Pound Sterling Boosted by Strong U.S. Jobs Report, Here's Why

- Written by: Gary Howes

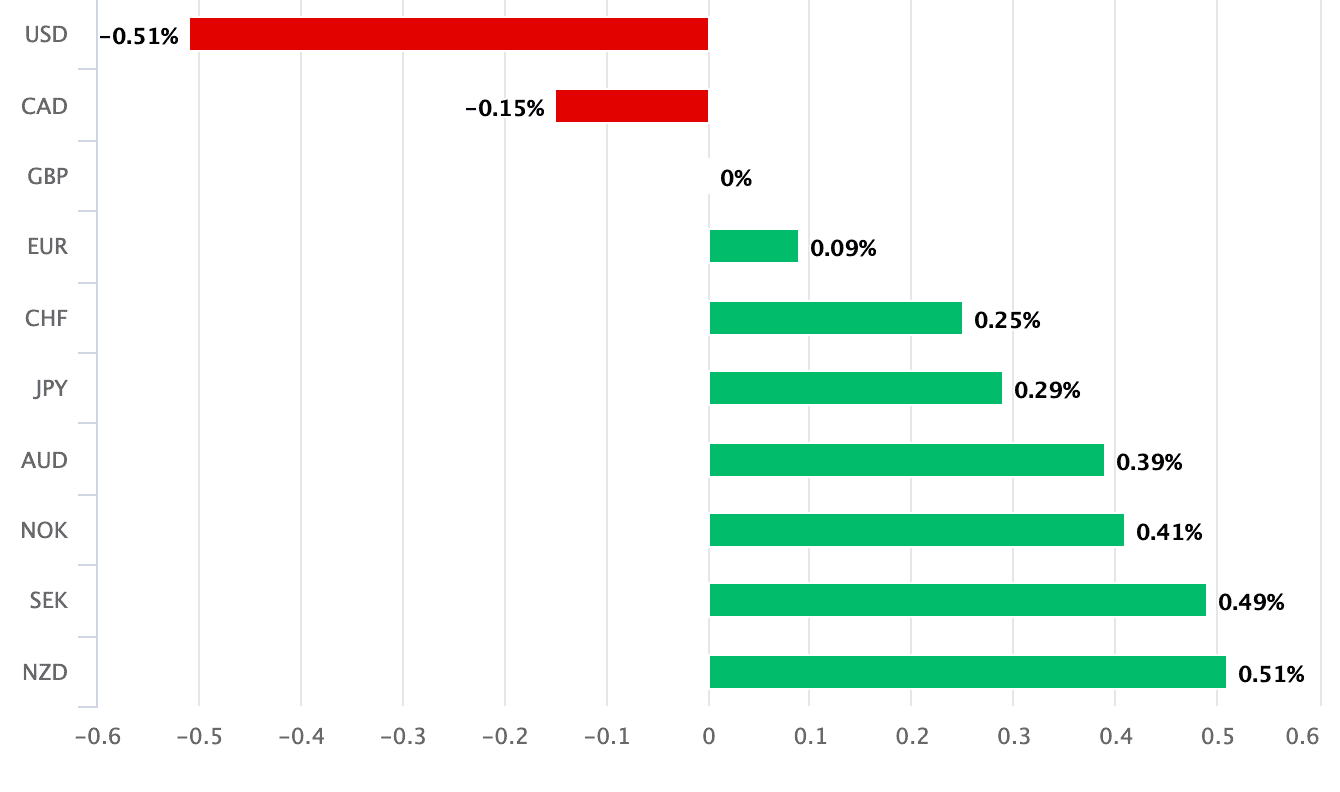

Above: GBP performance on June 07 following the U.S. labour market print.

The British Pound is an unlikely winner following the release of above-consensus U.S. labour market figures as investors see implications for the UK economy and Bank of England decision-making.

Although the Pound-Dollar exchange rate is considerably lower on the day following news of a red-hot U.S. job print, the Pound is up against the majority of its G10 peers.

In fact, it is the third-best performing currency in the G10 family after the USD and CAD, even as stock markets fall.

Interestingly, we saw the Pound to Euro rate overturn earlier losses and go into the green for the day following news the U.S. economy created 272k jobs in May, up from 170K in April, and outstripping expectations for 180k.

It is even up against the 'safe haven' Franc, which we would not expect given the selloff in stock markets.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market reaction suggests the strong job data materially lowers the odds of a U.S. rate cut in September and leaves markets questioning whether a rate cut will happen at all in 2024.

And this has implications for UK monetary policy, too: the Pound's rally suggests investors reckon the Bank of England will face a similar situation to that of the U.S.

Following the data, markets see less than two full rate cuts priced for 2024. This time, one month ago, the market was fully priced for a cut by August, with a 50/50 chance of a move as soon as June.

But UK inflation has proven resilient amidst a resilient jobs market, echoing what we are seeing in the U.S. The UK economy has turned a corner and will continue to improve, especially if the U.S. economy continues to steam ahead.

Thus, what is good for the USD is proving good for GBP.