Pound Sterling a Buy Against Euro Says Major Investment Bank

- Written by: Gary Howes

The Chase Tower, New York © Kristen Cavanaugh, Flickr, reproduced under CC licensing.

Currency strategists at JP Morgan have initiated a 'short' EUR/GBP position, citing valuations and expectations that this week's Eurozone PMI figures disappoint.

"We add a short position in cash and see the upcoming PMIs as a key catalyst for downside in the pair if the UK metric were to again outperform vs Europe," says a note from JP Morgan.

To go 'short' is trader parlance for selling an asset. In this instance, the holder of the position would benefit if the Euro fell against the Pound.

"European growth momentum has stalled in recent months; the latest regional PMI data disappointed and it appears as though the composite measure formed a top in May," says JP Morgan.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Eurozone PMIs will offer the first snapshot of Eurozone economic activity in August, and they follow a string of disappointing PMI releases in recent months, thanks mainly to a slowdown in Germany and France.

Regarding the Pound, the UK composite PMI outperformed that of the Eurozone last month, pushing the Pound to Euro exchange rate higher.

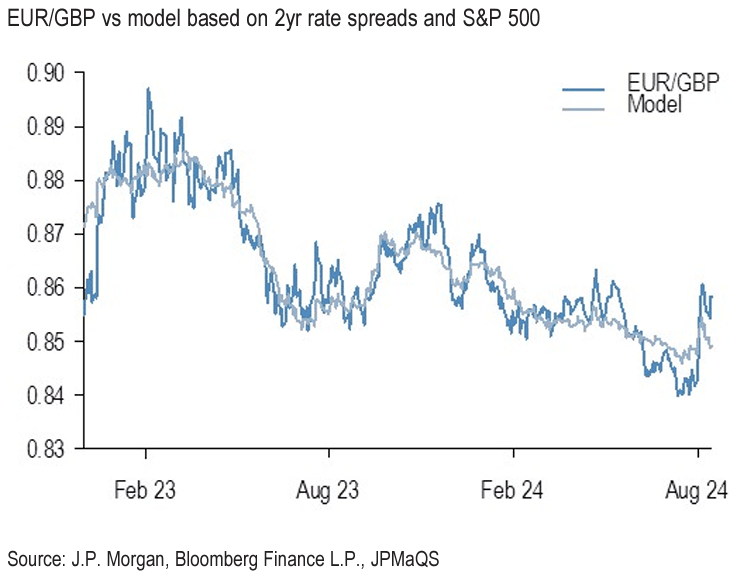

Heading into Thursday morning's PMI releases, JP Morgan says the Euro is looking richly valued relative to the Pound.

"With EUR/GBP now screening rich on our fair value metrics, we add a short position in cash and see the upcoming PMIs as a key catalyst for downside in the pair if the UK metric were to again ouperforms vs Europe.

"Our positioning metrics also show emerging demand for EUR topside vs both USD & GBP, suggesting greater scope for potential unwinds if the Eurozone PMI were to indeed print soft," adds the investment bank.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Pound to Euro exchange rate is in recovery mode, having fallen 2.30% peak-to-trough at one stage earlier this month, with declines following a Bank of England interest rate cut that prompted investors to reduce a significant long exposure to the British Pound.

The decline has taken the exchange rate to below the median value forecasted by over 30 of the world's major investment banks, with the median estimate now residing some 70 pips higher than the current level in the spot exchange rate.

The survey of forecasts shows that although the median estimate for Pound-Euro is higher, the mean is slightly lower than current levels.

These data suggest the recent fall in the Pound leaves it better balanced from a valuation perspective, and if the 'big brain' is right, it is set for a gentle and modest appreciation trend into the quarter-end.