Increase in New Orders at UK Businesses Boosts Pound Sterling

Above: Firms in the UK services sector - which includes restaurants - report a pick up in new business in January which has boosted GBP. Image (C) Pound Sterling Live 2015.

The British pound is strong in the mid-week session after it was reported a third of UK service sector companies reported a rise in new work in January.

The much-watched services PMI (Jan) read at 57.2; analysts had forecast a reading of 56.3 - well ahead of the previous month’s figure of 55.8.

The above-expectations Services PMI follows similar positive surprises from the Manufacturing and Construction PMI sets.

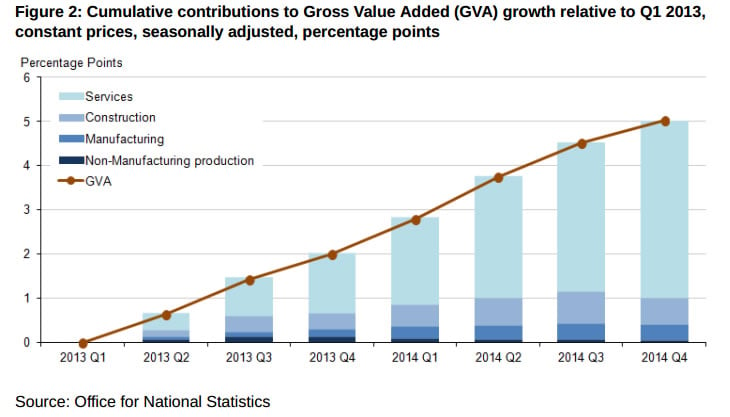

Over the course of the two previous days we have seen sterling show an immunity to the positive data; however the service sector accounts for 70% of the UK economy and as such was always the more important of the three.

Markit and the CIPS, who compile the service PMI series, report that new business received by UK service

sector companies increased at a marked and accelerated pace in January.

Nearly 30% of the survey panel recorded a rise in new work, with companies commenting that demand was strong in line with a positive business environment.

This confirms to us that the UK’s economic growth trajectory remains solid and should underpin the UK currency moving forward.

Andy Scott at foreign currency specialists, HiFX, says:

“The services sector saw a stronger than expected bounce back in activity growth in January, from a 17-month low in December, easing concerns that the economy was slowing sharply.

“This reading is always closely watched as it provides a fairly reliable indicator for overall GDP growth, which is currently tracking just above the fourth quarter’s 0.5% pace based on January’s reading.”

British Pound Outlook is Bright

We are seeing the pound firm against the euro, however it remains well below its 2015 highs at 1.3248.

The sterling / dollar exchange rate is meanwhile trading well above its support zone at 1.50 and is now approaching 1.52.

“GBP/USD is edging higher on the back of the services PMI. Key resistance seen around 1.5200/20 - short term bias bullish above here,” say Forex.com.

According to Kathy Lien at BK Asset Management longer-term strength in GBP can be expected:

“Regardless of whether the BoE chooses to tighten this year, these recent reports refute the need for easing which alone helps the BoE stand apart from all of the other central banks that have recently taken steps to increase stimulus. In terms of our outlook, this means we are looking for additional strength in GBP/AUD, GBP/CAD and a reversal in EUR/GBP.”