The Pound vs. Euro 5-Day Forecast: Support at 1.1200 Eyed as Bears Strengthen their Grip

Image © Adobe Images

- GBP/EUR to probably fall a little way lower

- After hitting 1.12 a number of possibilities exist

- Pound to be driven by Brexit news and PMIs

- Euro by inflation and retail sales

Pound Sterling starts the new week on a slightly firmer footing, with traders likely to keep an eye on the Conservative Party's conference taking place in Manchester for any fresh steers on how the Government intends to deliver Brexit by October 31.

With this in mind, Prime Minister Boris Johnson's speech on Wednesday will form a highlight for the coming week.

Until then, technical considerations might be in charge of the Pound-to-Euro exchange rate, which is trading at around 1.1244 on Monday. The pair fell 0.75% in the previous week, and studies of the charts indicate that limited near-term weakness is likely, but the outlook on longer-term timeframes is more uncertain.

The 4 hour chart - used to determine the short-term outlook, which broadly means the coming week or next 5 days - shows the pair falling within a longer-term rising channel.

The next potential downside target is at 1.1200 and the level of the lower trend channel line. From there anything is possible - the pair could mount a recovery within the confines of the channel or try to break lower out of it.

We would look for a break either above the 1.1381 September 20 highs for confirmation of more upside, or a break below the 1.1145 level for confirmation of more downside.

The next upside target lies at the key 1.1500 level whilst the next downside target at 1.1070.

The RSI momentum indicator in the lower pane is mirroring the decline providing supporting evidence.

The daily chart shows how the pair has pulled back after touching resistance from the 200-day Moving Average (MA) at 1.1320.

The move down will probably continue until it reaches support from the lower channel line at 1.1200. After that, it could go either higher or lower as explained on the 4hr chart above.

A break down to support at 1.1070 is a possibility but after that further downside may be stymied by support from the 50-day MA.

If it trends higher, however, there is a heightened chance it could pull-back for a breather after reaching 1.1500.

The daily chart is used to analyse the medium-term trend, which is the next week to a month of price action.

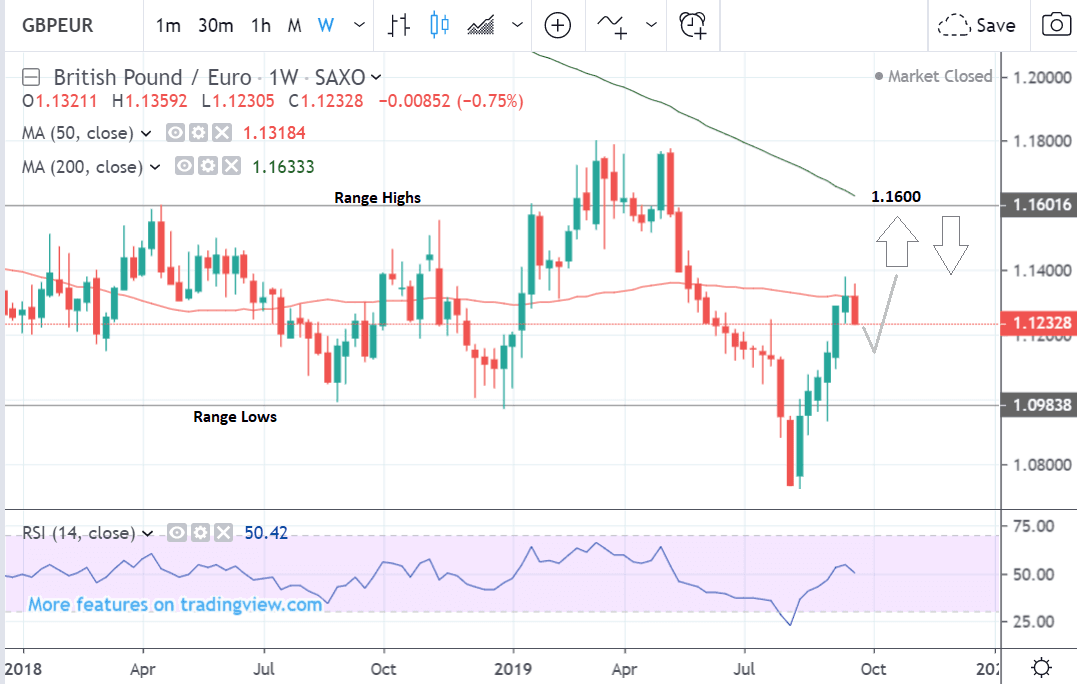

If we step back further and take a look at the weekly chart, which gives us a long-term overview, we see the GBP/EUR exchange rate has pulled back after touching the 50-week MA (red line).

It may be that the weakness we are witnessing is merely a 'correction' within a steep up-move.

The RSI momentum indicator is also peaking and rolling over further supporting the idea the pair may be about to correct.

There is a chance it could pull-back down to the 1.10s as described on the 4hr and daily charts and after that resume moving higher again, to an eventual target at the top of the range, at 1.1600.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Pound: What to Watch

The main drivers for Sterling in the week ahead are the unfolding Brexit drama and PMI data.

The main risk to the Pound is that the government strengthens its position on taking the UK out of the EU on October 31 regardless of whether a deal is in place or not.

In reality, this would involve them finding a loop-hole around the so-called Benn Act - the law forcing it to seek an extension to the Brexit deadline if it does not have a deal by October 19.

The Observer on Sunday reports one law the government could invoke to get around the Benn Act is the Civil Contingencies Act 2004, which grants it special powers in the event of a national emergency to override parliament.

Another loophole would be that highlighted this week by John Major whereby the Government uses an ‘Order of Council’ to suspend the law, something which would not require the approval of either lawmakers of the Queen. Such a move, however, would be heavily criticised and almost surely challenged in the courts.

If either of these courses were taken in the week ahead they would have extremely negative knock-on effects for the Pound. However, we regard chatter of these methods as being highly speculative and therefore unlikely.

We feel the more pertinent story will come out of Parliament, which also has options which would impact on the Brexit saga in the coming week.

The first would be to bring a vote of no-confidence in the government, however, lawmakers are split on who should lead any possible care-taker government, with the Labour party and the SNP supporting a Corbyn-led government, but the Liberal Democrats and rebel Conservative MPs against the idea.

Another possibility is that a figure which is agreeable to everyone is appointed as caretaker PM instead.

A vote of no-confidence would bring a lot of uncertainty with unclear effects on the Pound, although initially, it might weaken it. It could raise the risk the UK could drop out of the EU anyway simply due to the clock ticking down in the midst of the political vacuum which would temporarily ensue during the wait for a general election.

One positive potential outcome for the Pound would be if the government managed to finally agree a deal with the EU and this is more possible given increased willingness on both sides to return to the table.

There is a possibility that the government’s recent proposals to solving the problem of the Irish backstop may be published in the coming week and these may also impact the Pound. If the proposals look workable Sterling could rise strongly.

"Sterling has room to recover if the Brexit situation moves towards a “deal outcome”, but a delay of the Brexit deadline to January or a snap election in the UK could push back the GBP rally into 2020," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan. "Caution still prevails regarding a possible agreement and at the same time the risk of a snap election in the UK remains."

On the data front, the main releases for the Pound are PMI data - survey-based leading indicators for the economy.

Manufacturing PMI for September is expected to show a decline to 47.0 from 47.4 when it is released on Tuesday, at 9.30 BST.

Services PMI for September is forecast to show a fall to 50.3 from 50.6 when it is released on Thursday, at 9.30 BST.

Construction PMI is estimated to show a show a decline to 44.9 from 45.0 when it is released on Wednesday, at 9.30 BST.

A lower-than-expected result would put pressure on the Pound and vice versa for a higher result.

This is especially true following recent comments from Micheal Sauders, an official at the Bank of England (BOE), who said the BOE may need to lower interest rates to help offset a slowdown in the economy.

Lower interest rates normally depreciate the local currency because they attract less money from foreign investors looking for somewhere to park their capital.

The Euro this Week: Inflation Data

The main data releases for the Euro in the week ahead are September inflation data on Tuesday and retail sales on Thursday.

Inflation dictates central bank interest rates which are highly correlated to currency strength, so Eurozone CPI data on Tuesday at 10.00 BST has the potential to move markets.

It is expected to remain unchanged at 1.0% in September, with core inflation - which cuts out volatile food and fuel components and is thus a better gauge of demand - expected to rise to 1.0% from 0.9%.

If inflation rises more than expected it will support the Euro but if it declines more than expected it will weaken the currency.

Lower interest rates are negative for a currency because they make it less attractive to foreign investors looking for somewhere to park their capital.

The other main release for the single currency in the week ahead is retail sales which is forecast to show a 0.3% rise from -0.6% previously when it is released on Thursday at 10.00 BST.

A higher than expected reading should be taken as positive for the Euro, while a lower than expected reading should be taken as negative for the Euro.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement