Bank of England Delivers 14th Consecutive Rate Hike, Pound Recoups Initial Knee-jerk Losses

- Written by: Gary Howes

Image: Bank of England. Licensing: 2.0.

The British Pound tracked bond yields and fell in a knee-jerk reaction to the Bank of England's decision to raise interest rates by 25 basis as it downshifted from the 50bp hike of June, and released guidance that analysts say veers towards the 'dovish' side.

But the Pound soon steadied and corrected itself as there were enough 'hawkish' elements to the Bank's guidance to maintain expectations for one, or even two, more interest rate hikes.

These include upgrades to economic growth and inflation forecasts, suggesting another hike in September is likely.

The kneejerk move lower was anticipated by analysts, some of whom also reckoned weakness would be shortlived given the Bank will likely out hike peers in the Eurozone and elsewhere. "A 25bp delivery risks a near-term outcome of lower GBP," said Brauten-Smith, Kristian Brauten-Smith, an FX trader at Goldman Sachs, "but we believe this will be short-lived."

The Pound to Euro exchange rate fell as low as 1.1556 in the wake of the Bank's decision, before paring the advance back to 1.16, suggesting Sterling's ship steadied somewhat as traders grasped the full implications of the guidance.

The Pound to Dollar went as low as 1.2620 before correcting to 1.27.

It does appear that the Bank will hike interest rates again in September given the Monetary Policy Committee vote breakdown erred to the 'hawkish' side in that two members voted for a 50bp hike.

Only one member voted for a 25bp move; if more members had voted for a hold we would sense that the Monetary Policy Committee (MPC) was closer to hitting the pause button.

Above: GBPEUR tracked two-year bond yields lower following the BoE decision.

"There were still some elements of hawkishness in the vote split, the statement, and the forecasts," says Dominic Bunning, Head of European FX Research at HSBC. "Some of the hawkish elements below the surface of today’s decision may limit excessive downside in the currency from here."

The steady sell-off in the Pound from its recent highs over recent days nevertheless reflects some easing in expectations for a peak in Bank Rate, with the move extending after the Bank acknowledged "the current monetary policy stance is restrictive" owing to "the significant increase in Bank Rate since the start of this tightening cycle."

"Relatively dovish 25bp hike from the BoE. Firmly data dependent in signalling the outlook. Amplifies the importance of CPI print on 16 August & signs of cooling wage inflation. The vote to (possibly) increase the pace of APF Gilt sales in September could provide basis for a pause," says Simon French, Chief Economist and Head of Research at Panmure Gordon.

Above: The August MPR inflation forecast profile. "We expect inflation to fall further this year and meet our 2% target by early 2025" - Bank of England.

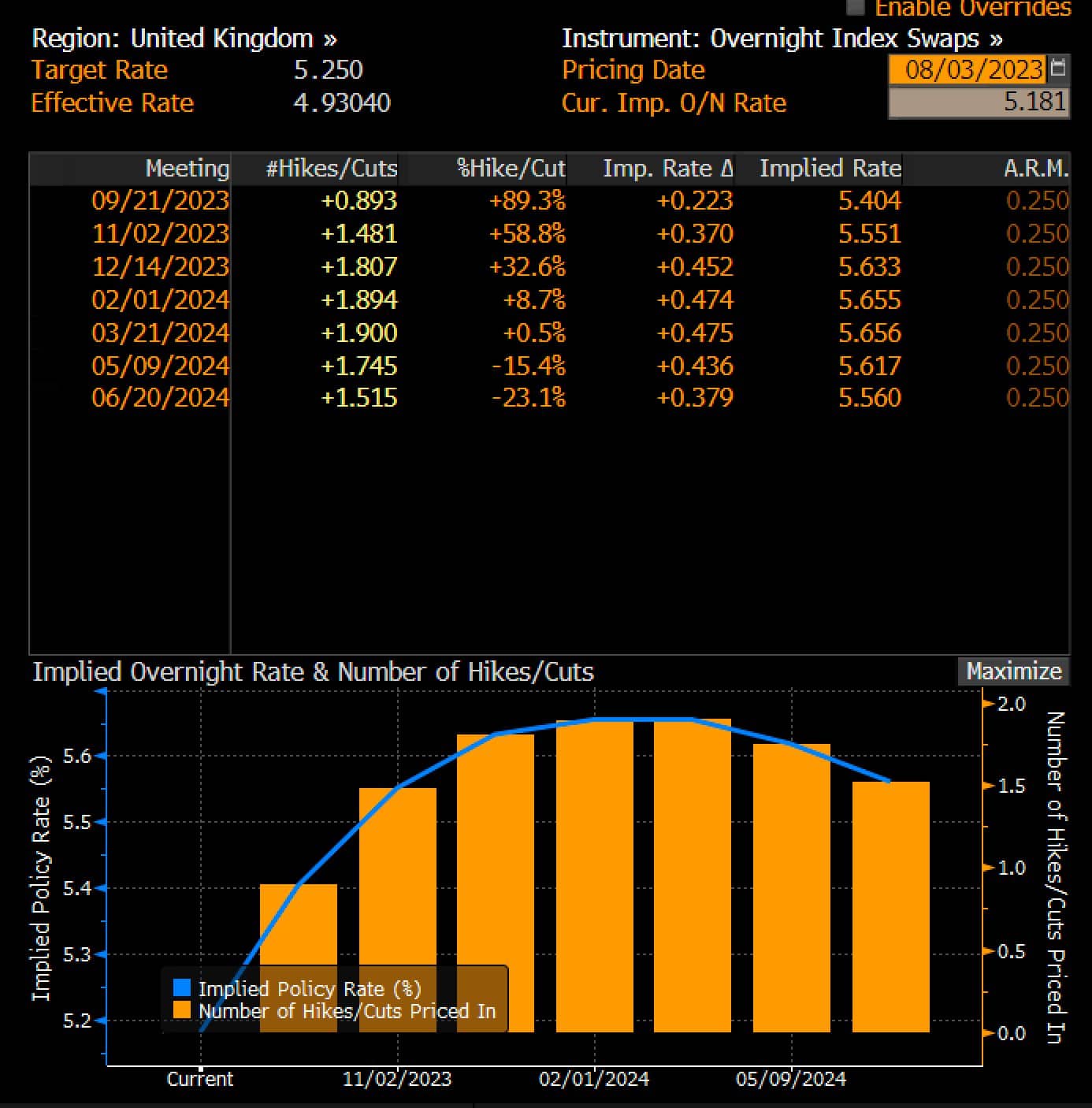

Expectations for the number of hikes yet to come declined after the Bank said it expects CPI inflation to fall "significantly further, to around 5% by the end of the year," while projections contained in the Monetary Policy Review showed a return to the 2.0% target in three years based on the market's expectations for a couple more hikes.

Twelve-month CPI inflation fell from 8.7% in May to 7.9% in June, which the Bank acknowledges was lower than expected at the time of the Committee’s previous meeting.

"It's perhaps a little astonishing that, with inflation sitting at 7.9%, the Bank of England has managed to sound somewhat dovish today," says Seema Shah, Chief Global Strategist at Principal Asset Management. "Clearly the weaker-than-expected June inflation number has strongly influenced the Bank’s decision to hike by just 25 basis points rather than the 50 basis points, although the three-way split in voting suggests that there are still a couple of hawks who are very concerned by the extremely elevated inflation numbers."

The Bank does however remain concerned wage settlements are still inflationary, noting annual private sector regular pay growth increased to 7.7% in the three months to May, materially above expectations at the time of the May Report. Another strong wage report in August would therefore likely cement a September hike.

Above: Market implied expectations for the peak in Bank Rate have fallen back below 5.75 after the August decision. Image: @EdConwaySky

The Monetary Policy Report shows Bank economists meanwhile no longer expect a recession, "reflecting more resilient household income" although they foresee three years of flat growth.

"New forecasts imply further tightening is likely, but the peak level of Bank Rate is near," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Pantheon Macroeconomics thinks the MPC will raise Bank Rate by 25bp in September and that this will be the last increase in this tightening cycle.

If correct, this means market-implied expectations for the peak in Bank Rate must fall a little further, which would weigh on UK bond yields and Pound exchange rates. However, with the peak for Bank Rate now seen at just below 5.75% by the market, the gap for downside corrections is materially more limited than was the case earlier in July when the peak was seen above 6.5%.

This suggests downside potential for the Pound, based on a recalibration lower of Bank Rate expectations, is more limited from here.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes