Pound Sterling Outlook Stabilises as the Gap Between Fantasy and Reality on Rate Hike Expectations Closes

- Written by: Gary Howes

Image © Adobe Stock

The Pound initially fell in the wake of the Bank of England's decision to hike Bank Rate to the highest level in 15 years but it soon recovered as market expectations for further interest rate hikes converged with the Bank of England's guidance as to how many more it would likely deliver.

Investors scaled back ambitions for the peak in Bank Rate to just below 5.75%, closing the gap between expectation and reality and easing downside risks for the British Pound in the process.

The Bank's forecasts and statement suggest it will likely be a case of 'one more and done' at Threadneedle Street, something the market is close to accepting.

The prospect of a pause or end to the hiking cycle by November has increased, says Christopher Graham, an economist at Standard Chartered. "The BoE is not yet done with its tightening cycle, but we are entering the final stretch."

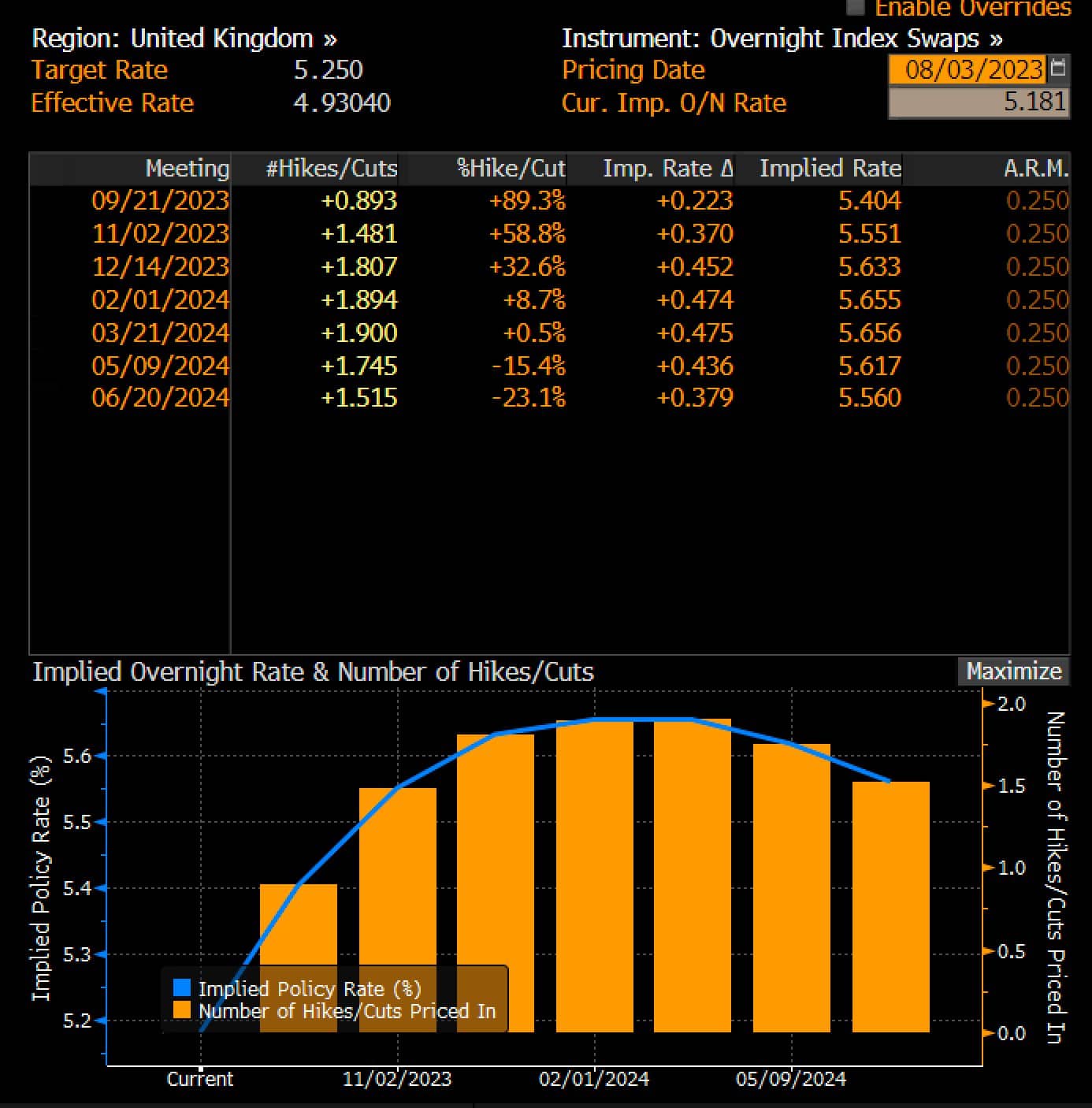

Money markets show investors are now priced for approximately 30 basis points of further increases, which suggests a September hike is seen as a definite and November a maybe.

This matters for the Pound which tends to track market expectations for Bank Rate: the 2023 highs in the Pound to Euro and Pound to Dollar exchange rates of mid-July reflected a market that was expecting an eye-watering peak in Bank Rate just above 6.5%.

The subsequent pullback in Pound Sterling reflects a deflation in these fantastical expectations to the current ~5.65%.

The question for the Pound is whether expectations can fall further, or whether the convergence with reality has played out.

The Bank's guidance from the August Monetary Policy Report suggests market expectations have come down to realistic expectations and hints the Pound could find itself better supported. It said it was confident inflation would fall sharply over the remainder of the year but Governor Andrew Bailey said in a press conference following the decision that wage pressures remained a concern.

The evidence on inflation and wage dynamics, therefore, suggests at least one more hike is likely from the Bank, even if the final resting point is coming into view.

The market sees less the two more hikes, but even investment banks with a bearish view on the Pound - such as Citi - reckon two more hikes are possible from here. This could even imply the markets can take expectations a little higher, offering the Pound some support.

Image: @EdConwaySky

"We have argued that GBP was looking stretched on the upside in mid-July and have expressed a tactically bearish view on the currency versus NOK in recent weeks. But some of the hawkish elements below the surface of today’s decision may limit excessive downside in the currency from here," says Dominic Bunning, Head of European FX Research at HSBC.

It is easy to see why the Bank is now data-dependent, there are pockets of good and bad news in the data with new projections in the Monetary Policy Report arguing for and against further hikes.

On the positive side, the Bank raised its growth forecast for this year to 0.5%, double its last update in May of 0.25%, but lowered its outlook for subsequent timeframes.

Inflation, currently at 7.9%, is expected to end this year below 5% and move inside of 2% by 2025.

"Current policy was seen as restrictive which says we are close to the peak in rates. Much will depend on the data going forward, with the bank now evidence-driven," says Jamie Dutta, Market Analyst at brokers Vantage.

But further hikes are likely given the nature of the labour market, which is considered to still be tight and therefore consistent with further 'sticky' core inflation.

"The tone of the press conference was arguably more dovish when inflation was being discussed and more hawkish on wage pressures," says Graham.

Could the Bank surprise and not hike again? This is of course possible, but we would likely need to see an incredible downshift in inflation when the next set of statistics are released on August 16.

Julian Jessop, Economics Fellow at the Institute of Economic Affairs, says the Bank has already gone too far and should have already left rates unchanged.

"Money and credit growth have already slowed sharply and other leading indicators of inflation have weakened, including commodity prices and evidence from business surveys," says Jessop.

He compares the UK economy to a frog slowly being cooked by ever-higher interest rates. "By raising the temperature further now, the Bank risks doing too much and, once again, only realising its mistake when it is too late."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes