Bailey Addresses Pound Sterling Meltdown, Losses Against Euro and Dollar Now in Excess of 1.5%

- BoE's Bailey addresses GBP slump

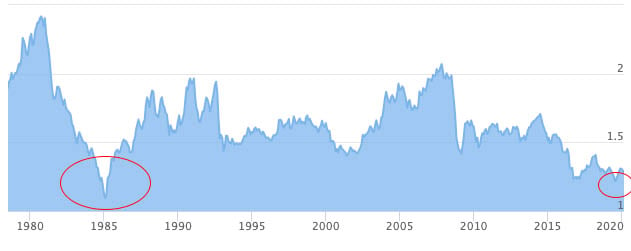

- GBP/USD crashes to 1985 lows

- GBP/EUR plummets into 1.08s

- BoE tipped to announce new quantitative easing

Image © Adobe Images

- If you would like to talk to a foreign exchange specialist about the current slump in Sterling, please get in touch with our partners at Global Reach here.

The British Pound has plummeted to its lowest level against the U.S. Dollar since 1985 as a sell-off that started in late February continues virtually uninterrupted, but the move has caught the attention of the new Bank of England Governor Andrew Bailey.

The Pound-to-Dollar exchange rate has fallen to a daily low at 1.1762; the lowest level since 1985, if you were to exclude the lows around 1.14 recorded during a technical flash crash in October 2016.

The sell-off in GBP/USD has been mirrored by losses in Sterling against a host of other currencies, with the Pound-to-Euro exchange rate plummeting to a low of 1.0780, its lowest level since August 2019.

Bank of England Governor Andrew Bailey has today said the Bank is currently watching Sterling "very carefully", taking note of the current fall which will be addressed at the March 26 Monetary Policy Committee Meeting.

Bailey said there is no "single story" for the Pound's decline.

"Sterling is being shunned for a variety of factors, including heightened demand for the highly liquid greenback and expectations that the new-look Bank of England may unveil bolder monetary measures next week, like QE, to ease the economic blow from the coronavirus. The market has priced a more than 33% chance of new BOE Gov. Andrew Bailey cutting interest rates to zero on March 26 from 0.25% currently," says Joe Manimbo, Foreign Exchange Analyst at Western Union.

Despite Bailey's comments, we believe there is very little the Bank of England can actively do to defend Sterling, particularly when the scale of the forces working against it are so substantial.

"The Pound has fallen to its lowest level against the U.S. Dollar since 1985. An SOE country with a large external trade deficit requires funding via capital inflows. In a sudden stop of global capital flows - the currency adjusts to offset the lack of inflows. Can't fight this," says Viraj Patel, FX and Macro Strategist at Arkera.

The Bank of England is likely to announce a new round of quantitative easing (QE) at their next meeting, designed to inject further capital into the UK financial system as the UK economy battles with the coronavirus outbreak.

Quantitative easing involves the printing of money to buy government and corporate bonds, but a side effect of the programme is a weaker Pound and we believe the currency has suffered notable losses in value as markets prepare for the Bank's next moves.

"We expect the BoE to cut interest rates 15bp to their effective lower bound probably before their 26 March meeting, or otherwise at that meeting. With 10y yields 20-30bp above that lower bound, and the government potentially needing a much larger fiscal expansion, there may now be some point in gilt QE," says Robert Wood, UK Economist, Bank of America Merrill Lynch.

Gilt QE refers to the purchase of UK government debt - known as gilts - via the Bank of England's quantitative easing programme.

Following the previous programme of quantitative easing that went through until August 2016, purchases of government bonds now totals £435 billion.

Kamal Sharma, FX Strategist at Bank Bank of America Merrill Lynch says another round of quantitative easing at the Bank of England would present significant downside pressures on the value of the Pound.

"With Brexit having already compromised the UK's external trade position, the reintroduction of QE and the inevitable slide in UK yields will place further strains on the funding of the deficit," says Sharma.

The UK runs a sizeable and persistent current account deficit that ultimately stems from the country importing more than it exports. A sizeable portion of Sterling's longer-term valuation has therefore relied on the steady inflow of investment from foreigners who seek to take advantage of the UK's attractive investment climate.

However, this reliance on investor flows can become a source of weakness for Sterling when global investor sentiment is compromised, as is the case with the coronavirus outbreak.