Weak Pound Sterling Fighting On The Floor Against Euro And Dollar

- Written by: Gary Howes

Image © Adobe Images

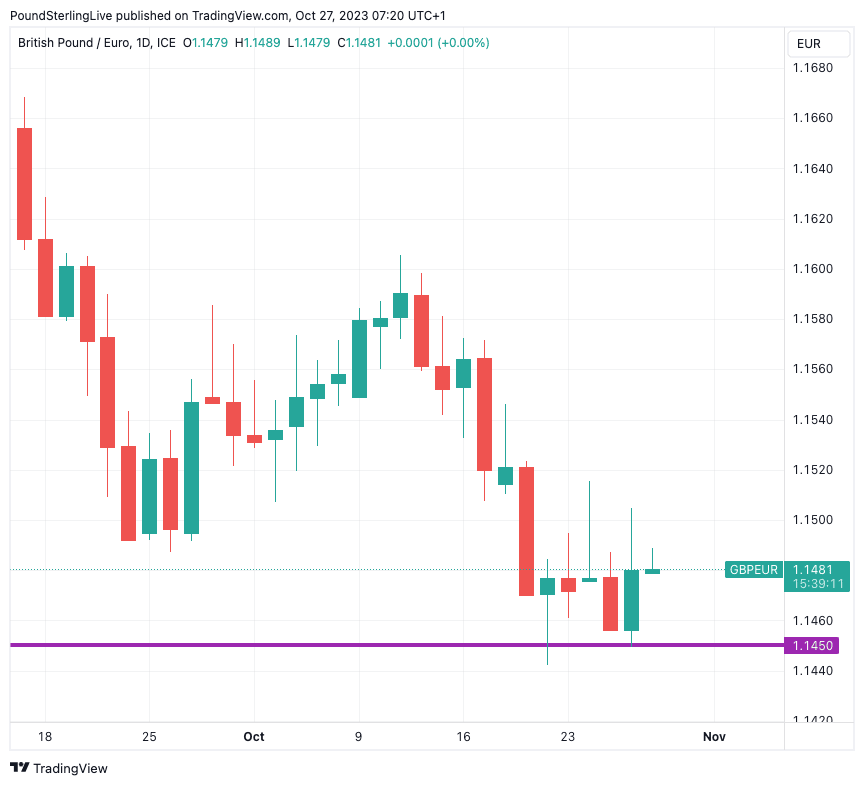

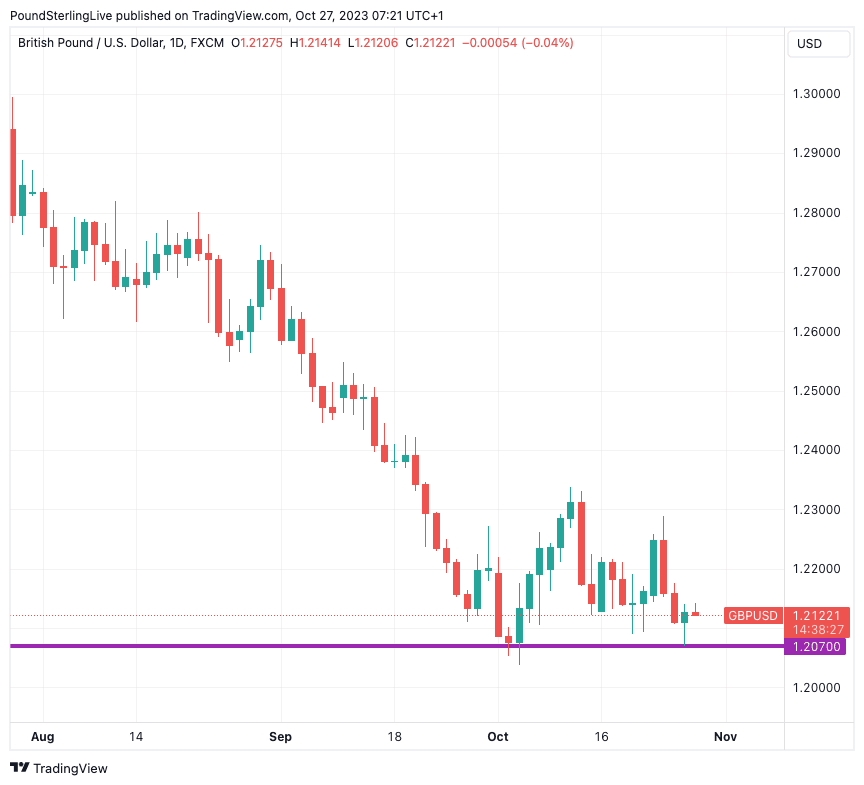

The British Pound is staging a desperate attempt to defend the tentative floors of support it has established against both the Euro and Dollar ahead of next week's all-important Bank of England interest rate decision.

The Pound to Euro exchange rate is holding levels above 1.1450 while the Pound to Dollar exchange rate is defending support located approximately at 1.2075.

The Pound ultimately failed to capitalise on weakness in the Euro that followed Thursday's European Central Bank (ECB) policy decision to maintain interest rates at unchanged levels, a decision some economists we follow say is proof the central bank has completed its rate hiking cycle.

