Alarm Bells Sound Over German Economy

- Written by: Sam Coventry

Image © Adobe Stock

"This looks like a serious problem. Germany’s economy fell back into contraction territory, dragged down by a steep and dramatic fall in manufacturing output," says Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank.

la Rubia was commenting on news German private sector output contracted at the start of the third quarter on a combination of a deeper decline in manufacturing production and slower growth of services business activity.

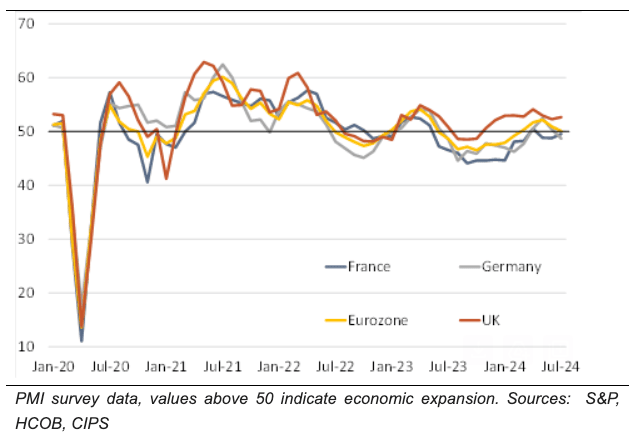

S&P Global's Manufacturing PMI read at 45.6 in July, down from 45.8 and below expectations for 46.1. The Services PMI registered 51.9 from 52.8 (exp: 53) and the Composite PMI 50.1 from 50.9 (exp: 51.1).

"Structural problems (shortages of skilled workers, insufficient investment in productive capacity, high energy costs, excessive taxation and regulation, etc.) are seriously hampering potential GDP growth," says Salomon Fiedler, an economist at Berenberg Bank.

Image courtesy of Berenberg.

The PMI survey showed a softening of the rate of increase in service sector output prices to the weakest since April 2021. Input costs and output prices in manufacturing meanwhile continued to fall.

This, when combined with signs of a potential slowdown, raises the odds of further ECB interest rate cuts in 2024.

"Growth in services activity is also moderating. Amid a broad-based decrease of employment, services firms are now cutting some jobs, too," says Fiedler.

The Eurozone Composite PMI for July also declined compared to June and is now in stagnation territory (at 50.1, down from 50.9 in June), undershooting consensus expectations.

"Today’s reading indicates growth of the bloc’s economic activity flatlined moving into Q3. We already anticipate a slowdown in growth in Q2 and Q3 to 0.2% q/q, down from 0.3% in Q1. But today’s PMI readings underline risks to that view are tilted to the downside," says Jan-Paul van de Kerke, an economist at ABN AMRO Bank.

Disappointing PMIs support ABN AMRO's call for a 25 basis point ECB rate cut in September and a more extensive rate cut cycle than financial markets have priced in.

If the market begins to price at a more aggressive rate cutting cycle, the Euro can come under pressure.