requierd to bear down on persistent inflation components.

"Market doesn't believe it with 92% likelihood of November cut, & 60% for a December follow-up cut. But it is a clear message even the internal MPC members are split on pace of removing restrictiveness," says French.

Until these likelihoods come down, the Pound will struggle to reclaim 2024 highs.

The Pound to Euro exchange rate is nevertheless up 0.40% on the day at 1.1940, (it dell 1% on Thursday), and the Pound to Dollar exchange rate is up 0.33% at 1.3166 (it was down 1.20% on Thursday).

"Sterling received a modest boost this morning after some hawkish comments from BoE chief economist Pill, which appeared to pour cold water over Governor Bailey’s remarks on the possibility of a faster easing cycle. Pill reiterated the MPC’s official stance that the bank remains wary of cutting rates too deeply or too quickly, highlighting continued concerns over structural issues that could keep UK inflation elevated for longer," says Matthew Ryan, Head of Market Strategy at Ebury.

Ryan says Pill provides an element of validation to his view that markets perhaps took Bailey’s words too literally, and as a confirmation of faster cuts ahead, rather than merely a warning that this is a possibility.

"Indeed, we were somewhat perplexed and thrown off guard by Bailey’s comments, as we do not believe that UK data since the last MPC meeting has necessarily deteriorated to an extent that would warrant a shift to a more dovish stance," he adds.