Although the ECB said it was willing to raise interest rates again in the future, owing to uncomfortably high inflation, it did emphasise the sharp fall in inflation recorded in September.

"We remain of the view that the ECB has over-tightened and expect the Euro area to fall into recession this quarter or next. As a result, we expect the ECB to begin cutting rates sooner and more aggressively than current market pricing," says Salman Ahmed, Global Head of Macro and Strategic Asset Allocation at Fidelity International.

The Pound-Euro spiked as high as 1.1505 following the decision, before retracing to close back at 1.1480. This disappointing price action mimics Tuesday's spike to 1.1516, which was rejected, resulting in a slump back to 1.1482.

Above: GBPEUR at daily intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound-Dollar exchange rate meanwhile remains vulnerable to to fresh lows owing to the broad-based strength of the Dollar, which has been boosted by a host of factors, including shaky global investor sentiment, rising U.S. bond yields, rising oil prices and an outperforming domestic economy.

Economic outperformance was reinforced on Thursday with the release of above-consensus U.S. GDP numbers for the third quarter, which showed the economy expanded 4.9%, defying investors' expectations for an increase from 2.1% in Q2 to 4.3%.

The Dollar didn't capitalise on the numbers for two reasons: firstly, much of the U.S. economic outperformance narrative is already baked into the value of the Dollar, and secondly, economists see some one-off factors at play and warn there is a high likelihood of negative growth in the final quarter of this year.

Above: GBPUSD at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

"We expect significant payback in Q4 following the exceptional strength in Q3, with a high likelihood of an outright decline in GDP," says Bill Diviney, an economist at ABN AMRO.

As a result, the Pound-Dollar managed to close the day with a modest advance of 0.14% to 1.2126, and remains supported at the time of writing at 1.2137.

Despite the tentative gains, Pound Sterling hasn't been able to overturn the losses against the Dollar experienced earlier in the week and can't close above 1.15 against the Euro.

An assured rally is unlikely to transpire ahead of next week's Bank of England decision, which will potentially result in another 'dovish' outcome for the Pound.

The Bank is universally expected to keep interest rates unchanged at 5.25% given an ongoing decline in inflation and will be keen to emphasise that rates will stay at current levels for an extended period.

But when a central bank says something and fails to back these words with actions, the message can sound hollow, and this is the main downside risk for the Pound next week.

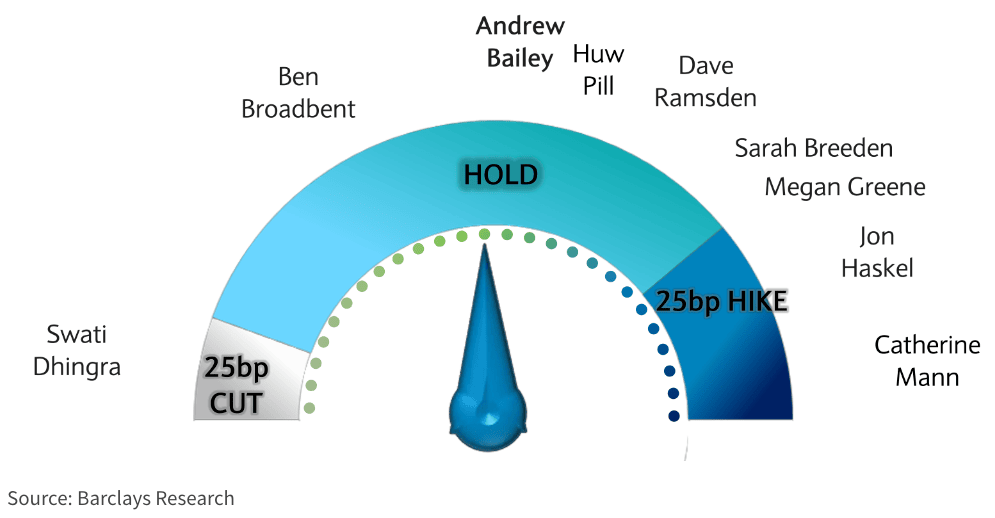

For example, the Monetary Policy Committee will probably see fewer votes for another rate rise (potentially two votes), with the majority voting to keep rates unchanged. But, one member (Dhingra) could already vote for a rate cut.

Dhingra is no fan of high interest rates and will be the first to advocate for a rate cut; therefore, she will immediately undermine the 'higher for longer' narrative that the rest of the MPC is trying to curate.

"We think the case for a pause is strong and will win out for the majority bloc of the committee, leading to a three-way split vote with Dhingra on one end and Mann and Haskel on the other," says Jack Meaning, an economist at Barclays.

In fact, a vote for a cut would be the first signal from any major central bank that cuts are now actively being discussed.

This will almost certainly undermine the Pound given the likes of the Federal Reserve and European Central Bank simply refuse even to countenance such a move.

Elsewhere, the composition of forecasts released in the monetary policy report will be important. Cuts to growth and inflation forecasts are expected by economists we follow.

Such predictions could signal the Bank of England is confident it has done enough to bring inflation under control and that it has the luxury of considering rate cuts as early as the first half of 2024, much earlier than current market expectations suggest.

Herein lies the danger for the Pound: if the market brings forward these expectations, expect significant downside over the coming weeks.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes