The Pound Shows Nerves after Johnson Won't Commit to Asking for Brexit Extension

Boris Johnson, House of Commons, Sept.25. Still Courtesy of BBC News.

- Johnson won't committ to asking for Brexit extension

- Bitter divide in House of Commons lowers prospect of Brexit deal being agreed

- Political stalemate unhelpful to Sterling

The return of Parliament has coincided with a fresh bout of selling in the British Pound, with markets finding little by way of progress towards a resolution to the current Brexit impasse as heated exchanges between MPs exposes deepening divides.

If anything, risks of a notable decline in the currency on a 'no deal' Brexit have grown after Prime Minister Johnson told MPs on Wednesday night that he would not be asking for an extension to Brexit in the event Parliament fails to pass a Brexit deal on October 19.

Asked if he would abide by the terms of the Benn Bill - which requires the Prime Minister to ask for an extension of the EU in the event of a Brexit deal failing - the Prime Minister simply said "no."

"If he doesn't get a deal through this House, or a 'no deal' through this House, by 19 October, will he seek an extension from the EU to 31 January?" asked MP Ian Murray of Johnson.

"No," replied Johnson.

Johnson was asked numerous times by MPs whether he would comply by the legal requirement to secure another extension, and on no occasion did he indicate he would be prepared to break the law.

Johnson also said he would not break the law, which suggests he has a strategy that has not yet been revealed.

The Benn Bill - a law passed by Parliament forcing the Prime Minister to delay Brexit if he has not reached a deal with the European Union - appears to have loopholes Johnson is planning to exploit. "The bill is not perfect," James Duddridge, a Brexit minister, told parliament, citing in particular an amendment which said a delay to Brexit should be used to pass a Brexit deal based on the exit agreement reached by Johnson's predecessor Theresa May.

"The government believes it does have deficiencies and its effect is unclear," adds Duddridge.

"PM Johnson again and again repeated the message that the UK will leave on 31 October with or without a deal, like there were no legislation commanding the Government to ask for an extension unless there is a deal with the EU that can be accepted by the Parliament on 19 October," says Richard Falkenhäll, Senior Currency Strategist with SEB.

For foreign exchange markets, this all amounts to increasing uncertainty, and it is little wonder Sterling's recent run higher might have come to an end.

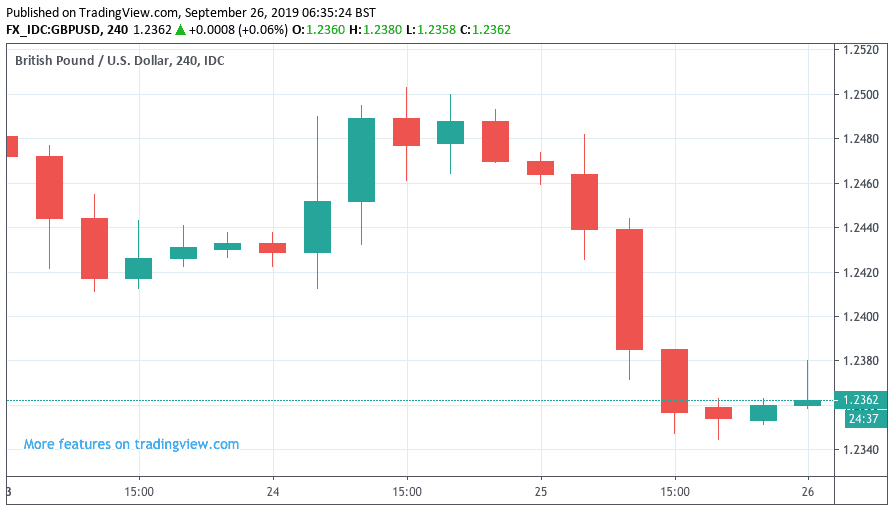

The Pound-to-Euro exchange rate is on Thursday quoted at 1.1285 after experiencing a 0.45% fall the day prior, the September high is up at 1.1380.

The Pound-to-Dollar exchange rate is quoted at 1.2368, following a sizeable 1.0% fall the day prior, the September high is at 1.2582.

"UK politics remains the centre of attention in sterling markets. While the pound was initially lifted by the Supreme Court ruling, it has settled lower again on market perceptions that uncertainties about outcomes remain high and all possibilities are still on the table," says Hann-Ju Ho, Economist with Lloyds Bank.

It appears Sterling might now have left its high-water mark, and we would be wary of further downside in the current environment as markets consider the non-neglible risks of a 'no deal' Brexit on October 31.

The Prime Minister's strategy to call for an early General Election has not worked, and he will double-down on delivering a new Brexit deal. However, judging by the acrimonious exchanges in the House of Commons on Wednesday it is difficult to see how any cross-party consensus can be achieved.

Therefore any deal that is struck with the EU at the October 17 European Council meeting will find itself unable to pass through the House of Commons.

Therefore, it rests to the Prime Minister to deliver on his pledge to exit the EU on October 31.

There is simply little insight into what might transpire, ensuring an environment in which markets will likely stay weary of Sterling.

"Sterling is looking more prone to price in political risks again after having moved to levels that we consider somewhat stretched, i.e. too much optimism has been baked in, in our view," says Jens Nærvig Pedersen, Senior Analyst with Danske Bank.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement