Pound Sterling Losses Extend: SNP say Ready to Back Corbyn Govt., Bank of England's Saunders Warns of Rate Cuts

Above: Michel Barnier. File Image © European Union , 2018 / Source: EC - Audiovisual Service / Photo: Mauro Bottaro

- Sterling sell-off extends as London markets open

- SNP could back an interim Corbyn Govt.

- BoE's Saunders helps underpin Sterling weakness

- Negotiations to continue in Brussels today

- Johnson urged to ditch hardline approach with EU

- Barclays say 'no deal' is their base-case expectation

The British Pound is under pressure against the Euro, Dollar and other major currencies ahead of the weekend with market's continuing to shed exposure to the UK currency in an environment of increasing political uncertainty and deepening divisions over Brexit.

The currency was meanwhile not helped by comments from Bank of England MPC member Michael Saunders who said today an interest rate cut at Threadneedle Street might be warranted, even in the event of a 'no deal' Brexit.

Saunders, an external member of the MPC, which sets interest rates at the Bank of England, said Friday an ongoing global slowdown and "persistently high uncertainty" over the likely outcome of the Brexit saga are now weighing heavily on the UK economy and that it might soon be appropriate to cut borrowing costs for companies and households as a result.

"The economy could follow very different paths depending on Brexit developments. But in my view, even assuming that the UK avoids a no-deal Brexit, persistently high Brexit uncertainties seem likely to continue to depress UK growth below potential for some time, especially if global growth remains disappointing. In such a scenario – not a no-deal Brexit, but persistently high uncertainty – it probably will be appropriate to maintain an expansionary monetary policy stance and perhaps to loosen further," Saunders said.

"The FTSE 100 is surging higher amid a sharp decline in the Pound, with comments from BoE hawk Saunders signalling the potential for a rate cut even before the Brexit deal has been resolved," says Joshua Mahony, Senior Market Analyst at IG. "While Sterling traders have typically been bullish when no-deal Brexit fears recede, it is also evident that this huge uncertainty is not helping the economy. His comments highlight the economic impact of any Brexit extension beyond October and marks the completion of a huge reversal BoE rhetoric."

On the political front, heavy fog rests on the horizon ensuring traders will likely maintain a defensive attitude towards Sterling.

Markets are digesting news that Scotland's SNP could back an interim government under the leadership of Jeremy Corbyn in order to prevent a 'no deal' Brexit.

A source close to the SNP leadership tells ITV's Robert Peston that Ian Blackford, leader of the SNP in Westminster, and Nicola Sturgeon, Scotland's First Minister, are deeply concerned that it may now be impossible to prevent a no deal Brexit unless Boris Johnson is removed from office.

"It is increasingly clear that we will have to install a new prime minister via a vote of no confidence, so that we can request a delay to Brexit and hold an election. The convention is absolutely clear that it is the leader of the opposition - in this case Jeremy Corbyn - who should become prime minister in those circumstances," the source is reported to have said.

The developments suggest Prime Minister Boris Johnson could soon be defeated in a vote of no-confidence and find himself replaced by remain-leaning coalition. However, hurdles to such an outcome include the plethora of independent MPs and the Liberal Democrats whoes leader Jo Swinson said any agreement must exclude Corbyn.

The establishment of a caretaker Governmnet might offer Sterling temporary support as the near-term threat of a 'no deal' would certainly be avoided. But the longer-term implications are harder to call, as it could shake up the voting public ahead of any expected General Election. The outcome of that vote should give clearer guidance as to the direction of Brexit, and therefore ultimately Sterling.

"With the many twists and turns in the Brexit saga, we see downside risks for GBP with the clock still ticking towards 31 October," says Daragh Maher, Head of FX Strategy at HSBC. "GBP will be caught between the opposing forces of a 'no deal' Brexit risk and another possible Article 50 extension."

The Pound-to-Euro exchange rate is currently quoted at 1.1254, having been as high as 1.1379 earlier in the week. The Pound-to-Dollar exchange rate is meanwhile currently quoted at 1.2284, having been as high as 1.2502 earlier in the week.

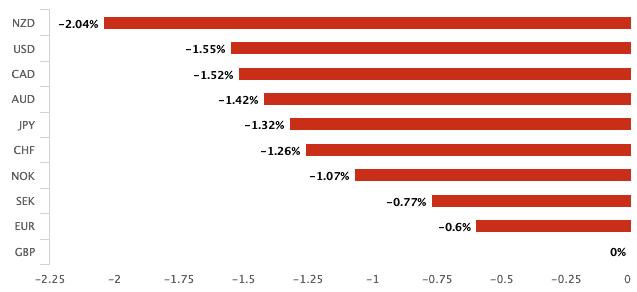

The Pound is down 0.77% against the Euro and 1.55% down against the Dollar this week. In fact, Sterling is the worst-performing major currency of the past five days:

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Pound's retreat from recent highs suggests to us the Brexit pendulum is swinging back to a 'no deal' following the recent weeks of optimism driven by 1) Parliament effectively outlawing a 'no deal' and 2) signs of compromise by the EU in order to strike a revised Brexit deal.

The return of Parliament this week, following the Supreme Court judgement, has however exposed the deep divides in Parliament, and there is an argument to be made the the required cross-party consensus for any Brexit deal to be passed might have evaporated.

Heated exchanges in Parliament have lead some commentators to suggest that those Labour MPs, and independents, the Conservatives would require to help pass a deal will now be notably fewer in number.

Striking a Brexit deal now appears to be Prime Minister Boris Johnson's only 'clean' route to delivering Brexit by October 31 as the Benn Act, passed by Parliament in early September, legally requires the Prime Minister to request another Brexit delay in the event of the deal failing to pass through Parliament.

Pressure on Johnson to yield to the EU and seek a compromise is apparently coming from within his own cabinets according to reports out on Friday.

According to Tom Newton Dunn, Political Editor at The Sun, three different Cabinet ministers are now prepared to confront Johnson and demand he abandons the current “aggressive” negotiating strategy and insist he accepts the EU’s last minute offer.

"We’re never going to beat the numbers in the Commons, and they are against us," one Cabinet source told Dunn, “the PM has to lean in now and take what he can get. Being aggressive doesn’t work, the Cummings plan has clearly failed."

Of course these reports are yet to be substantiated and will ultimately be borne out of any final deal the EU and UK reach on October 17.

Pound Sterling tends to climb whenever expectations for a Brexit deal rise, and we would expect any apparent softening in the UK's position to prove helpful.

However, the political environment is fraught with difficulty for Johnson as he knows any apparent capitulation to the EU will fire up support for the Brexit Party once more, which would ultimately see the Conservatives put out of power in the election that is expected in coming months.

As such, we would be inclined to believe that Johnson sticks out his current strategy, further committing to leave the EU on October 31.

"There’s a lot of noise of course and all the chatter is about MPs’ use of language and how could Boris possibly still take the UK out of the EU by October 31st without a deal. The fact is he can and he intends to," says Neil Wilson, market analyst with Markets.com.

Indeed, in Parliament on Wednesday Johnson on numerous occassions said the UK is leaving the EU on October 31, something we believe has contributed to this week's losses in the currency.

Sir John Major thinks he has found No 10's cunning plan to get round the Benn Act, to leave the EU on time even without a deal - you might hear a lot about 'orders of council' in the next few days ... https://t.co/70IoQqHRLw

— Laura Kuenssberg (@bbclaurak) September 26, 2019

Market focus will today fall on any updates following the meeting of UK Brexit Secretary Stephen Barclay and EU chief negotiator Michel Barnier.

As is customary, we expect a press briefing to occur after the meeting, and we would expect any surprises to potentially have a bearing on Sterling ahead of the weekend.

Various reports and briefings out over the course of the past week suggest that the two sides are still some way apart following the latest UK proposals on how to solve the Irish backstop issue.

Indeed, we would fully expect negotiations to go 'down to the wire' and this therefore puts the October 17 European Council meeting in the spotlight and would be surprised to hear of any positive, or negative, developments coming out of today's negotiations.

Barclays Expect 'No Deal' Outcome, See Weaker Sterling Ahead

"There is some serious risk that GBP declines from here into the middle of October on the uncertainty and heightened risk of no deal. This would then be the make or break moment – extension agreed and we easily pop back to 1.25, no deal and it’s down to 1.15 or even 1.10," says Wilson.

Indeed, this morning we report foreign exchange analysts at Barclays are forecasting notable declines in the Pound as a 'no deal' Brexit is their base-case assumption going forward.

"Brexit’s path has become immensely more complicated. While the Johnson Government’s intent to exit the EU at all costs on 31 October appears to have been thwarted by Parliament, there still are many paths to a no-deal Brexit and it remains, narrowly, our base case outcome," says Nikolaos Sgouropoulos, an analyst with Barclays.

Amid this high uncertainty Barclays "assume" that a 'no deal' Brexit takes place in the first quarter of 2020.

Such an outcome would trigger "significant dislocations on both sides of the English Channel" and analysts at the bank say they see the UK falling into a "shallow recession" despite expected fiscal expansion and easier monetary policy.

The negative impact on Sterling will be notable according to the bank's latest suite of forecasts.

"We expect a sharp depreciation in GBP to accompany the initial stages of a no-deal Brexit and forecast a low of 1.10 in cable and high of 0.97 in EUR/GBP," says Sgouropoulos.

EUR/GBP at 0.97 equates to a GBP/EUR exchange rate of 1.03.

"Once the initial uncertainty created by short-term dislocations clears, we believe the nearly 50-year low in the real effective value of GBP should attract significant long-term buyers and investment to an economy that still has many attractive attributes," says Sgouropoulos.

Forecasts show a partial rebound in the Pound vs. the Euro as a result, taking EURGBP back to 0.93 by third quarter 2020. This gives a GBP/EUR exchange rate of 1.0752.

The GBP/USD exchange rate is however forecast to only recover back to 1.11 by the third quarter of 2020.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement