Low Oil Prices Boost UK Factories but GBP Remains under Heavy Selling Pressure

Image © Pound Sterling Live 2015.

The pound sterling complex (GBP) was sold at the start of the new month despite consensus-beating UK factory data being released.

"Sterling is still at delicate levels against the dollar, at just above GBP/USD 1.5000, and has dropped back against the euro from EUR/GBP 0.74 to 0.75," notes Asmara Jamaleh at Intesa Sanpaolo:

For the time being, the release of strong manufacturing PMI has had no supportive effect on sterling, despite the stronger than expected improvement.

UK Factories Boosted by Lower Oil Prices

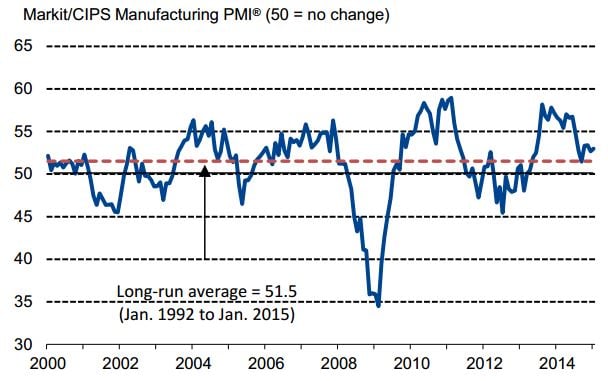

The seasonally adjusted Markit/CIPS Purchasing Manager’s Index (PMI) rose to 53.0 in January, higher than December’s revised reading of 52.7.

Currency markets had predicted a reading of 52.6 would be announced and the news saw an initial rally in GBP.

Analysts note the impact of softer oil prices is starting to feed through to industrial output.

“The big mover during January was the trend in purchasing costs, as the recent slump in oil prices fed through to the steepest drop in input costs since May 2009,” says Rob Dobson, Senior Economist at survey compilers Markit.

Dobson continues:

“The domestic market remains the main growth driver, as the UK economic recovery provides a steady stream of new business.

“There were also signs of improvement in overseas markets, with new export orders posting the first meaningful gain for five months, but it still looks as if lacklustre demand from the eurozone in particular remained a headwind for British manufacturers.”

Services PMI, Bank of England Decision Ahead

The Pound's challenges for this week include the Bank of England interest rate and QE announcements.

"I doubt any change will come from that but we also have the purchasing manager’s index from the UK manufacturing sector today and a British Retail Consortium report on Wednesday. Neither is hugely market-moving but we expect the data to be mildly positive," says David Johnson at currency brokerage Halo Financial.

All eyes will be on next week’s Inflation Report (IR - Thursday, 12 February).

At current exchange rate levels, the market is not pricing in an initial bank hike this year, therefore any downward revisions of growth and/or inflation forecasts in the IR risk further weakening the pound.

However, if over the following months the UK economy delivers, the BoE may be ready to kick off the process of normalising rates towards the end of the year.

Pound Dollar Exchange Rate at Key Support

The sell-off in the GBP confirms technical levels and external drivers are a big concern for the UK currency at the present time.

Of particular interest is the 1.50 support level in GBP/USD, which if broken, will likely prompt a more aggressive sell-off.

According to Ipek Ozkardeskaya at Swissquote Research:

"GBP/USD remains weak as long as prices remain below the key resistance at 1.5274.

"A support stands at 1.4952. Another resistance is given by the down trendline (around 1.5381), whereas a strong support lies at 1.4814.

"In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5274 (06/01/2015 high, see also the declining trendline).

"A full retracement of the 2013-2014 rise is likely."