Red-hot U.S. Job Report Boosts the Dollar

- Written by: Gary Howes

Image © Adobe Images

Dollar exchange rates rallied after the U.S. printed red-hot job numbers that will raise questions of whether an interest rate cut in 2024 is at all tenable.

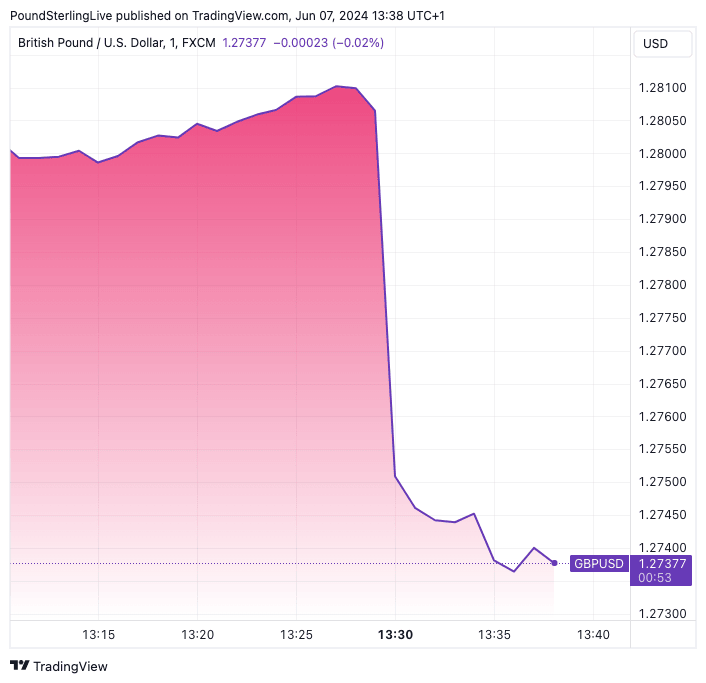

The Pound to Dollar exchange rate dropped in the minutes half a per cent in the minutes following news U.S. non-farm payrolls rose to 272k in May, from 170K in April, outstripping expectations for 180k.

Average hourly earnings rose to 4.1% year-on-year in May, up from 3.9% in April, beating expectations for 3.9%.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The latest jobs report demonstrates that the labour market, which has been helping fuel inflationary pressures, is still remarkably robust. Even hourly pay is up," says Nigel Green, CEO of de Vere Group. "We expect that there’s a significant risk that we might not see a rate cut until 2025."

The U.S. disinflation process has stalled in 2024 amidst a strong economy and the diminishing odds of interest rates cuts has ensured the yield paid on U.S. bonds remains attractive to international investors.

This, in turn, boosts the Dollar. These figures could turn the tide on a recent trend of Dollar strength, putting downward pressure on Pound-Dollar.

Above: GBP/USD showing the immediate market reaction to the paryrolls. Track GBP/USD with your own custom rate alerts. Set Up Here

"The dollar is coming off an eight-week low in line with a curve-wide rise in Treasury yields as traders push expectations for Federal Reserve policy easing further into the future - toward December and beyond. Equity futures, commodity prices, and risk-sensitive currencies are all tumbling in relative terms," says Karl Schamotta, Chief Market Strategist at Corpay.

He adds that the data defies expectations for a cooldown in the U.S. economy and suggests that the Fed will have to maintain rates at current levels for longer.

"The extraordinarily-wide expected growth and interest differentials that favour the U.S. dollar look set to remain intact for now, helping maintain the greenback’s relative overvaluation," says Schamotta.