EUR/USD: The Euro-Bulls at Credit Suisse Upgrade Forecasts, Again

Another day, another upgrade for the Euro against the US Dollar.

Credit Suisse are the latest big-name institution that have announced an upgrade to targets for the Euro to Dollar exchange rate (EUR/USD) as they admit their previous expectations for a strengthening in the single-currency have proven too cautious.

The Swiss bank have been advocates for a stronger Euro since March when they shifted stance from negative to positive.

However, the pace of the Euro’s rally against the Dollar has left their bullish stance looking too cautious.

“While we have been explicit EURUSD bulls since March, the rate of appreciation continues at a rate that has exceeded our initial expectation,” says Shahab Jalinoos at Credit Suisse in a note dated July 26.

Analysts have long felt that a weekly close above 1.1500 would be significant, given that until last week the pair had failed to register that since Q1 2015, and indeed had only traded intra-week above that level for two separate weeks in that period.

“The fact that this occurred last week after an ECB meeting that was widely judged to be dovish is another bullish factor,” says Jalinoos.

In this context, Credit Suisse are revising up their three-month EURUSD forecast to 1.19 and their 12m forecast to 1.22 (from 1.15 and 1.15, respectively, previously).

The move comes a day after analysts at Danske Bank upgraded their EUR/USD forecast profile by a similar margin.

Over the past month, EUR/USD has witnessed a kind of perfect storm, starting with Draghi’s hawkish speech at the ECB Forum in Sintra in late June. In our view, Draghi and the ECB have already let the ‘EUR/USD genie’ out of the bottle – and basically paved the way for a continued correction in the FX market of some of the long-standing undervaluation in EUR/USD,” says Morten Helt, Senior Analyst with Danske Bank.

More details on this particular upgrade below.

Reasons Why the Euro Will Going Higher

A number of key drivers to Credit Suisse’s upgrade on EUR/USD have been identified, not least the apparent green-lighting of recent Euro strength by the European Central Bank during their July policy update.

“ECB speakers, and especially chief Draghi, have not been explicit about not wanting to see a higher EUR, and instead have said they'd prefer not to see a rapid tightening in financial conditions. As financial conditions include other factors like credit spreads, the market is interpreting the ECB as either uninterested in stopping EUR strength, or unskilled at doing so,” says Jalinoos.

Other reasons for the move is the continued expansion of the Eurozone economy, a more benign political outlook which contrast quite favourably against US politics where we see President Trump struggling to push his legistlative agenda through Congress.

Credit Suisse’s equity analysts still believe that European equities have room to outperform and attract foreign capital which should shore up demand for the single-currency.

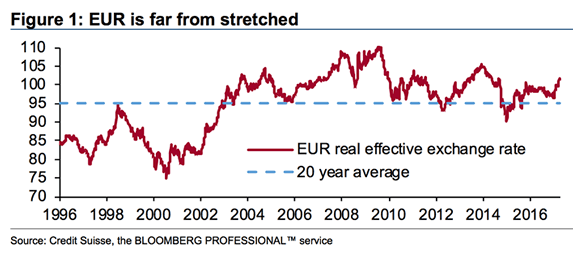

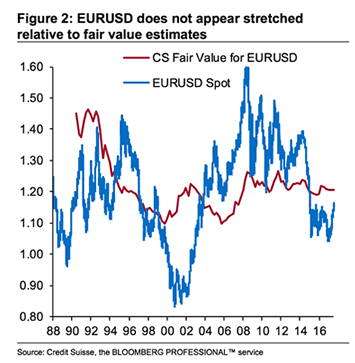

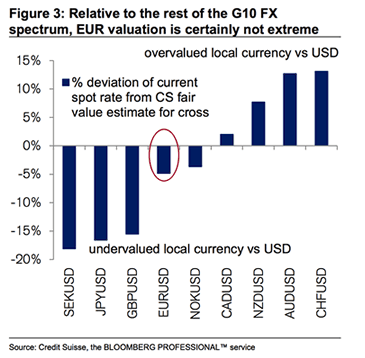

Valuation is also said to be beneficial in that the currency’s recent rally has merely dented the long-term undervaluation that has seen it tread water at cheap levels.

The road to fair-value is therefore still not fully travelled.

Near-Term Correction Possible

While prospects for the Euro are certainly possible, we would caution that some near-term unwinding must occur.

A recent sharp spike in the EUR/USD to trade briefly above 1.17 this week with no particular news flow being behind the move suggests to the strategist team at MayBank that there must have been a degree of “stop-loss hunting” behind the move.

Alan Ruskin at Deutsche Bank agrees with the observation that technical drivers are in fact driving the Euro and Dollar at present and therefore technical levels must be respected.

"For the moment this is an FX market that is prepared to trade the key EUR pair, one level at a time," says Ruskin.

With this in mind, MayBank observe Bullish momentum on daily chart remains intact but shows tentative signs of waning.

Stochastics are now in overbought conditions which suggests a period of consolidation or reversal is likely which might give pause to the Euro's rally.

Danske Shift Forecasts Higher

A big upgrade for the Euro to Dollar exchange rate has been announced by Danske Bank who believe a perfect combination of events have transpired over recent weeks that will allow the single-currency to race higher.

Analysts at the Scandinavian banking giant say recent ECB communication and the balance of political risks “have shifted in favour of the Euro”.

In a briefing to clients dated July 25, Danske Bank’s Senior Analyst Morten Held says he and his team are lifting their one, three, six and twelve month forecasts in tandem.

“Over the past month, EUR/USD has witnessed a kind of perfect storm, starting with Draghi’s hawkish speech at the ECB Forum in Sintra in late June. In our view, Draghi and the ECB have already let the ‘EUR/USD genie’ out of the bottle – and basically paved the way for a continued correction in the FX market of some of the long-standing undervaluation in EUR/USD,” says Helt.

The balance of political risks has shifted in favour of the Euro with the French elections passing by without offering any negative surprises and expectations for future German elections suggesting the status quo will win out.

So while the skies are seen clearing in the Eurozone, politics in the US has been a USD negative recently.

The inability of US President Donald Trump to stamp his authority on his Republican lawmakers suggest the President’s pro-Dollar policies on tax and spending will likely have to be watered down significantly.

Meanwhile, the Russian scandal simply won’t die and questions are being asked as to whether the administration has the focus to deliver on policy.