The Pound is Rallying: Volatility is the Order of the Day for Nervous Sterling

Image © Gov.uk

- Sterling started day deep in red, only to recover

- Heightened volatility tipped to extend

- Government has this afternoon officially lost its Parliamentary majority

- MPs seek to take control of Parliamentary business away from Govt.

- Johnson tipped to call on MPs to vote for an election

The British Pound has shown exceptional volatility ahead of manoeuvres in the House of Commons that could see a 'no deal' Brexit outlawed by MPs.

The Pound was trading deep in the red as London markets opened for the day, but is seen posting strong daily gains ahead of tonight's crunch vote in parliament.

The volatility underlines how nervous markets are as UK politics heads into a crunch period that could throw out numerous outcomes.

Negative outcomes for Sterling include a chaotic 'no deal' Brexit, while positive outcomes range from a Brexit deal finally being struck between the EU and UK or a full-blown reversal of Brexit.

In short, risks are two-way and readers should therefore be wary of volatility until outcomes become clearer.

"If we needed any further proof as to headline driven the Pound is at present, the GBP/USD rate just surged 80 pips in under a minute. Seems algorithm driven after misinterpreted quotes from Boris spokesman but a clear example of the heightened sensitivity nonetheless," says David Cheetham, Chief Market Analyst at XTB UK.

Parliament is tonight expected to vote to seize control of parliamentary business away from the government in order to pass legislation aimed at outlawing a 'no deal' Brexit.

Prime Minister Boris Johnson has however warned he would never go to the EU to ask for a delay to Brexit, and it is an open secret that Number 10 intends to use the defeat as reason to call for a General Election.

The need for a General Election will be heightened by news that the Government has this afternoon officially lost its majority in parliament with the defection of MP Philip Lee to the Liberal Democrat party.

Sterling Volatility is the Order of the Day

Expect Sterling to remain highly volatile in the current fast-moving political environment.

We see the Pound-to-Euro exchange rate quoted at 1.1025, having been as low as 1.0992 earlier in the session.

Above: Sterling-Euro performs a u-turn in London trade.

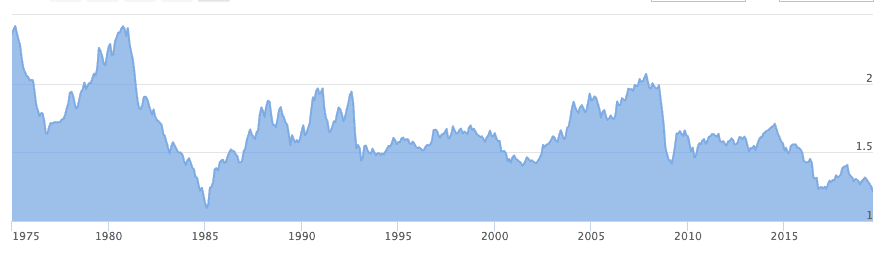

The Pound-to-Dollar exchange rate is meanwhile attracting attention with some data sources showing the pair to have hit a fresh 34-year low.

GBP/USD is currently at 1.2087, but has today gone as low as 1.1959, which some data providers place at its lowest point since 1985: but this excludes the lows reached in the flash-crash of October 05, 2016. Flash-crashes tend to be technical phenomenons and it is a matter of individual interpretation as to whether that lows is recognised.

The all-time according to Bank of England data suggests the low is down at 1.0637, which was struck in March 1985.

Above: There is still some way to fall before GBP/USD hits all-time lows which are near 1.06

Foreign exchange markets continue to take cues from politics, and we expect a highly volatile few days ahead.

"The British Pound can hardly escape the downward spiral as the numerous political imponderables have completely poisoned the atmosphere around the currency," says Marc-André Fongern, analyst with MAF Global Forex.

Prime Minister Boris Johnson has threatened to call a General Election before he would consider returning to Brussels to request another delay to Brexit, ensuring the political risk premium in the British Pound will remain heavy over coming days.

"Sterling is likely to remain weak," says Robert Mialich, FX Strategist with UniCredit Bank in Milan. "Talk of either snap elections or a three-month Brexit delay may add nervousness to the currency against either the USD or the EUR."

Above: The Pound has lost ground against all the major currencies today

Should the government lose tonight's vote and cede control of parliamentary business to parliament, the Prime Minister is on Wednesday tipped to call on parliament to vote for an election.

Whether or not the two-thirds majority is achieved now becomes the issue: the Liberal Democrats have vowed to reject such a request, and there is talk Labour might also vote against a General Election.

It could be that the two parties opt to keep the status quo in place until a Brexit extension has been secured.

How Johnson proceeds under such a scenario is uncertaint.

"The possible scenarios that result from it are innumerable. As a result uncertainty is high and volatility continues to rocket. I fear cable will soon ease sustainably below 1.20 with EUR-GBP establishing itself above 0.91," says Antje Praefcke, FX Analyst with Commerzbank.

EUR/GBP at 0.91 equates into the GBP/EUR exchange rate establishing itself below 1.0989.

Time to move your money? The Pound may be down, but you can still get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Parliament Bids for Control

Expect Sterling to remain highly sensitive to developments through the night as MPs seek to seize control of parliamentary business, which is normally at the full discretion of the government.

The unusual shift of control of the parliamentary agenda will be facilitated by the Speaker, John Bercow, who has in this parliament broken the precedent of impartiality typically expected of the Speaker to actively facilitate remain-leaning MPs.

If remain-leaning MPs can wrest control of the agenda, a Bill to outlaw 'no deal' would be debated and voted on in Wednesday's session.

- Timeline:

- 14:30 Parliament returns

- 17:30: Application for emergency debate

- 18:00: Emergency debate on Brexit

- 21:00-22:00: Vote on whether MPs should take control of parliament

The European Union (Withdrawal) (no 6) Bill will be presented to Parliament by Labour former minister Hilary Benn.

The Bill requires the Government to either reach a deal with the EU, or gain Parliament's approval for a 'no deal' exit by October 19.

If the Government has not met one of these conditions by the deadline, it will be require to write to the European Union seeking an extension, until January 31, 2020.

The move should provide some near-term support for Sterling in that it provides a solid legislative framework that ensures a 'no deal' Brexit won't happen on October 31.

On paper therefore, Sterling should find support on the Bill's passing with the support of some 15-20 Conservative MPs willing to rebel against the Government.

However, the passing of the Bill will in all likelihood trigger a series of events that could work against Sterling: Johnson on Monday said from the steps of 10 Downing Street under no circumstances would he request another Brexit extension, repeating his pledge the UK was leaving the EU on October 31.

UK media sources have been awash with stories suggesting that should the government lose and 'no deal' is effectively outlawed, then a fast-track General election would be called that would potentially take place around October 14, ahead of a key meeting of EU leaders.

This will likely keep uncertainty as to the future state of UK politics elevated, and keep Sterling under pressure.

"I don't want an election, you don't want an election"

— BBC Politics (@BBCPolitics) September 2, 2019

Boris Johnson warns MPs against "another pointless delay" to #Brexit, saying it will "chop the legs out from under the UK position"

???? Watch PM's Downing Street statement in full ⬇️

Live updates: https://t.co/4bQSoz317A pic.twitter.com/K6BoWpGp3e

Foreign exchange analyst Viraj Patel with Arkera says there is a chance Sterling could experience some positioning "neutralisation" before a more concerted "directional path" is adopted once the outcomes of October's key EU summit / General Election become known.

Markets are heavily bet against Sterling at present, and events could see traders opt to close out the bets and buy back the Pound: this creates a short-term technical phenomenon called a short squeeze which could see the Pound bounce back.

If Johnson loses the vote seeking to outlaw a 'no deal' then it is "likely that election sees GBP shorts (leveraged funds) neutralise on greater two-way Brexit risks. 2017 General Election being called saw GBP/USD move 1.5-2.0% higher. Relief of 'no deal' delay (at worst) offsets short-term uncertainty," says Patel.

Patel says the fact that UK polls have got elections wrong of late will make speculative investors nervous over all potential outcomes and this might not warrant Sterling markets being positioned so one-way.

"Sure ongoing uncertainty arguably makes the Pound a sell-on-rallies in short-run. But be wary of a squeeze first," says Patel.

Time to move your money? The Pound may be down, but you can still get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement